Every empty truck on the highway represents a missed opportunity. A load that wasn't matched. A backhaul that couldn't be found. Revenue that never materialized.

The numbers are staggering: between 15% and 30% of all trucking miles in the U.S. are run empty. That's not a rounding error, it's a fundamental inefficiency that's plagued the industry for decades. Until now. Artificial intelligence is finally cracking the code on empty miles, turning what once was inevitable waste into recoverable profit.

What's Actually Causing Empty Miles?

Bad route planning is probably the most obvious one. Dispatchers can't see the full picture, so trucks end up deadheading 200 miles to the next load. And the visibility problem? Most carriers still operate in silos. You've got a truck in Dallas looking for freight while a shipper in Fort Worth needs capacity, 30 miles apart but might as well be on different planets.

Broken marketplace matching doesn't help. Traditional freight boards are slow and often outdated. Then there's unpredictable demand — seasonality creates massive imbalances. Trucks flow into certain regions but can't find loads going back out.

Manual dispatching means juggling dozens of variables with partial information. And fragmented logistics networks leave small carriers operating in isolation, constantly scrambling for return freight.

How AI Solves Empty Miles: Key Technologies in Smart Transportation Systems

Predictive logistics powered by machine learning algorithms crunch historical data — past shipments, seasonal patterns, economic trends — and forecast where demand will emerge. These systems analyze thousands of data points: which routes typically have return freight, seasonal corridor patterns, even weather effects on shipping volumes.

The result? Your TMS can start positioning trucks before demand spikes. One client told us they started seeing available backhauls before they even finished their delivery. The AI had already matched them with a return load.

With real-time data feeds (traffic, weather, port congestion, fuel prices), AI systems continuously recalculate optimal routes. But it's not just about avoiding congestion. Smart routing algorithms consider opportunity cost. Should you take that slightly longer route if it means you're more likely to find a backhaul?

UPS's ORION system, a leading example of AI for route optimization, processes 30,000 route optimizations per minute. That kind of computational capacity means every delivery gets optimized, not just the ones a dispatcher has time to think about.

Load matching platforms use algorithms analyzing compatibility between trucks and freight based on dozens of factors: location, timing, equipment type, weight, driver hours. Traditional brokers handle maybe 20-30 matches a day. AI platforms? Thousands per hour.

According to recent research, AI matching platforms are reducing empty miles by 45% while cutting carbon emissions significantly. That's a fundamental restructuring of how freight moves.

Why should a truck only carry one load at a time? AI systems excel at finding multi-stop opportunities, picking up partial loads from multiple shippers and consolidating them. Uber Freight's platform has cut empty miles by 10-15% just by optimizing these routes. The math gets complex, but the outcome is simple: fewer trucks moving more freight with less wasted mileage.

Digital twin technology creates virtual replicas of your entire logistics network. You can test routing strategies and simulate demand scenarios before they happen. Modern TMS platforms integrate all these AI in trucking capabilities — predictive analytics, dynamic routing, load matching, automated dispatching — into one unified system that delivers comprehensive fleet optimization through every trip.

Real-World Scenarios Where This Actually Works

Here's where AI is delivering measurable results across different use cases:

| Use Case | How AI Helps | Results |

|---|---|---|

| Backhaul optimization for regional carriers | AI platforms search load boards, shipper APIs, and carrier platforms simultaneously | 30% empty trips → under 10% within 6 months |

| Dynamic load matching for spot-market freight | Real-time algorithms monitor spot rates across hundreds of lanes | Response time: 30 minutes → 30 seconds |

| AI-based consolidation in LTL | Evaluates millions of shipment combinations considering weight, timing, priorities | 20-30% improvement in asset utilization |

| Predictive capacity management | AI-powered forecasting positions trucks before demand spikes | DHL: 25% faster delivery, 95% accuracy, 10M miles saved annually |

| Real-time re-routing | Detects disruptions and recalculates routes automatically | Hours of phone calls → minutes of automated response |

| Intermodal planning | Optimizes across trucks, trains, ships as one unified system | Fills drayage legs with container moves, eliminating empty repositioning |

The common thread? AI turns wasted miles into revenue-generating opportunities regardless of your fleet size or operational model.

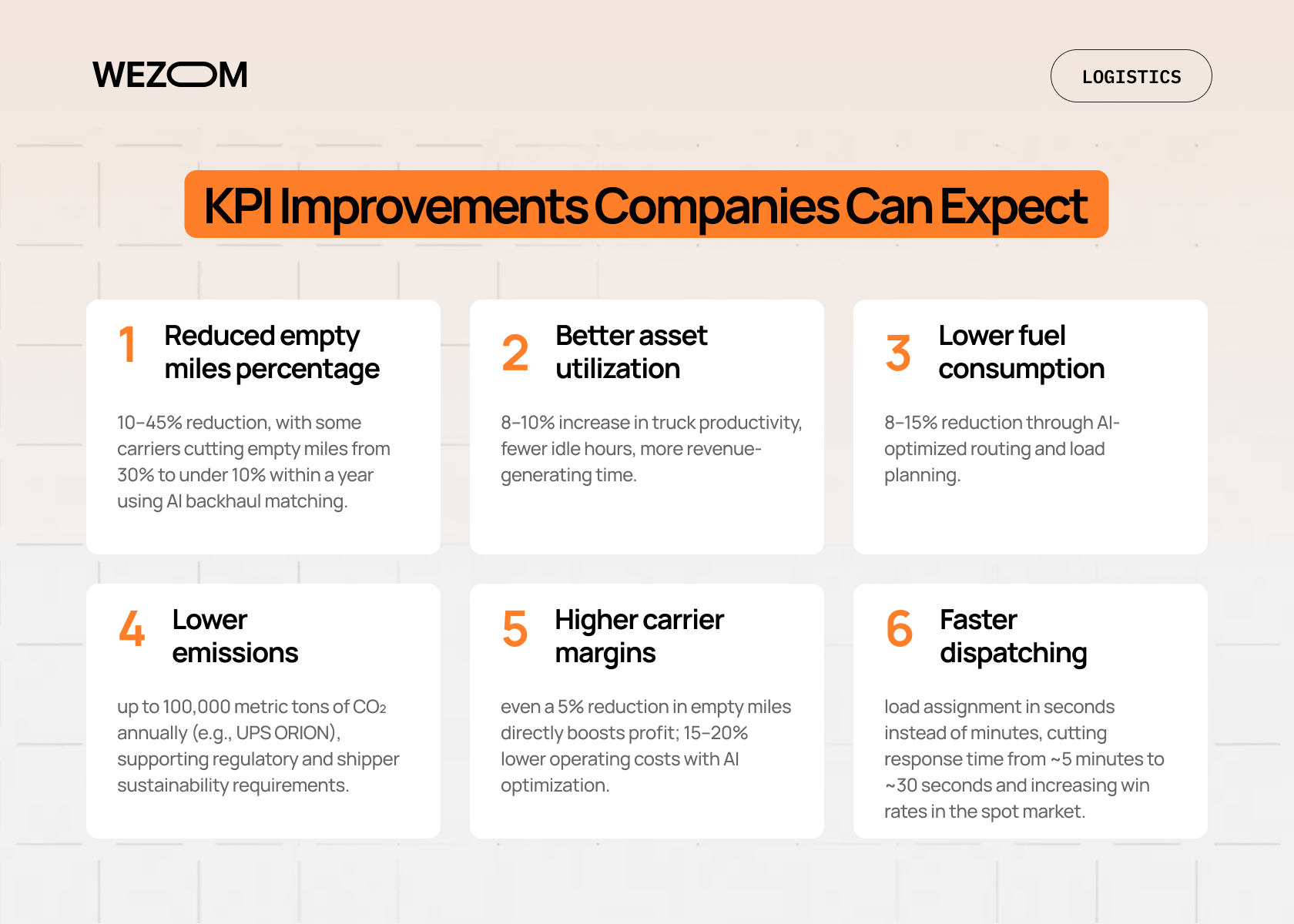

KPI Improvements Companies Can Expect

Let's talk numbers. Here's what companies are actually seeing when they implement artificial intelligence in transportation for empty miles reduction:

- Reduced empty miles percentage. This is the big one. Companies typically see 10-45% reduction depending on their starting point and implementation depth. AI matching platforms connect trucks with backhaul opportunities that manual dispatching simply can't find fast enough. Some regional carriers report going from 30% empty miles down to under 10% within the first year.

- Better asset utilization. When trucks spend less time running empty, they're generating revenue for more hours per day. Fleet data from Geotab shows 8-10% improvement in asset utilization, meaning each truck is productive for more of its available time. That's the difference between a truck sitting idle 15% of the time versus 5%.

- Lower fuel consumption. Empty miles still burn diesel, so cutting them directly reduces fuel costs. DHL, Tesco, and UPS report 8-15% reductions in fuel consumption through AI-optimized routing. With fuel being one of the largest operating expenses, even an 8% reduction moves the needle significantly on profitability.

- Lower emissions. Less fuel burned means fewer emissions. UPS's ORION system prevents approximately 100,000 metric tons of CO2 annually. This isn't just good PR — it's increasingly critical for meeting regulatory requirements and customer sustainability demands. Many shippers now require carriers to report carbon footprints.

- Higher carrier margins. When you're operating on razor-thin margins (and most carriers are), even a 5% reduction in empty miles translates directly to profit. McKinsey studies show a 15-20% reduction in overall operating costs for fleets using AI optimization. That's the difference between a profitable quarter and a struggling one.

- Faster dispatching. AI systems assign loads in seconds instead of minutes or hours. That speed advantage means you're capturing loads that would've gone to competitors while your dispatcher was still on the phone. Companies report cutting response times from 5 minutes down to 30 seconds, and in the spot market, that's often the difference between winning and losing the load.

Limitations and Challenges of Using AI

Poor data quality is the biggest killer.If your telematics data is spotty or load history is incomplete, the AI will make bad predictions. Garbage in, garbage out. Many carriers discover they don't actually know their own operations as well as they thought until they start collecting quality data for AI systems. Fragmented systems create another headache — data trapped in silos limits visibility across the operation.

High integration costs can be brutal for small carriers. Enterprise-grade AI solutions aren't cheap, and you need ongoing investment in data processing and system maintenance. Lack of real-time visibility inputs limits what AI can do. Without GPS tracking on all trucks or if systems only update every few hours, AI can't make truly dynamic decisions.

Marketplace imbalance is another issue — AI can't create freight where none exists. If supply massively outweighs demand in a region, even the smartest algorithms can't fix that fundamental imbalance. AI still fails with rare shipment types, rural areas with limited freight, and extreme seasonality. The algorithms learn from patterns but struggle with one-off situations or sparse data where historical trends don't provide reliable guidance.

Best Practices for Implementation

Before buying AI software, get your data house in order. Information needs to flow freely between systems — TMS, telematics, ELD, warehouse platforms.

Start with one corridor or region. Don't try to boil the ocean. Pick one high-volume corridor, implement AI optimization there, learn what works, then expand. This phased approach reduces risk.

Combine AI with human dispatch. The best results come from combining AI recommendations with human judgment. Let AI handle data crunching while experienced dispatchers make final decisions. They understand nuances — customer relationships, driver preferences, equipment quirks — that AI might miss. This hybrid approach delivers better outcomes than either humans or AI working alone.

Integrate with TMS, telematics, ELD, warehouse systems. Your AI solution needs deep integration with existing platforms. If it's sitting in isolation, you're not getting full benefits. This means connecting your transportation management system with telematics for real-time truck location, ELD systems for hours of service data, and warehouse platforms for pickup and delivery scheduling.

Make forecasting and load matching collaborative. Share data with trusted partners. Participate in freight matching networks. The more participants in the ecosystem, the better AI performs. Some carriers resist this because they see it as giving away a competitive advantage. But the network effect is real, everyone benefits when the data pool is larger and creates better matching opportunities for all participants.

Conclusion

Empty miles are killing margins. AI gives you real tools to fight back right now. The technology isn't perfect, but carriers who figure this out will have a massive competitive advantage.

AI has matured enough to deliver real results, but adoption is still low enough that early movers can capture significant gains. The question isn't whether AI will transform freight optimization — it already is. The question is whether you'll be leading or playing catch-up.

Want to explore how AI can optimize your fleet operations? We work with transportation companies to implement practical AI solutions that reduce empty miles and improve margins.

FAQ

What are empty miles in transportation?

Empty miles (deadhead miles) are the distance a truck travels without carrying a load, typically after delivering freight but before picking up the next shipment. They represent pure cost (fuel, driver time, vehicle wear) with zero revenue generation.

How is AI used in transportation to improve route planning?

AI for transportation analyzes massive datasets such as traffic patterns, weather, historical deliveries, and real-time freight availability to continuously optimize routes. Unlike static planning, AI adapts dynamically and evaluates millions of routing combinations to find the most efficient paths, including backhaul opportunities.

What types of AI are used to reduce empty miles?

Several AI technologies work together:

- Machine learning for demand forecasting.

- Predictive analytics for capacity planning.

- Optimization algorithms for dynamic routing and load matching.

- Computer vision and sensors for real-time tracking.

What are the main limitations of AI in transportation?

Key challenges include poor data quality, high integration costs for smaller carriers, fragmented systems that prevent unified visibility, and marketplace imbalances where supply dramatically exceeds demand. AI can optimize matching, but it cannot create freight where none exists.

What ROI can logistics companies expect from using AI?

Companies typically see a 10–45% reduction in empty miles, 8–10% improvement in asset utilization, 8–15% reduction in fuel consumption, and 15–20% reduction in operating costs. Most companies begin seeing meaningful improvements within 6–12 months of deployment.