No doubt, 2022 was an exciting year for the financial industry, from the crypto market crash to new financial regulations and the rise of "Digital-Only" Banking.

The fintech industry is evolving with the market trends to meet customers' needs, business goals, and regulatory demands worldwid, driving higher demand for specialized software development for Fintech. In 2023 we expect to see robust technologies shaking the finance industry and enable it to strengthen business propositions, enrich customer experiences and boost revenues.

Let’s look at some FinTech trends of 2023:

1.Embedded Finance

The incorporation of financial services and goods within established financial institutions is known as embedded finance. This entails integrating payment methods into e-commerce platforms without asking the customer to leave the website; this is a useful tool for SMEs who lack the funding and expertise to expand their services.

“It simplifies the customer journey, and enables value-added services, such as incentives, discounts, or additional products, whereas it remains invisible in the background. For brands and companies, it provides opportunities for increased loyalty and potential additional revenue streams,” Panagiotis Kriaris comments.

It makes sense that many industry experts view it as the next financial frontier given that the U.S. alone is expected to have a market worth over €50 billion by 2026. FintechOS is also worth examining as it enables financial companies to create various kinds of solutions with little to no coding.

“The ecosystem of embedded finance – the integration of financial tools or services within the offerings of nonfinancial institutions for a seamless, convenient, easy-to-use customer journey – is considerably large and is further expected to grow significantly in the coming years.” Alexandra Pollack shares.

2.Fintech Trends for SMEs

Even if corporate software solutions are the key to growing quickly in a downturn, embedded financial services will lead to an increase in the number of fintech solutions for small and medium-sized businesses. The re-invention of small-business financial services will be the focus of 2023. They require simpler financial operations, straightforward smart analytics, and practical guidance.

Mark Batsiyan, partner and COO at Inspired Capital said, “And fintech for SMBs will be a huge area of focus as SMBs look for innovative solutions to help them through the economic cycle.”

3.Alternative Payment Infrastructure

Without a doubt, the use of virtual cards and contactless payments will increase in 2023. Digital wallet use has dramatically increased as a result of how simple they are for customers to use and for companies to set up. According to IT service management firm Marqeta, 60% of customers claim they would feel safe leaving the house with only their phone and not their wallet, while 75% of consumers are already using digital wallets to pay for their transactions. In 2023, virtual card payments are anticipated to become commonplace.

With the emergence of alternative or individualized payment methods, like Romanian PAGO provides, say goodbye to credit cards and bank transfers. When compared to more conventional financial techniques, these provide convenience, quickness, and security. By 2030, account-to-account (A2A) transactions may account for 15% of all transactions.

4.Functional Business Models

In 2023, what will set forward-thinking banks apart from their competitors will be their capacity to foresee changing client demands and, in turn, build user experiences that successfully drive intrinsic human behavior and promote financial health.

Instead of placing a heavy emphasis on user growth, the transition will be toward functional business models, which may turn lucrative faster. Investors may carefully examine the cost of user acquisition to customer lifetime value ratio, paying particular attention to the assumptions behind the value portion and the speed at which that value may be realized.

5.Blockchain-Based Transfers

There is a declining trend in cryptocurrencies, however underlying blockchain technology is still developing and holds potential for a number of uses.

These days, sending money abroad is a costly, time-consuming operation. DeFi enables peer-to-peer transactions that are instantaneous and cost-free, which solves one of the main challenges faced today. According to recent research, more people are beginning to recognize the benefits of cryptocurrencies for overseas payments.

The central banks of various nations want to issue CBDCs, which are blockchain-based digital representations of their respective national currencies. Since clients progressively shifted to cashless transactions throughout the pandemic, it is anticipated that the deployment of such initiatives will pick up speed the following year. According to experts, CBDCs will offer security, privacy, transferability, ease, and accessibility.

6.Know Your Customer (KYC) Guidelines

Innovative rules are required when cashless solutions experience an exponential growth and more financial firms emerge on the worldwide market. The coming year will see significant increase in KYC requirements, which are laws protecting financial institutions from corruption. In 2023, new rules will probably concern cryptography and biometry, to mention a couple.

The procedures that companies should take to correctly verify the identification of their consumers are outlined in KYC guidelines. These involve checking documents, such as government-issued identity or proof of residence, as well as personal data, such as name, address, and date of birth.

Additionally, they mandate that companies determine the risk tolerance of their clients and keep an eye out for unusual behavior with their financial transactions.

7.Micro-insurance

Pay-per-use insurances—which require you to only pay for auto insurance while you are really driving—as well as micro-insurance—which covers risks for a short period of time—could be an intriguing method to challenge the status quo in the insurance industry.

Andreas Rung predicts that 2023 will be the year of micro-investments: “As branches are disappearing, the banks should find a strategy to engage younger generations in investing. They are ready to learn and experiment even in risky fields, but only with small amounts of money to see what will happen.”

8.ESG is a Key Topic in Finance Too

With several banks already pledging to achieve net-zero carbon emissions, the green banking movement has recently gained a lot of momentum. Banks are beginning to investigate how they may handle their ESG objectives in a more comprehensive approach that not only covers their own operations but also helps their customers' own decarbonization initiatives in order to fulfil that promise.

With this in mind, many banks will implement solutions in 2023 that are less data-focused and more effective at assisting consumers in adopting sustainable lifestyles and lowering their carbon footprints as opposed to continuing to use the traditional green financial products that have dominated the market in recent years, such as carbon footprint calculators.

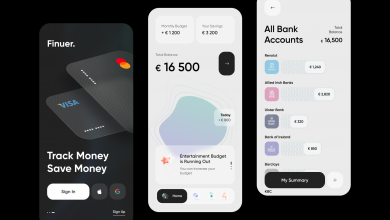

9.Personalized Tools

Pre-made solutions will be the go-to option at a fraction of the cost as we experience one of the most challenging economic times in the previous 50 years. Any business should take use of off-the-shelf modules that complement and integrate well with their existing product stack to generate additional income streams.

Although general financial apps will always have a place in the market, tailored solutions that address the needs of certain audiences will be far more successful going ahead.

Pre-made solutions will be the go-to option at a fraction of the cost as we experience one of the most challenging economic times in the previous 50 years. Any business should take use of off-the-shelf modules that complement and integrate well with their existing product stack to generate additional income streams.

According to Andreas Rung, the voice front will experience progress in design over the course of the upcoming year. Natural language processing (NLP) and voice recognition technologies must advance in order for customers to utilize voice commands to access services in a smooth manner. “Siri? Alexa? Pay my internet bill, please.

10.AI Technology as a Cost-Effective Alternative

FinTechs will continue to concentrate on cost minimization and digitization as they run their businesses during these times after a year with international external concerns like the war in Ukraine and the energy crisis.

The financial industry is well-positioned to benefit from everything that artificial intelligence has to offer since it is on the rise across the board. A cost-effective replacement for the existing high expenses of collecting, interpreting, and using data is algorithmic AI decision-making. Additionally, chatbots are swiftly becoming a priceless tool for customer service organizations.

Brian Dixon, managing partner of Kapor Capital said, “Generative AI meets fintech. I expect robo investors to roll out new AI-assisted robo advisors.”

Conclusion

Along with market trends, the FinTech sector is growing to meet global regulatory requirements and customer needs. In 2023, powerful new technologies will continue to shake up the sector, allowing it to improve customer experiences, strengthen business propositions, and bring in more money.