If the keyword for fintech in 2025 was "innovation," then in 2026, it will be "revolution."

2026 will mark the year when the development of Fintech will completely redefine our understanding of money and finance. This is not just about software development; it's about creating an entirely new world where technology doesn’t merely accompany finance but governs it. A world where credit decisions are made instantly (through P2P systems, bypassing banks), and fraudsters are left powerless against security systems that leave them no chance.

Developers, entrepreneurs, and companies are already paving the way to this future today, exploring why invest in technology sector to gain a competitive edge in finance. If you want to be part of this revolution, it’s time to start now. At the very least, read this article to stay informed about upcoming events and new trends. But first, let’s start with the basics: definitions and the current state of the market.

What is Fintech?

Financial Technology is a field where technology and innovation are used to create new financial products and services. Essentially, it’s the integration of finance and information technology. A Fintech software company typically offers more convenient, faster, and accessible solutions than a traditional bank.

Simply put, it’s all about software for financial services that makes managing our finances more digital and user-friendly. From banking apps to mobile wallets where you can buy Bitcoin, fintech simplifies and enhances our financial experience.

How Does Fintech Work?

Fintech operates on a variety of technologies, with the key ones being:

- Big Data: used to analyze vast amounts of information and create personalized products and services.

- Artificial Intelligence: enables process automation, fraud detection, and the provision of smart financial advice.

- Blockchain: a decentralized technology that ensures the security and transparency of transactions (e.g., in cryptocurrencies).

- Cloud Technologies: used for data storage and the delivery of online services.

For all of this to function as intended, software is essential. This software enables access to personalized services, facilitates payments via smartphones, manages cloud data, and more. The creation of such software is the domain of Fintech Software developers.

Market Overview in Fintech Software industry

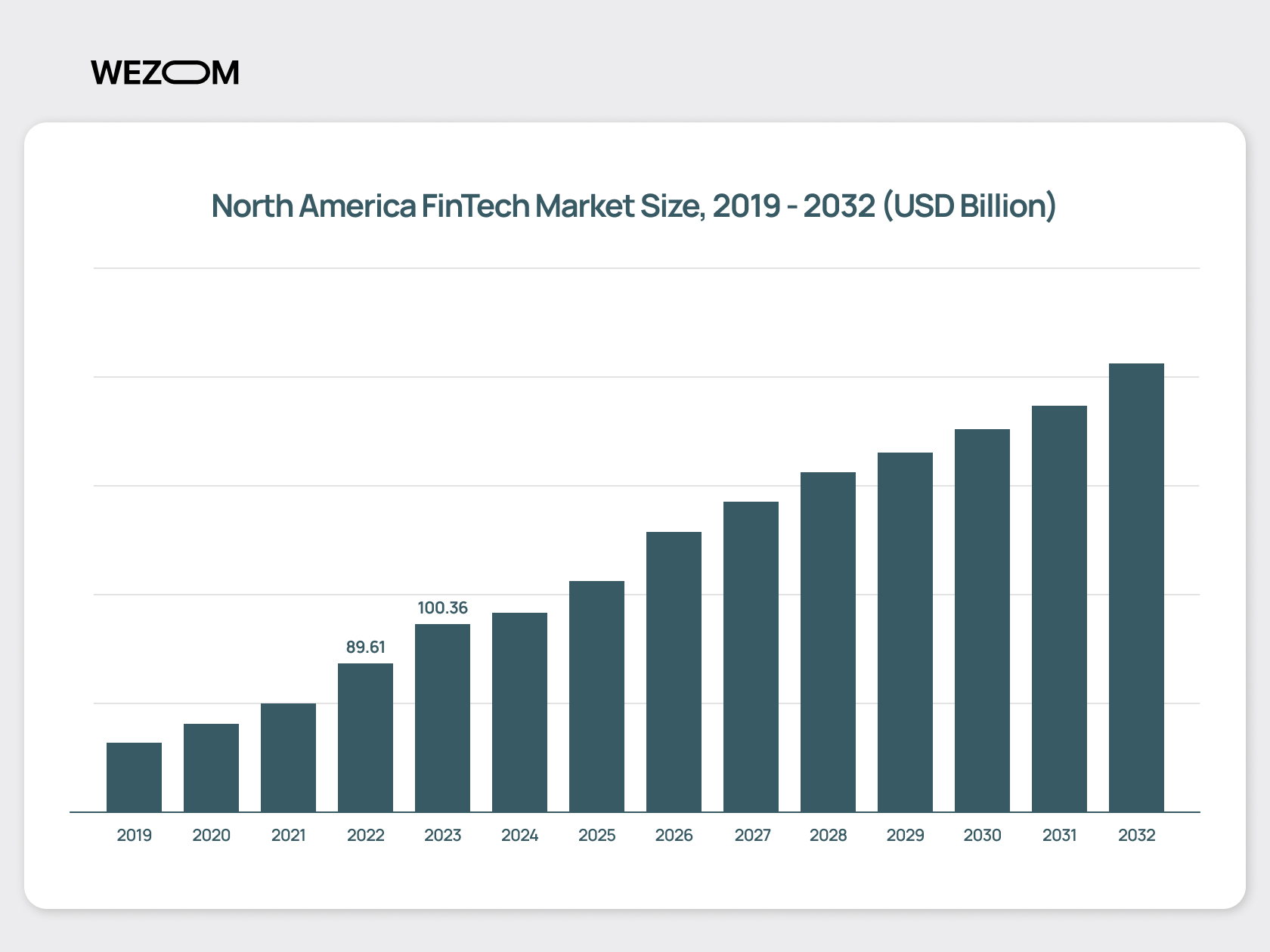

In 2025–2026, the global fintech services market is valued at $420 billion, with a projected increase to $1.152 trillion by 2032, reflecting a compound annual growth rate (CAGR) of 16.5%.

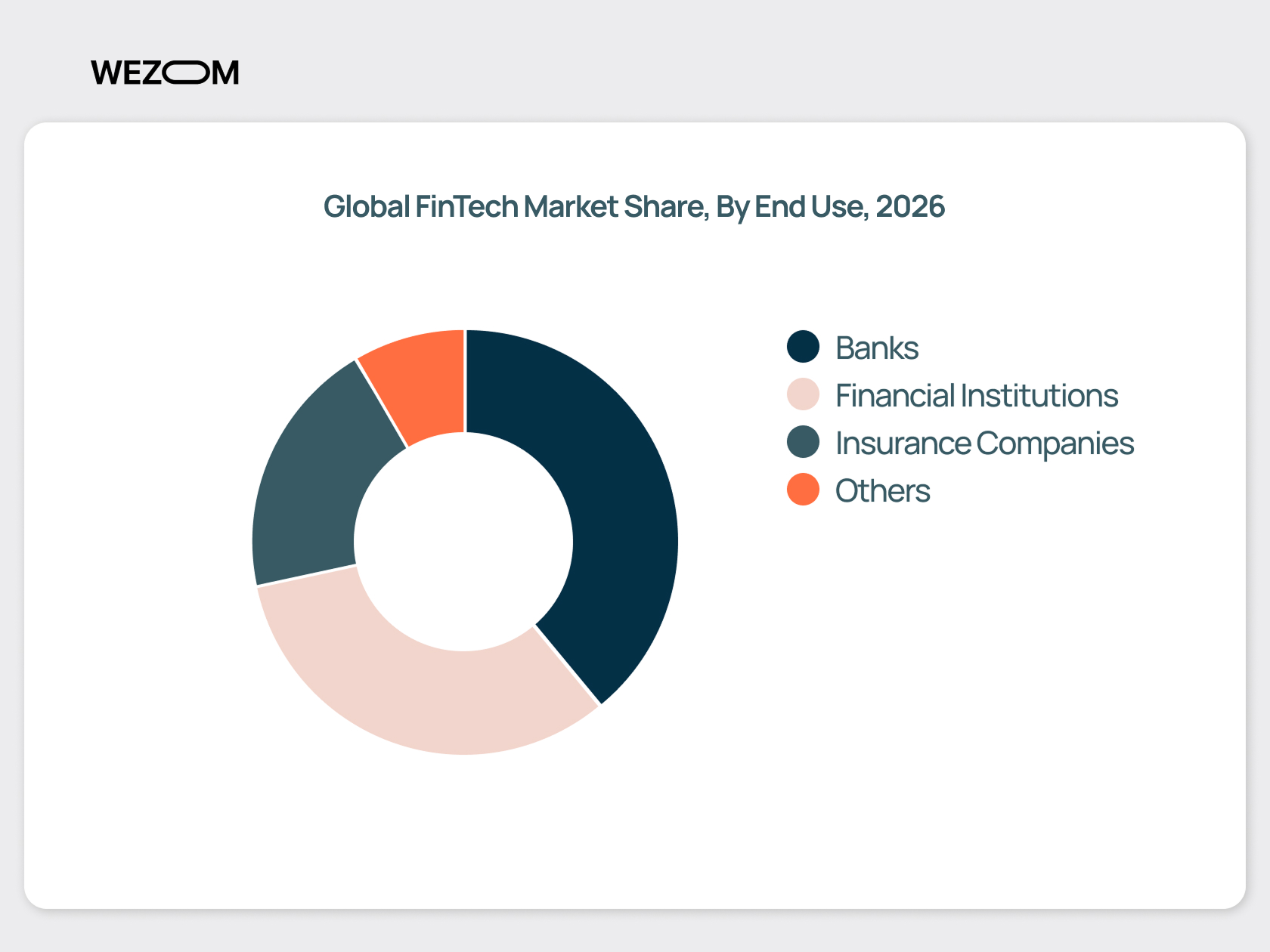

The global fintech software development market is divided into several key segments:

- Money transfers and payments (dominating the market with the growing influence of instant payment technologies).

- Digital lending and loan marketplaces.

- Personal finance and wealth management.

- Insurance (InsurTech).

- Regulatory technology (RegTech), helping companies comply with international standards.

RegTech continues to gain strategic importance as financial institutions face increasingly complex international regulations and stricter supervisory requirements. By 2026, the global RegTech market is estimated to reach $28–30 billion, driven by accelerated adoption of automated KYC/KYB, AML monitoring, real-time transaction screening, and regulatory reporting. The market is expected to grow at a CAGR of approximately 20–22%, fueled by expanding cross-border operations, AI-powered compliance tools, and rising penalties for non-compliance.

At the same time, embedded finance remains one of the fastest-growing fintech segments. Financial services integrated directly into non-financial platforms — such as payments, lending, insurance, and compliance checks — are becoming standard across industries. By 2026, the embedded finance market is projected to exceed $120 billion globally, with sustained double-digit growth expected through the early 2030s. This expansion is driven by demand for seamless user experiences, API-first architectures, and regulatory-ready financial components embedded into digital ecosystems.

These trends highlight a broader shift in fintech: compliance, automation, and integration are no longer supporting functions but core business enablers shaping the next generation of financial products.

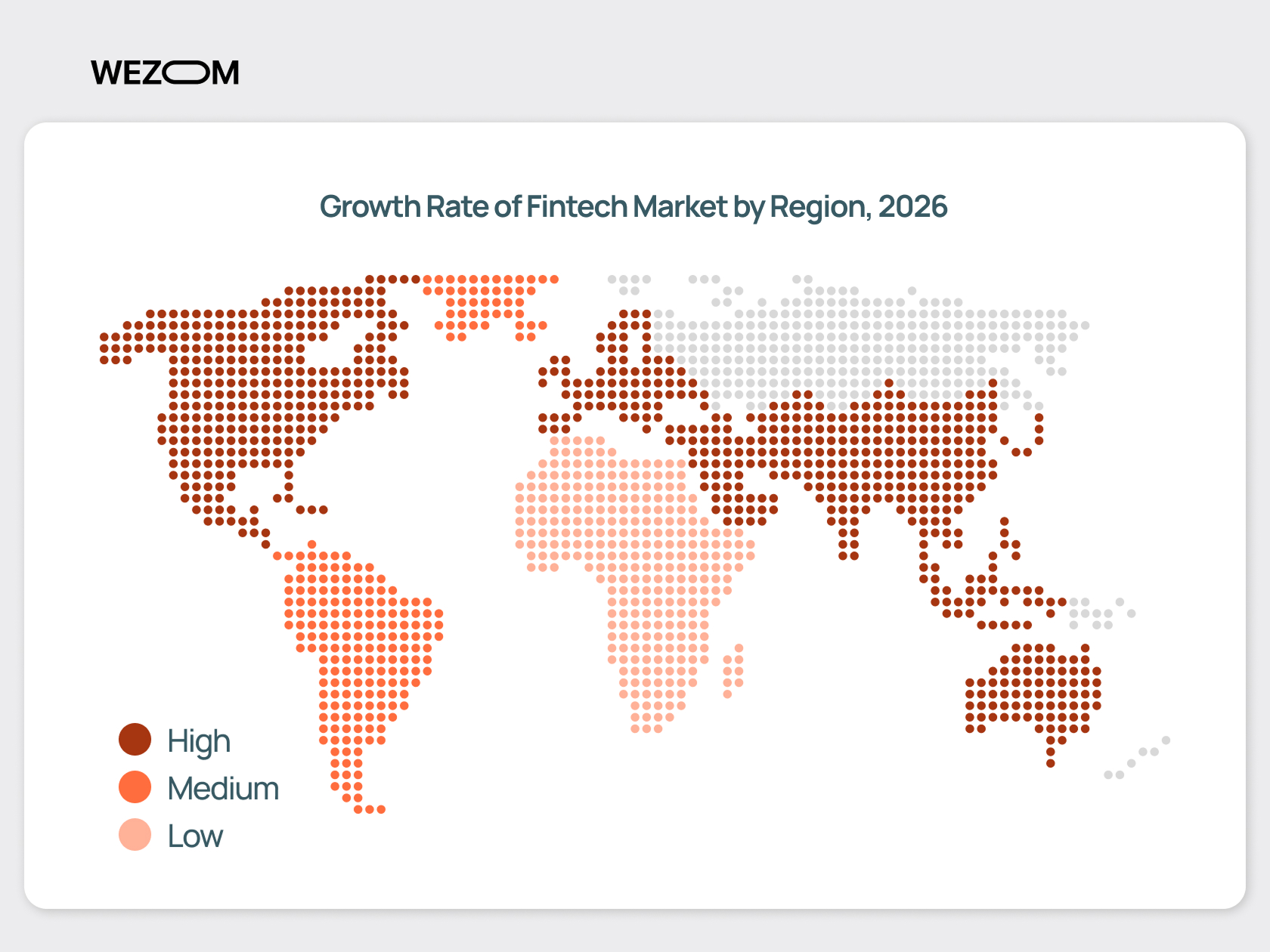

In terms of geographical distribution:

- North America remains the market leader, driving significant investments in AI and blockchain technologies.

- Europe, with its strict regulatory environment, is actively developing RegTech and open banking.

- The Asia-Pacific region shows impressive growth rates, fueled by the popularity of mobile payments, particularly in China and India.

- Latin America and the Middle East are leveraging fintech to reduce cross-border transfer costs and enhance financial accessibility.

Challenges in Fintech Software Development in 2026

The Future Outlook for Fintech Software Development Beyond 2026

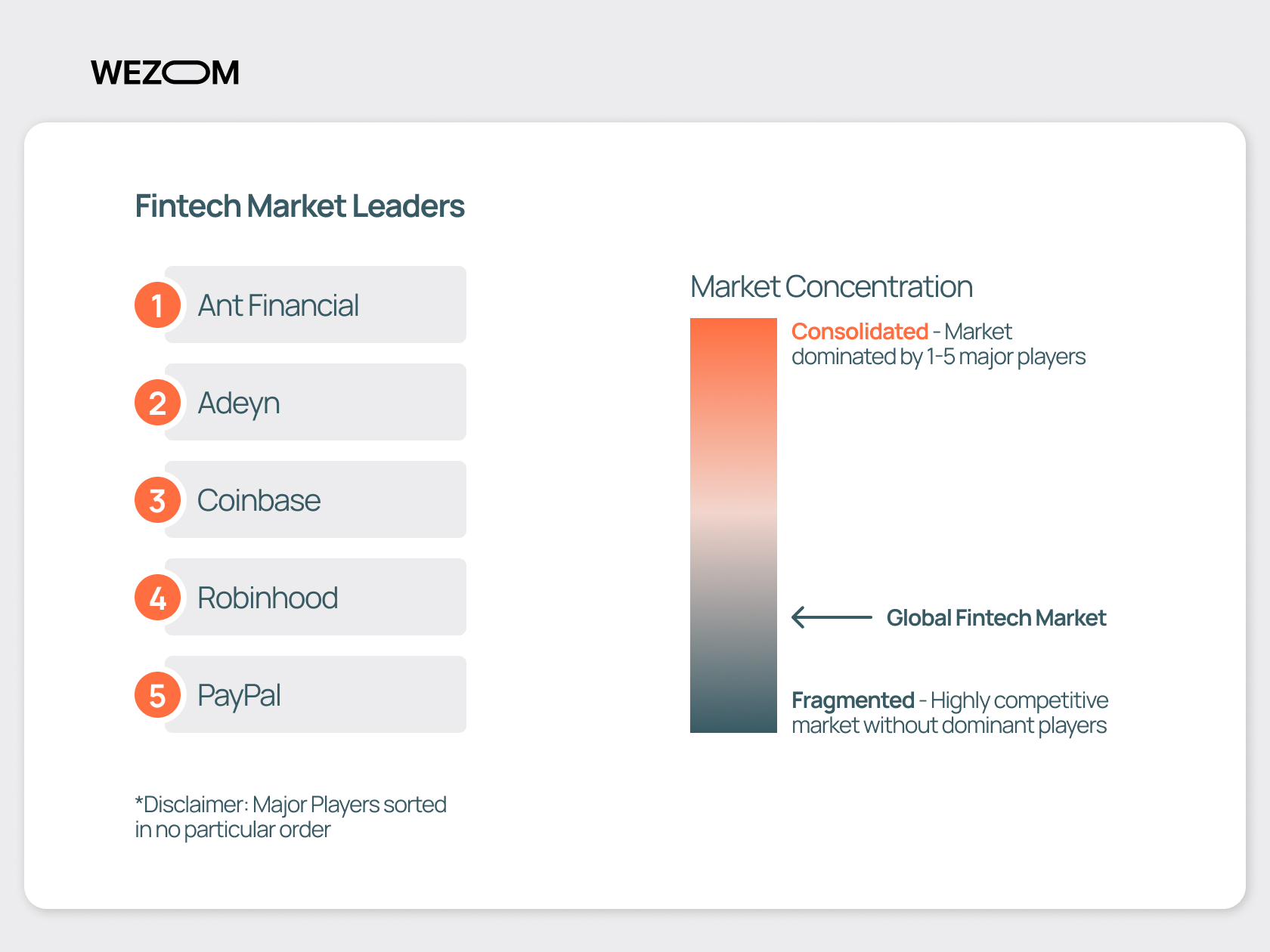

Digital banking is becoming mainstream, reaching 386 million users by 2028. Companies like PayPal, Alipay, and Revolut are actively promoting mobile-focused services.

Types of Fintech Software Development

Fintech software solutions encompass a wide range of possibilities. These can include embedded services aimed at improving convenience, standalone programs for personal banking, corporate platforms for insurance companies, and much more. Typically, no Fintech Software Development company adheres to strict standardization or classification by type, as the primary focus is always on the specific goal for which the software is being developed—and these goals vary widely.

However, for the sake of convenience and clarity, let’s attempt to categorize Software Fintech into specific types.

1. Fintech software for payments

One of the most popular areas includes solutions that simplify money transfers and make payments faster and more secure. Examples include Apple Pay, Google Pay, and Samsung Pay for mobile payments and contactless transactions, as well as digital wallets like PayPal, Venmo, and Alipay.

Interestingly, according to research by Mordor Intelligence, PayPal is one of the best fintech tools and a market leader in terms of both user numbers and company capitalization.

This category also includes cryptocurrency wallets (such as Ledger, MetaMask, and Trust Wallet).

The main features of this type of Fintech Softwares are:

- Integration with banks and third-party platforms.

- Use of biometrics and encryption for data protection.

- User-friendly interfaces designed for the general public.

2. Digital lending platforms

Digital lending has become an important element of the fintech industry, providing users with quick access to loans (without the need to visit bank branches). This has been made possible by two factors: 1) integration with credit risk assessment systems; 2) instant data processing and decision-making based on machine learning algorithms.

Main types:

- P2P lending (Peer-to-Peer). Platforms like LendingClub and Prosper allow users to borrow directly from other individuals.

- Microfinance. Programs focused on small amounts, popular in developing countries. An example is Tala in Africa.

- Digital banks: For example, Chime or Revolut offer lending services through mobile apps.

3. Personal finance management software (PFM)

Services for managing personal and corporate finances. For example, Mint, YNAB (You Need a Budget) - programs for tracking income, expenses, and savings. Or QuickBooks and Wave - fintech software for startups used for accounting and financial planning.

The integration of such applications with bank accounts (for automatic transaction tracking) is no longer surprising. However, modern features provided by fintech developers include smart data analysis to identify behavioral patterns and trends. This software has long surpassed simple tables and calculators and is fully capable of replacing a very good financial advisor: offering optimization of certain expenses, pointing out how to claim tax deductions, and suggesting where to best invest surplus funds.

4. Investment platforms

Fintech software for investment. Offers access to financial markets, investment portfolios, and trading tools.

Popular categories:

- Robo-advisors: Betterment, Wealthfront - top fintech platforms that use AI-powered fintech software for automating investment management.

- Financial software for trading: Platforms like Robinhood and eToro provide access to stocks, cryptocurrencies, and other assets.

- Crowdfunding: Kickstarter and Indiegogo bring together investors to fund startups.

What does fintech development promise us in this area in 2026? Even higher levels of automation using big data analytics, as well as the implementation of blockchain for ensuring transaction transparency.

5. Insurance technologies (InsurTech)

InsurTech addresses the automation of the insurance business, from premium calculation to claims processing. It uses AI for risk analysis and is often integrated with RegTech for regulatory compliance.

Examples:

- Digital insurers: Lemonade, Oscar Health. Offer insurance through apps.

- Comparison platforms: PolicyBazaar and CompareTheMarket. Help choose the best insurance product.

The main breakthrough we expect: insurance products based on health data. These data will, in turn, be sourced from mobile phones and smartwatches.

If you regularly visit the gym and buy organic healthy food, wouldn't you like to get a discount on your insurance? After all, that’s a reduction in risk factors. On the other hand, software already knows quite a lot about us. Not everyone is ready for insurance company robots to also analyze our grocery receipts.

6. Regulatory technologies (RegTech)

RegTech fintech specializes in automating compliance processes such as AML (anti-money laundering) and KYC (know your customer).

For example, services like ComplyAdvantage and Trunomi are fintech software solutions for banks that help identify fraud. Other programs are used for transaction monitoring and detecting suspicious activities.

7. Blockchain and cryptocurrency solutions

Blockchain technologies are influencing all aspects of the financial industry, from payments to smart contracts.

Key trends:

- new types of digital assets are emerging;

- payment systems and operations are improving;

- decentralized finance (DeFi) is becoming more accessible to a wider audience. Platforms like Uniswap and Aave operate without intermediaries.

8. Embedded finance

Embedded finance provides services directly within other platforms. For example, buying on credit directly on marketplaces (Buy Now Pay Later - BNPL) through third-party services like Klarna.

It also includes the integration of banking functions into apps, such as the ability to pay for your Uber ride through online banking.

9. Cybersecurity software

Given the threats of cyberattacks, a software developer in finance must actively use solutions to protect data and prevent fraud. This includes not only tools for two-factor authentication, like Duo Security, but also modern technologies based on big data, machine learning, and artificial intelligence.

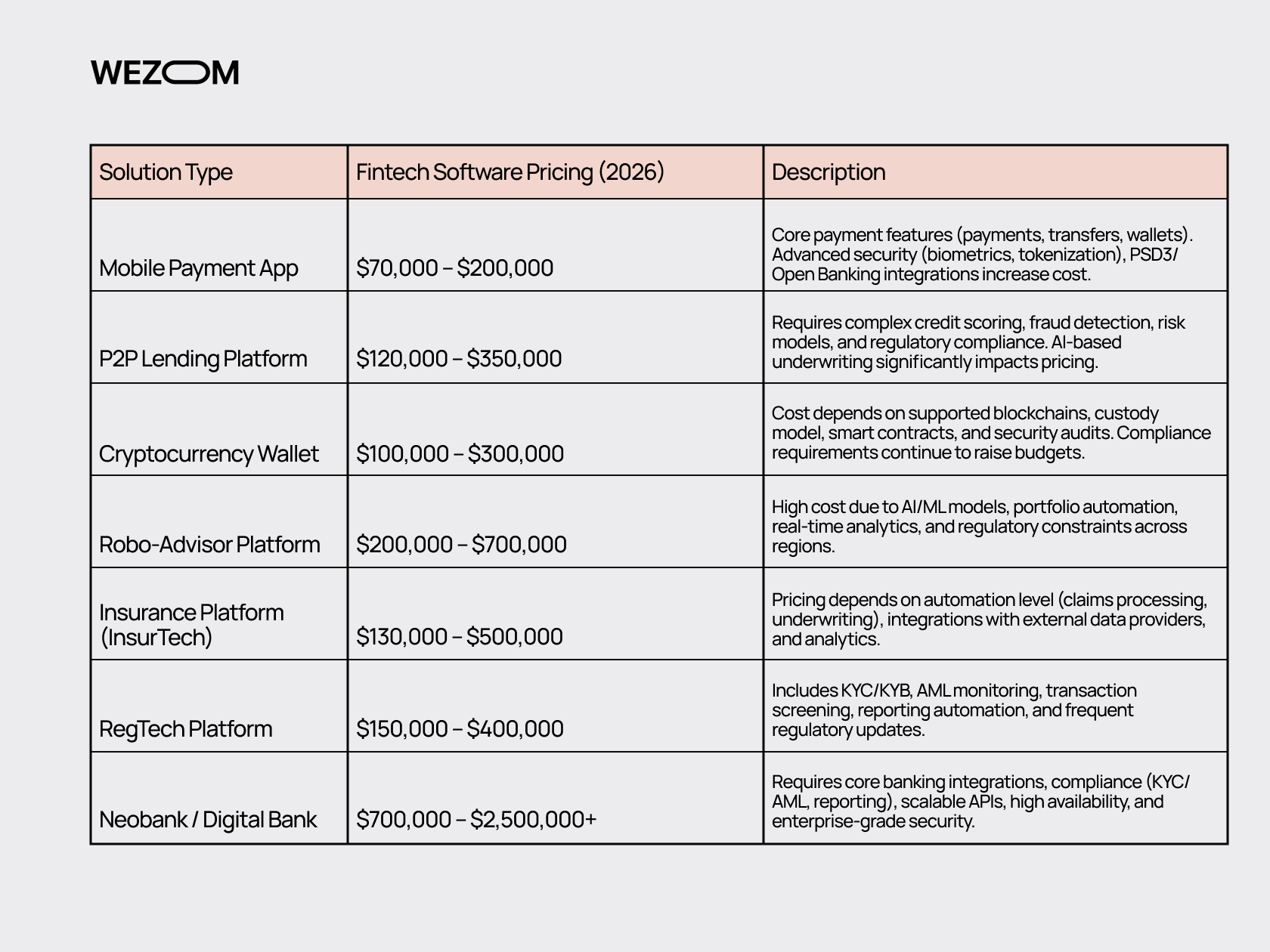

How Much Does Fintech Software Development Cost?

As always, the cost of fintech software solutions varies depending on the complexity of the project, the technologies used, the hourly rate of the fintech developer, and other factors.

All data is approximate and does not constitute a public offer. For a more detailed consultation with a fintech software developer and to estimate the cost of custom fintech software development, feel free to contact us through any available channel.

You can also optimize costs using classic methods: start with an MVP, leverage ready-made solutions (API interfaces). We recommend migrating your infrastructure to the cloud to reduce capital expenses on hardware and maintenance.

Key Trends Shaping Fintech Software Development in 2026

Fintech in 2026 is a market saturated with major players and startups. To stand out, companies are compelled to offer unique features, often sacrificing margins to retain users. What can we expect?

Artificial Intelligence as the Brain of the New Economy

In 2026, AI will serve as the heart and brain of most fintech applications. While today it helps banks assess risks and offer personalized products, tomorrow it will predict clients’ financial behavior even before they recognize their needs.

A real-life example: a financial advisor in your pocket

Imagine an AI that analyzes your financial behavior, including spending habits, income, and even emotional purchases (like that $6 latte after a tough day). This AI would proactively suggest saving strategies or advise how to invest excess funds based on your long-term goals.

For instance, Plaid is already testing solutions where fintech programming assists small businesses in managing cash flow gaps. By 2026, this technology will be accessible to everyone. This means that even a small corner shop could compete with global corporations in financial efficiency.

Biometrics and Blockchain: Armor for Your Data

Fintech is inseparably tied to trust, and trust begins with security. By 2026, biometrics and blockchain will be the standard rather than the exception.

Instead of passwords or PINs, you'll access your bank account using unique biometric data: fingerprints, iris scans, or even your heartbeat. This isn’t just convenient—it’s exceptionally secure, as your “access code” cannot be stolen.

On the other hand, blockchain offers the transparency that traditional banks have long lacked. By 2026, blockchain systems will be used not only for cryptocurrencies but also to create trusted chains in lending, insurance, and even international payments.

Fintech as a Bridge to Financial Inclusion

By 2026, fintech will serve as a lifeline for millions of people who currently lack access to banking services. According to the World Bank, over 1.4 billion individuals remain "unbanked." Fintech companies, through mobile applications and integration with government initiatives, will help bridge this gap.

In African countries, mobile banking apps like M-Pesa are already popular, enabling money transfers via basic phones. By 2026, we’ll witness the evolution of such apps with AI technologies, offering microloans and insurance services to millions, driving unprecedented levels of financial inclusion.

Digital Money: How Fintech is Changing Our Relationship with Currency

Central Bank Digital Currencies (CBDCs) will become mainstream by 2026. The United States, China, and the European Union are already developing their digital versions of the dollar, yuan, and euro. These currencies will enable lightning-fast transfers and increase the transparency of government finances.

The Role of Software Developers: Magicians of the New World

No matter how powerful the ideas, without developers, they remain mere dreams. By 2026, the role of financial technology software developers will grow exponentially. They will become the architects of the digital world, building platforms that not only solve current challenges but also anticipate the future.

One of the key trends for 2026 is the rise of low-code and no-code platforms. These tools will enable fintech software companies to launch products at a fraction of the time, significantly accelerating innovation and delivery.

Algorithms for Life: Personalization as the Key to the Customer's Heart

Personalization will become a mandatory standard. Companies unable to offer tailored solutions risk being left behind.

Practical example: smart credit scores

Traditional credit scoring models, like FICO, are becoming obsolete. By 2026, AI will assess borrowers based on a broader range of factors, including their online activity, consumer habits, and even social connections. This comprehensive approach will allow lenders to make more accurate and fair lending decisions.

Metafinance: A Step into Virtual Reality

The metaverse is unlocking an entirely new niche for fintech. By 2026, you’ll be able to secure a loan from a virtual bank using your digital real estate as collateral or trade NFT assets directly through your VR headset.

The Role of Fintech APIs in Software Development: How Integrations Drive the Growth of Fintech Ecosystems

Fintech APIs enable integration with non-financial sectors such as e-commerce, healthcare, and logistics. For example:

- E-commerce platforms can utilize payment APIs to provide diverse payment options at checkout.

- Healthcare providers can integrate APIs to offer patient financing solutions for treatments.

APIs also drive the adoption of embedded finance, seamlessly integrating financial services into non-financial platforms.

Additionally, APIs enable fintechs to scale globally by integrating with local payment gateways, tax systems, and currency exchange services. This promotes financial inclusion and expands the customer base.

Open banking relies on APIs to securely share user data between banks and third-party providers. This fosters competition and innovation, empowering users to access personalized financial products.

Emerging Technologies in Fintech Software Development

By 2026, we anticipate the widespread adoption of groundbreaking technologies that will redefine the financial landscape. We eagerly await the day when our reality includes:

- NFT-based bonds or loans as part of the decentralized finance (DeFi) ecosystem.

- The implementation of quantum algorithms to accelerate transaction processing and optimize investment portfolios.

- A shift from traditional passwords to fully biometric security systems for enhanced user authentication.

- The creation of "virtual branches" where customers can interact with banks through VR devices.

- IoT-powered platforms that manage budgets and connected devices through a unified interface, enabling seamless payments via smart devices like cars and smart homes.

- The emergence of super apps combining finance, lifestyle, and other services into a single, integrated experience.

- The use of hybrid cloud solutions to optimize costs and increase operational efficiency for fintech services.

- The integration of Generative AI for automatic creation of financial recommendations and tailored products.

- Platforms designed to manage eco-friendly investments and track their environmental impact.

These technologies are set to form the foundation of the fintech industry’s future, delivering safer, more convenient, and highly personalized services for customers. Startups that successfully integrate these innovations will secure leadership positions in the market and redefine the industry for years to come.

Challenges in Fintech Software Development in 2026

Developing fintech software in 2026 is akin to steering a ship through a storm: the market is expanding, waves of technology are surging, but a single misstep could spell disaster. While fintech solutions of the past decade focused on user-friendly mobile apps and online banking, today's landscape demands complex systems incorporating artificial intelligence, blockchain, and integration with legacy banking infrastructures.

Stronger Security? More Sophisticated Ways to Breach It!

Data protection in 2026 is like a fortified vault: even if it's unbreakable, you must ensure the keys remain secure. Consider the recent hack of one of the largest cryptocurrency exchanges, where over $600 million was stolen. If such a major player can be targeted, what can we say about less-protected fintech startups?

Is there a solution?

For instance, secure fintech software that analyzes user behavior and flags suspicious activities could offer a robust defense. Additionally, implementing two-factor authentication and biometric security as standard practices can greatly enhance safety. In the ever-evolving battle against cyber threats, proactive and adaptive measures will be crucial.

Regulatory Challenges

The number of regulations is growing faster than IT companies can implement them. Each region imposes its own laws: GDPR in Europe, CCPA in the US, and local requirements in Asian and African countries.

Example: A fintech app operating in the US may process data without issue, but when expanding to the European market, it must comply with GDPR. This requires significant costs to adapt the architecture.

Solution: Development of fintech data management software with integrated RegTech - automated systems that simplify regulatory compliance. For example, using built-in APIs for checking AML (Anti-Money Laundering) or KYC (Know Your Customer) requirements.

High User Expectations

Users expect the utmost convenience from fintech. Delays, complex interfaces, or errors are unacceptable. Modern customers want their financial world to fit in their pocket and work like clockwork.

Real Example: In 2023, one BNPL (Buy Now, Pay Later) platform experienced transaction processing delays, causing thousands of users to immediately switch to competitors.

Solution: Investment in UX/UI design and regular testing of user experience. Using cloud-based fintech software to improve speed and reliability.

Fintech Software Integration With Legacy Systems

Banks and financial institutions have been using systems for decades that remain relevant in 2026 but are incompatible with modern technologies. Integrating new systems with legacy platforms is difficult, and errors in integration can result in data loss.

Solution: Utilize middleware solutions to simplify interaction between new and old systems. Gradual migration of data to the cloud or distributed databases can help improve compatibility and reduce the risks of data loss.

Technological complexity

As technology advances, it becomes increasingly complex. Innovations such as blockchain, artificial intelligence, Big Data, and other innovative fintech software are being integrated at a rapid pace. These technologies evolve faster than specialists can master them, and implementing blockchain or machine learning algorithms requires significant investment.

Solution: continuous training for teams and hiring specialized professionals is essential to keep up with these advancements. Leveraging ready-made platforms and libraries can help reduce development time and costs, allowing companies to focus on integrating the most relevant features without reinventing the wheel.

Case Study: Successful Fintech Software Development Project

Our client, a company specializing in 3D modeling and rendering for the real estate sector, faced a significant challenge: 15–20% of their work remained unpaid because existing solutions like WeTransfer and Dropbox couldn’t link file transfers with payments. They needed a platform to securely deliver their visual content to clients while ensuring timely payments.

Our Solution

We proposed the concept of Makeit.io, a unique platform that combines file sharing with payment processing. The initial phase focused on creating an MVP with essential features:

- Uploading images with a low-resolution preview.

- Payment integration to ensure files could only be downloaded after payment.

- Fast and reliable file transfers accessible through any browser.

To build the platform, we employed advanced technologies:

- Laravel for backend reliability and flexibility.

- React.js for a user-friendly interface.

- AWS for stable and fast file storage.

An Innovative Approach to Product Development

Following the successful MVP launch, we began developing an enhanced version of Makeit.io. The platform evolved into a SaaS tool designed to help freelancers and creative studios manage their sales more effectively. Key new features included:

- CRM-like functionality (client database and analytics).

- Integration with popular cloud storage services.

- Data export and bulk file archiving.

Results and Trends

Our solution helped the client achieve the following:

- Reduced financial risks and ensured payment transparency.

- Attracted new users from related industries, including photographers, designers, and 3D artists.

- Created a functional platform ready for future scaling.

We anticipate that the trends we implemented in Makeit.io will remain relevant in 2026:

- Customizable SaaS platforms. Companies and freelancers increasingly need all-in-one tools to manage their businesses.

- Integration with popular ecosystems. Seamless connections to cloud services and payment gateways are becoming essential.

- Data security and risk reduction. Reliable methods for protecting information remain a top priority for users.

Makeit.io demonstrates how innovative technology and a client-focused approach can create solutions that shape the future of industries.

Conclusion: revolution is inevitable

If you can't prevent it, you must lead it!

As we've seen, software development in the fintech space is no easy task. Behind every convenient button in a mobile app and every instantaneous transaction, there are countless efforts: data protection, regulatory compliance, integration with legacy systems, and the adoption of cutting-edge technologies.

If you require fintech software development services, you need a partner who understands both the market and the technologies. We are not just developers – we are your guides to the world of innovation and sustainable growth. Together, we will create scalable fintech software that not only meets expectations but exceeds them.