Nowadays, many companies actively use ERP (enterprise resource planning) systems, and every year their numbers are only growing.

To be more precise, over the next 12 months (e.g., by the end of 2024), 1.4 million companies are expected to spend $183 billion to implement and/or maintain such systems. Moreover, this figure represents almost 18% of total IT software expenses and 5% of total IT expenses. This demand for such software is driven by the growing number of small and medium-sized enterprises and the need to optimize operational efficiency and provide a competitive advantage constantly.

For those looking for a comprehensive overview of ERP system modules and their significance in business operations, our Corpsoft's article "What Are ERP System Modules" offers valuable insights.

At the same time, one of the core ERP system modules remains the finance one. It collects data from other modules and transforms them into financial reports. Below, we will discuss this module in more detail and consider the case of its custom development, implemented by our team.

ERP Finance Module: What Is It?

So, what is this module? In a nutshell, it accounts for a company's financial assets and generally optimizes their management. Among the standard components that this module contains are a general ledger (GL), a balance sheet, a transaction processing tool, as well as a number of minor tools such as revenue management and profitability analysis. The main task of such a module is to provide the company’s employees with a solution for centralized management of financial flows and actual data associated with them.

Why Are ERP Finance Modules Important?

The importance of the finance module is difficult to overestimate: with its help, companies receive data on financial processes in real time and can also generate accurate accounting reports and analytics with calculated metrics of the efficiency and profitability of these processes.

Moreover, the value of this module can be transferred to helping develop planning strategies – in fact, what the ERP system itself is responsible for. Specifically, by having up-to-date information on the number of financial assets, companies are able to manage human capital, supply chains, and the level of demand for raw materials and other components for production more effectively.

ERP Finance Module Features

Now, we invite you to consider the main features of the ERP finance module in detail.

General ledger

This component of the finance module provides company employees with a history of financial transactions, including income and expenses, existing assets, debts, inventories, etc. Records from this ledger are not processed within it – instead, they are transferred in the required format to other components and tools of the finance module – for example, to calculate the volume of purchases, generate reports for a fixed period of time, etc.

Accounts payable

The Accounts payable component, as an essential part of an ERP finance system, provides end-to-end management of the finances that a company must pay to banks, investors, and other credit organizations. By centralizing the accounting of this data through the integration of the ERP accounting module, companies receive a comprehensive view of their financial status and can also optimize their further expenses according to these debts.

Accounts receivable

In addition to keeping track of their own debts, companies can also use the Accounts receivable component to provide them with insight into how much money their partners owe them. At the same time, they get the opportunity to track debt payments in real time, as well as automate the function of regular requests for debt payments. This approach saves them from unnecessary fuss with delicate communication.

Procurement

This ERP financial management component optimizes tasks associated with both regular and one-time purchases of materials and services necessary for the production of internal company solutions. They also generate and keep digital records of all related documentation, thereby eliminating the need to fill out paper one.

Fixed assets management

The fixed asset management component is responsible for control over the company's physical assets, be it equipment for the production of the company's products, employee computers, server equipment, trucks for transporting goods, or something else. With a centralized, standardized database of these assets, companies can plan for their maintenance and replacement.

Profit monitoring

This monitoring tool allows companies to assess their general financial situation and provides useful insights for improving it. In particular, thanks to powerful tools for profitability analysis, companies gain an objective understanding of which profit channels are the most effective (which means they can invest even more in them) and which return the least (or are completely unprofitable).

Tax management

This component simplifies procedures related to tax calculations. It can be especially useful for companies whose activities extend to countries with dynamic taxation. Thus, these companies minimize the risks associated with incorrect calculations of taxes and fines provoked by their late payment.

Risk management

This is an advanced component that is often based on artificial intelligence algorithms. In particular, in its operation, it relies not only on the company’s internal data but also on external public big data sources that can determine upcoming trends in consumer demand, audience’s preferences, and other important aspects of the business niche to which the company belongs.

In addition, this component automatically evaluates the creditworthiness of both the company itself, to be able to pay its debts, and partners, for whom the company acts as a creditor. There are also risk management components with advanced functionality that cover risks related to safety, compliance with standards and regulatory requirements, brand reputation, etc.

Reporting

Finally, let's talk about one more key component that uses all the financial data that the company owns and generates reports based on it. An important advantage of this module is the availability of reporting data visualization functions. At the same time, these modules are also capable of generating standard reports for provision to external independent authorities – for example, the tax office.

Benefits of ERP Finance Modules

Above, we have already outlined the basic structure of the ERP finance module. However, to better understand its value for business, it is also important to analyze the benefits that it can provide.

- Transparency and accuracy of financial transactions within the company through the implementation of a centralized accounting solution

- Increasing the efficiency of employees by automating routine, resource-intensive tasks

- Reducing risks associated with the human factor (incorrect data entry, use of outdated information, etc.)

- Improving decision-making processes thanks to the system’s advanced analytical capabilities (which are often provided through the introduction of artificial intelligence technologies)

- Digitalization of document flow and minimization of paperwork

- Elimination of risks associated with incorrect calculation of taxes and debts (both internal and from the company’s partners)

- Integration with other modules – both within the system it belongs and other business software solutions that the company uses

In fact, we have covered only the basic benefits, and you can evaluate the final list only when considering finance modules from specific ERP system providers.

Our Case of Development ERP Finance Module

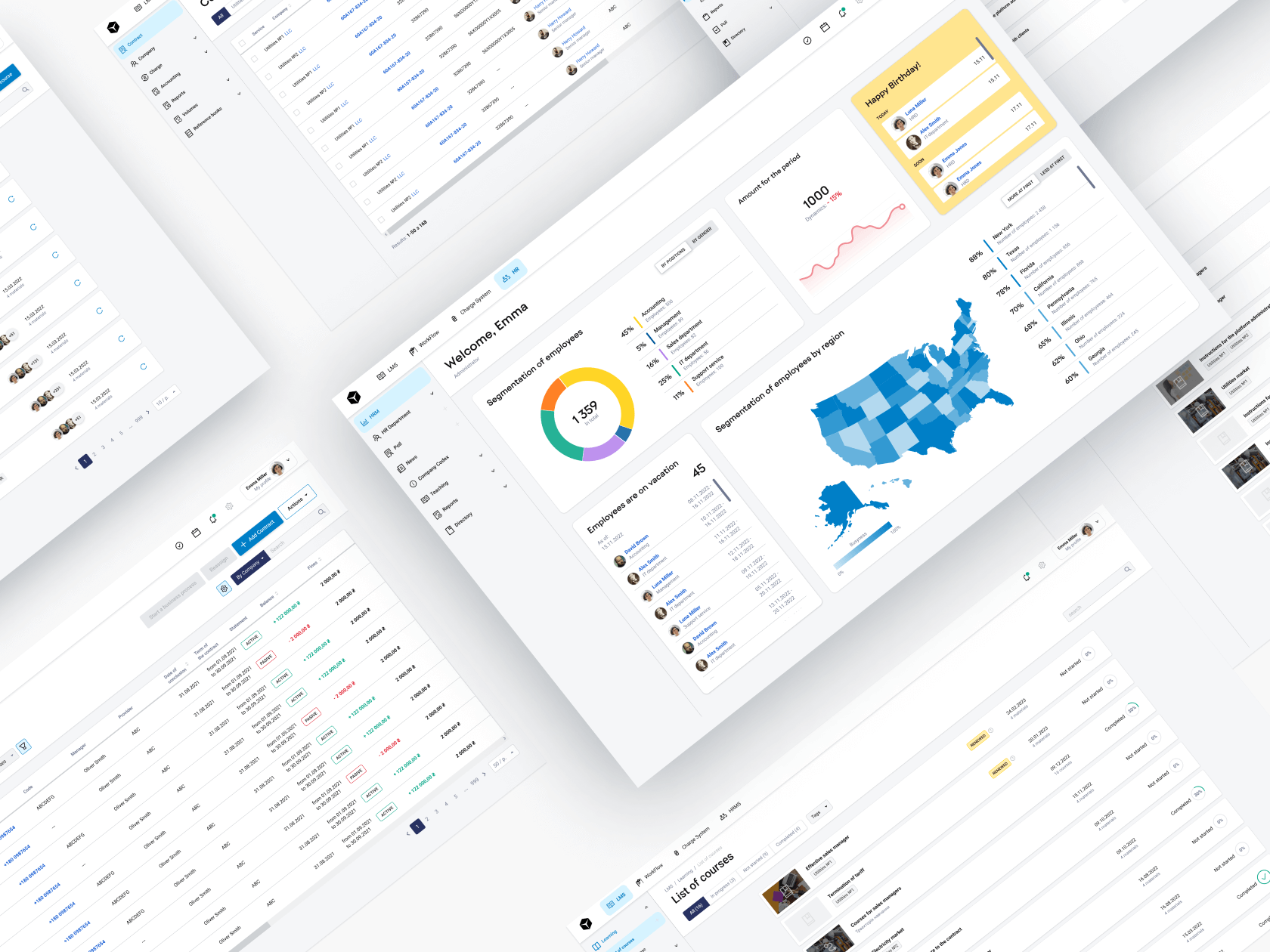

Finally, we propose you consider a relevant case, which the WEZOM team brought to life from start to finish.

In particular, we were approached by a client whose business activities are focused on the oil and gas sector. The client's company currently has 17 offices, but it continues to scale. This growth, in turn, imposes certain difficulties on managing business operations. This is especially true for finance because manually collecting data from each office is not only resource-intensive but also sometimes ineffective since not all accounting departments in each office can provide “fresh” data on financial flows on time.

To simplify financial accounting within the company, the client began to look for ready-made solutions. Unfortunately, none were found – those offered by well-known ERP system vendors turned out to be insufficiently customizable, unable to integrate with software solutions of the client’s ecosystem, and expensive to maintain. In addition, most of them didn’t meet local industry standards. Thus, the client decided to develop a custom finance module and approached us with this task.

We conducted an in-depth analysis of the market, considering the advantages and disadvantages of existing out-of-the-box solutions, and also considered the individual client’s requirements. As a result, having formed the most suitable technology stack for this project.

Note that the development of the ERP finance module took place within the framework of a more global solution – the custom ERP system that also had to include such modules as billing solution, CRM, electronic document management, HR module, and LMS.

To solve the problem posed by the client, we staffed a team of 12 specialists. As a result, after 30 sprints, we launched an MVP that meets ISO 31001, ISO 27001, GDPR, and CCPA standards. After deployment of this finance module in ERP, debtors' debts were significantly reduced by 38%.

You can also read more about this project here:

Conclusion

Even though the modern ERP market is replete with ready-made solutions, including for financial accounting, there are still companies whose business processes and individual requirements make it difficult for such solutions to meet their needs. If this case is about your business, you should consider the custom development option.

In particular, you can choose us to delegate this task. We have extensive experience working on such projects, so you can be sure that we will choose the best technologies and approaches to implement your idea.

Feel free to contact us now to discuss your problem in detail and estimate the budget needed to solve it.