If you did not spend the past year in the deep forest without the Internet, then you definitely read or heard something about NFT. It looks like this: crypto enthusiasts have thought of selling digital pictures and memes on the blockchain; there were also people who were ready to give millions of dollars for such a product.

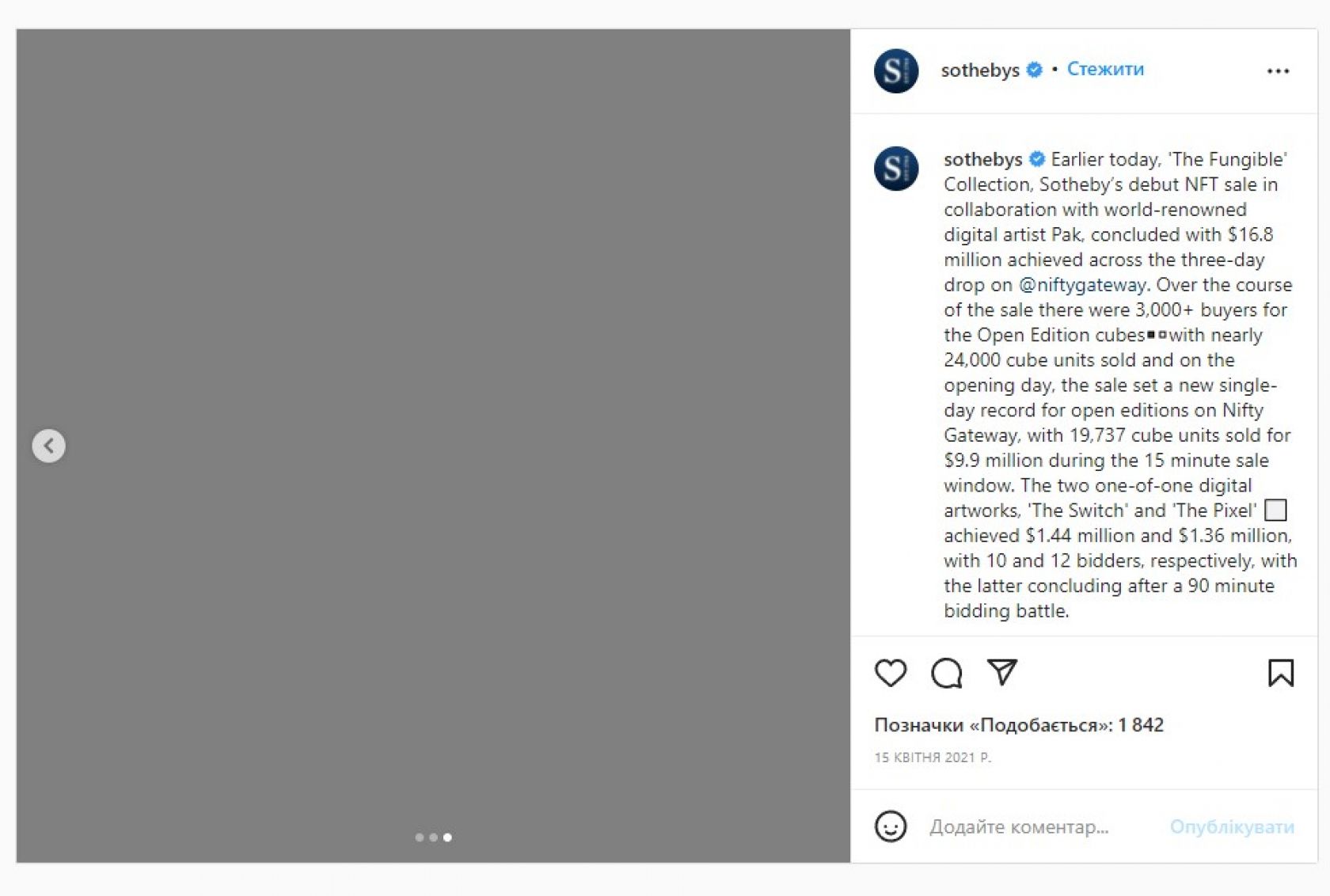

The media is full of similar high-profile headlines: the artist Beeple sold an NFT collage of five thousand of his works for $ 70 million; the original Nyan Cat gif went under the hammer for $600,000; meme photo with “disaster girl” sold in NFT format for $430,000. Cryptopunks pixelated avatars are selling for millions of dollars, and the work “Pixel” by anonymous artist Pak was sold at auction for $1.3 million (it’s really a gray pixel, a canvas in the spirit of Malevich).

For some, the NFT phenomenon is evidence of the final withdrawal of the economy into the digital “metaverse”. Others see the NFT fever as signs of a dangerous financial bubble of unprecedented proportions. One way or another, today trading in NFT artifacts has become a global and highly liquid business, estimated at at least $20 billion. It doesn't look like this market is just going to disappear. The other day, the largest NFT marketplace OpenSea attracted $300 million in investments and updated the historical maximum in terms of monthly trading volume - $3.5 billion. And all this - despite the January collapse of the world's most important cryptocurrencies - bitcoin and "ether".

What will be the future of this fancy market? To find the answer to this question, I spoke with blockchain developers and our crypto investor partners.

Gray “Pixel” NFT was auctioned off for $1.36 million

A couple of words about NFT

The network is full of attempts to explain what NFT (non fungible token, non-fungible token) is, almost all of them are equally incomprehensible to a person far from “crypto”. So let's outline here the most important thing for understanding the market.

NFTs are tokens on the blockchain network. But if the tokens of the same cryptocurrencies in the blockchain are equivalent (like the coins and banknotes we are used to), then NFTs are special. Each of them has metadata that provides them with complete uniqueness, “non-interchangeability”.

This makes NFT a convenient tool for expressing rarity. We assign a unique token to the picture, and we can talk about it as the “same” original picture. This is how the demand for a rare object is formed.

NFTs are created on the basis of smart contracts (usually on Ethereum smart contracts). Blockchain allows you to securely record transactions for the purchase and sale of such objects - a record of a transaction is extremely difficult to change or fake. That's what the NFT market is all about.

Trends

A couple of years ago, the NFT industry was of interest only to a narrow circle of enthusiasts and artists, but last spring the market literally exploded. If in 2020 the trading volume barely reached the mark of $100 million, then by the end of 2021 it exceeded $20 billion. What will happen to him now?

It is difficult to predict something in the field of blockchain fashion trends, but experts and investors one way or another talk about such trends:

- More regulation. While there are millions and tens of millions in NFT transactions, governments around the world do not understand how to regulate this market. This state of affairs is very popular with criminals, especially money launderers. In 2021, the aura of NFT was tarnished by high-profile scandals and uncovered episodes of token sale fraud. In the new year, regulators around the world will take on NFTs, as they once took on the regulation of cryptocurrencies. In the United States, several models of market regulation are being considered today: NFT trading can be equated with trading in works of art (control of this market is tightening every year), or even with the securities market. NFT marketplaces are likely to incline towards compliance with international AML / CFT standards (combating money laundering and the financing of terrorism).

- More security. The NFT market is often called a 100% safe area, because the blockchain must stop any fraud attempts. In practice, today everything is different, the rapid influx of money into the industry attracts scammers and hackers. There are many weaknesses in the NFT infrastructure. Hackers break into poorly protected trading platforms and steal tokens from users (users of the popular Nifty Gateway platform suffered from a hack not so long ago). Nobody canceled the methods of social engineering and banal phishing.

In 2022, market participants will focus on fixing vulnerabilities. Support for hardware wallets, strict adherence to KYC standards, full decentralization of transactions, thorough NFT authentication - these are the problems that need to be addressed as soon as possible. - Market stabilization. The peak of the hype around NFT is over, and we most likely will not see deals for the sale of digital art for astronomical amounts in the near future. In fact, the market began to cool down last autumn. Now investors are no longer throwing money at everything, but are actively looking for inexpensive, promising new tokens. The NFT industry is becoming more practical - the focus is shifting from the sale of art to the field of gaming (GameFi) and the “metaverse”.

- New technologies. Today, almost all NFTs are based on Ethereum smart contracts, but this iconic blockchain is becoming less and less suitable for operations with non-fungible tokens. Due to the growing scale of the network, transactions on the air are slow and require significant costs. So the market is increasingly looking for alternatives: Ronin, Solana, Polygon, Tezos networks and other blockchain projects that are ready to compete with “ether”.

- Metaverses and blockchain games. With the filing of Mark Zuckerberg, “metaverse” has become one of the most hyped words of 2021. The owner of Facebook and Instagram talks about it as the Internet of the future, mixed with VR and the new digital economy. In fact, VR projects like Decentraland and The Sandbox were selling “virtual land” on the blockchain before Zuckerberg. Metaverse platforms are actively involved in NFT, the value of virtual real estate there is estimated at millions of dollars.

At the same time, the video game industry seized on the NFT. Blockchain has given rise to a new form of gaming monetization - Play-to-Earn, in which players act as holders of unique tokens and can earn money on them (successful examples are Axie Infinity, Splinterlands). Meanwhile, gaming giants such as Ubisoft and Square Enix have announced plans to develop their own metaverses. Ubisoft is launching the Quartz marketplace for trading in-game NFT items, for example.

And what about Ukraine

Ukraine occupies far from the last place in the global crypto industry (specifically, 21st place in the global ranking Coincub , one position above the Netherlands). We have promising NFT projects and experienced developers. On the NFT, following the example of Western colleagues , they are PR Ukrainian brands and pop stars. At the end of last year, the first local marketplaces began to work.

There is also groundwork for decent regulation of this market. In September last year, the Rada adopted a law on the legalization of virtual assets, which include both cryptocurrency and NFT. The project involves the creation of a whole supervisory body to control crypto assets. Since autumn, the final approval of the law has stalled, but such an initiative is very important and will probably be adopted sooner or later.

Is it worth investing in NFTs in 2022? I am not calling anyone to anything. It is important to remember that now the crypto industry is a digital “Wild West” with a minimum of control and high risks. But investors still go there in the hope of hitting the big jackpot.

Today, everything points to great prospects for NFT technology and smart contracts, and this applies not only to digital art and gaming. For example, the creation of a marketplace of smart contracts for business can be a big step forward for a number of industries: real estate, law, logistics, retail, cybersecurity, etc. All you need is a good idea and a team of experienced NFT marketplace developers who can bring it to life.