How much of your tech budget are you wasting on stuff that doesn't matter?

That's not a rhetorical question. Most companies are still allocating money based on what made sense three years ago. But 2026 looks nothing like 2023. AI went from experimental to essential. Cyberattacks got personal. Cloud costs spiraled out of control for companies that never bothered to optimize.

This article shows you exactly where leading companies are investing their technology budgets in 2026. We'll cover the eight critical investment areas — from artificial intelligence and zero-trust security to data platforms and green IT. You'll get real allocation percentages, market data from trusted sources, and practical guidance on balancing innovation with operational needs. Plus, we'll tackle the factors that should actually influence your budget decisions, not just what sounds impressive in board meetings.

Why Companies Are Reallocating Budgets Toward Transformative Technologies

The free money era is over. CFOs aren't signing blank checks anymore, forcing healthy conversations about what tech really delivers value. Companies are hunting for automation that actually works — not the kind that sounds good in demos but creates more problems than it solves.

While some companies debate whether to invest in AI, others are already using it to redesign customer experiences. The gap between leaders and laggards? It's widening fast.

Your competitors aren't waiting. They're experimenting with generative AI for customer service, building real-time analytics into products, creating personalized experiences that make yours look dated.

We've moved from "Can AI actually do this?" to "How do we deploy this responsibly?". Companies are embedding intelligence into workflows, products, and decision-making processes.

Cybersecurity used to be an IT problem. Now it's a board-level risk that keeps executives up at night. Between ransomware gangs getting sophisticated and regulators demanding stronger protection, companies can't treat security as an afterthought. Modern security assumes breach, implements zero-trust architecture, and detects threats in real-time.

You moved to the cloud five years ago. Great. But cloud infrastructure ages too. Many companies did "lift and shift" migrations — basically moving old applications to the cloud without modernizing them. They're paying cloud prices for on-premise architecture.

2026 is the year companies do cloud right: containerization, serverless computing, proper multi-cloud orchestration.

How IT Budgets Are Changing in 2026

Let's talk numbers. According to Gartner's latest forecast, global IT spending is projected to reach $6.08 trillion in 2026, growing 9.8% from 2025. Software spending continues to lead growth, especially anything involving AI or data analytics. The tech sector is experiencing its strongest momentum in years, driven by enterprise demand for intelligent systems and cloud infrastructure.

That growth isn't evenly distributed. Some categories are exploding while others are basically treading water.

Here's how tech spending is shifting.

| Growing Investment Areas | Growth Rate | Key Drivers |

|---|---|---|

| Cloud services & infrastructure | 12-15% | Multi-cloud orchestration, serverless computing. |

| AI & machine learning platforms | 20%+ | GenAI APIs, AI copilots, ML infrastructure. Investors focus on top AI companies to invest in enabling this boom. |

| Cybersecurity tools & services | High | Breaches cost $4.45M average. Best software stocks in security outperform market indices. |

| Data management & analytics | Strong | Real-time platforms, modern BI tools essential for AI readiness. |

What's declining: Legacy system maintenance (down 3-5% annually), traditional data center hardware (flat or declining), and old-school collaboration tools are being replaced by integrated cloud platforms.

What companies want: efficiency, automation, resilience, and AI readiness.

Translation? They want systems that reduce headcount needs without sacrificing quality. They want processes that run themselves. They want infrastructure that survives outages, cyberattacks, and unexpected demand spikes. And they want to be positioned for AI adoption — which means having their data house in order.

The pattern is clear: if technology makes you faster, cheaper, or better at serving customers, it's getting funded. If it's just maintaining the status quo, it's getting questioned.

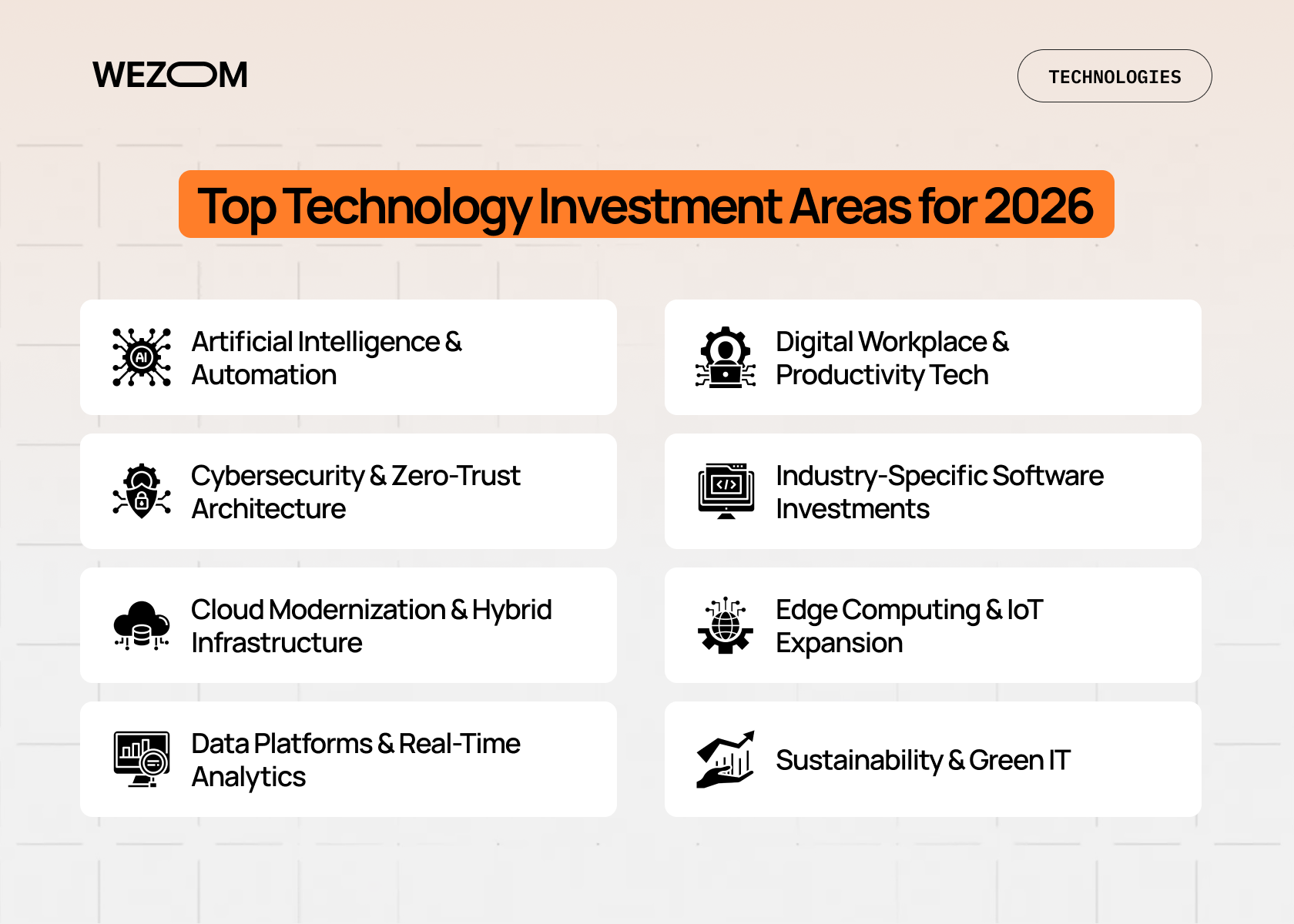

Top Technology Investment Areas for 2026

These eight areas are where smart companies are putting their money in 2026.

Artificial Intelligence & Automation

If you're not investing in new technology like AI in 2026, you're probably making a mistake. GenAI adoption is everywhere — companies use AI copilots to help employees write better code, draft clearer communications, and analyze data faster. These aren't replacing people, they're making them more productive.

Workflow automation is getting smarter, handling complex multi-step processes that used to require human judgment. One manufacturing client automated quality control inspections and caught defects they were missing before. The technology companies to invest in are those building practical AI tools that integrate seamlessly into existing workflows, not just flashy demos.

Cybersecurity & Zero-Trust Architecture

Zero-trust architecture is becoming the baseline. The idea is simple: trust nothing, verify everything. Companies are investing heavily in identity and access management, cloud security tools, AI-powered threat detection, and compliance automation.

The tools are getting better. Companies that invest now sleep better at night. When evaluating tech stocks to invest in, cybersecurity providers consistently rank among the best performing tech stocks due to sustained enterprise demand.

Cloud Modernization & Hybrid Infrastructure

Containerization with Kubernetes is standard practice now. Serverless computing is worth interest — you write code, the cloud provider handles infrastructure scaling automatically. You only pay for what you use.

Multi-cloud orchestration gets serious investment because companies realize putting everything in one cloud provider's hands is risky. They're building systems that work across AWS, Azure, Google Cloud — wherever makes sense. The infrastructure providers enabling this flexibility represent some of the best tech stocks to buy now for investors looking at long-term growth.

Data Platforms & Real-Time Analytics

Companies are building unified data lakes that bring together scattered information. Modern BI tools make data accessible to people who aren't data scientists. Real-time insights are becoming table stakes — waiting until tomorrow to know what's happening today is too slow.

Data governance tools are getting investment too. Having all that data is useless if you can't trust it or keep it secure. The tech to invest in includes platforms that handle data quality, lineage tracking, and compliance automation — the unglamorous but essential infrastructure.

Digital Workplace & Productivity Tech

AI-assisted collaboration tools are changing how teams work. Your meeting platform generates transcripts and action items automatically. Remote-first infrastructure means seamless access to everything, whether you're in Tokyo or your living room.

Companies are consolidating tools, investing in platforms that integrate well, and actually asking employees what they need instead of buying whatever's trendy.

Industry-Specific Software Investments

Retail automation is exploding — smart inventory systems, AI-powered demand forecasting, automated checkout. Fintech platforms are eating traditional banking's lunch with payment processing, lending automation, and fraud detection. Healthcare tech is catching up with telemedicine platforms and AI diagnostic assistance. Smart manufacturing uses IoT sensors and predictive maintenance to optimize in real-time.

These vertical-specific solutions often come from best tech startups to invest in — nimble companies solving niche problems that established vendors ignore.

Edge Computing & IoT Expansion

Edge computing brings processing power closer to where data's created. Autonomous vehicles can't wait for cloud latency — they need millisecond decisions. IoT sensors are getting cheaper and smarter, tracking shipments, monitoring equipment, measuring conditions. 5G rollout makes edge computing practical at scale.

Sustainability & Green IT

Energy-efficient hardware cuts costs while helping the planet. Carbon tracking systems measure environmental impact — with ESG reporting becoming mandatory, this isn't optional. Cloud providers face pressure to use renewable energy, and companies choose providers partly based on environmental commitments.

Emerging Technologies to Watch in 2026

You don't need to invest heavily in everything. But you should know what's coming.

Quantum-Ready Security Tools are getting attention because quantum computers could eventually break current encryption methods. Organizations handling sensitive long-term data — governments, banks, healthcare — are already piloting post-quantum cryptography. It's not urgent for most companies yet, but the groundwork is being laid now.

Synthetic Data Platforms generate artificial datasets that look real but aren't, solving privacy concerns and data scarcity problems. Companies use synthetic data to train AI models without risking actual customer information. Healthcare and financial services are leading adoption.

Robotics and Automation Systems are moving beyond factories into warehouses, hospitals, restaurants, and retail stores. AI-powered robots are getting cheaper and smarter, making them viable for mid-sized companies. Collaborative robots that work safely alongside humans are the fastest-growing segment.

Digital Twins create virtual replicas of physical systems (factories, buildings, supply chains) letting companies test changes digitally before implementing them physically. Manufacturing and logistics are seeing strong ROI from digital twin implementations.

Should you invest heavily now? Probably not. But pilot projects and proof-of-concepts make sense. Test the waters, learn from early adopters, and be ready to scale when the technology matures. These new technologies to invest in represent longer-term bets that could pay off significantly for early movers.

Factors Influencing Technology Budget Decisions

Every CFO wants ROI. When evaluating new technology to invest in, smart companies balance quick-win projects with longer-term strategic investments. They track metrics rigorously and stay honest about timelines.

Talent shortages affect what technologies you can realistically adopt. AI engineers, cloud architects, cybersecurity specialists — everyone wants them. Some companies invest in managed services, others train existing workforce.

Regulations shape tech investments. GDPR, CCPA, AI regulations, financial compliance — companies need technology that helps them stay compliant, not create new regulatory headaches.

Vendor consolidation matters because managing 50 different vendors is exhausting. Companies consolidate around platforms that do multiple things well. But don't get locked in — make sure you can leave if needed.

AI readiness requires clean data. You can't do AI if your data's a mess. Companies need data cleaning, standardization, governance, and quality controls — all the boring foundational stuff that makes exciting stuff possible.

How companies should allocate their 2026 tech budgets?

The 70-20-10 rule works well: 70% on core operations and proven systems, 20% on emerging technologies with clear business cases, 10% on experimental stuff.

Start small, prove value, scale up. Run pilots, measure results, expand what works. Consider the total cost of ownership, not just purchase price. Invest in your people alongside technology — the best software is useless if nobody knows how to use it. Build for interoperability because systems that play well together are worth their weight in gold.

Real-World Investment Patterns and Market Data

According to Morningstar's technology sector report, the best performing tech stocks share common traits: strong recurring revenue models, clear competitive moats, and exposure to secular growth trends like cloud adoption and AI integration. Companies in the tech sector stocks category are being evaluated not just on revenue growth, but on their ability to demonstrate clear paths to profitability.

Analysts at U.S. News highlight that software stocks, particularly those focused on cloud infrastructure and cybersecurity, continue to outperform hardware investments. The shift toward subscription models means companies prefer predictable monthly costs over large upfront investments. When considering tech stocks to invest in, market watchers emphasize the importance of recurring revenue and customer retention metrics.

Recent analysis from Yahoo Finance shows experts are bullish on companies enabling AI infrastructure, providing cybersecurity services, and facilitating digital transformation. These are the stocks to pay attention to because they're building the fundamental infrastructure that every digital business needs. The high growth tech stocks getting attention aren't just growing fast; they're capturing markets with strong network effects and switching costs.

What's becoming clear is that top performing tech stocks in 2026 aren't following the old playbook. Investors are rewarding companies that can articulate how their technology investments translate into competitive advantage and market expansion.

Conclusion

2026 is a year when technology choices really matter. The gap between companies that invest strategically and those that don't will widen. AI, cybersecurity, cloud modernization, and data platforms aren't optional anymore.

The companies that'll thrive aren't necessarily those with the biggest tech budgets. They're the ones that invest wisely, implement effectively, and keep their eyes on what actually drives business value.

Need help figuring out where to invest your tech budget? Our team helps companies cut through the noise and focus on technology that actually delivers ROI. Let's talk about your priorities for 2026.

FAQ

Which industries will increase tech spending the most in 2026?

Financial services, healthcare, and retail are leading tech spending growth in 2026. Banks invest heavily in AI-driven fraud detection, healthcare organizations modernize patient data systems, and retailers automate inventory management. Manufacturing increases investment in IoT sensors and predictive maintenance, while government and education sectors begin catching up after years of underinvestment.

How will AI influence corporate budgets in 2026?

AI is fundamentally reshaping corporate priorities. Companies are reallocating budgets from manual processes toward intelligent automation, with 20–25% of IT budgets dedicated to AI initiatives. In addition to direct AI spending, organizations invest in supporting infrastructure such as advanced data platforms, high-performance computing, and governance systems.

Why is cybersecurity a top investment area in 2026?

Cybersecurity is a top priority because threats are becoming more sophisticated and costly. Ransomware attacks, state-sponsored hacking, and strict regulations increase financial and reputational risks. Companies now view cybersecurity not just as an IT issue but as an existential business concern, since a single major breach can destroy customer trust and severely impact company value.

How can companies evaluate new technology before investing?

Companies should begin with pilot projects instead of full-scale deployments. Testing technology with small teams helps measure real-world results. Speaking directly with peers who already use the technology provides honest insights into benefits and challenges. It is also critical to confirm that the solution addresses a real business problem and aligns with the organization’s ability to implement and maintain it.

What are the risks of investing in emerging tech in 2026?

Emerging technologies may fail to meet expectations, and vendor stability can be uncertain. Integration challenges often complicate deployments, increasing costs and delays. To manage these risks, companies should balance innovation with pragmatism—experimenting carefully without overcommitting. In many cases, being a fast follower is safer than becoming a bleeding-edge pioneer.