We were approached by a Fintech company to ensure high-quality software testing in financial services.

ABOUT THE CLIENT

The main goal of turning to WEZOM was to provide the reliability and efficiency of the company's platform for its users. That’s why the client decided to resort to its comprehensive testing and QA.

GOALS AND OBJECTIVES

Solution

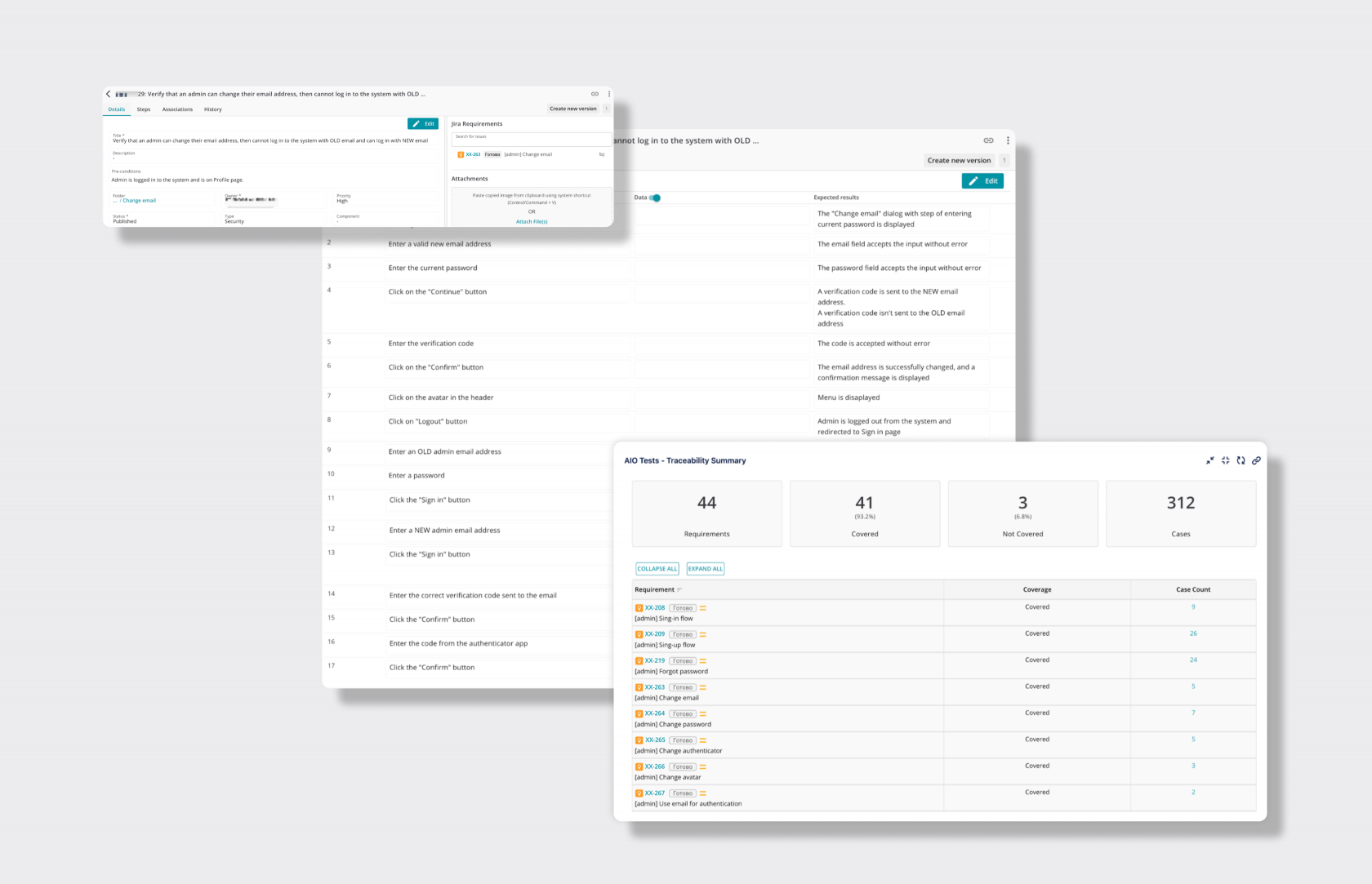

We started by creating a test plan that included:

- Testing goals and objectives;

- Testing scope, including functional and non-functional aspects;

- Testing environment description;

- Testing methodologies (manual and automated).

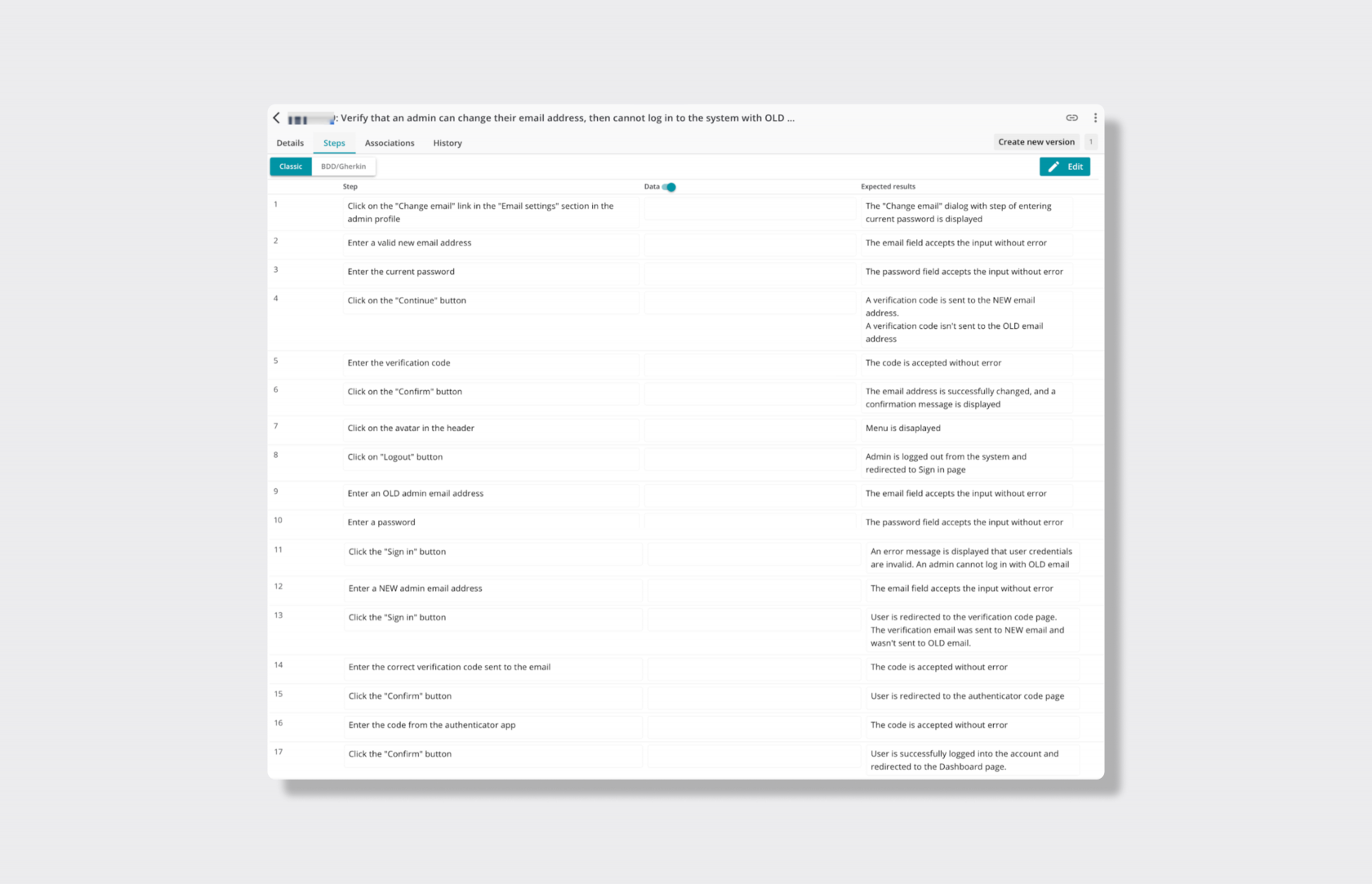

The client company had already used both dynamic (functional, non-functional, usability, performance, change-related, regression, smoke, and re-testing) and static (non-code execution, including code reviews and document reviews) testing methods in this project, so we decided to follow a proven example.

To reduce the regression testing time, our AQA specialists developed and implemented automated tests for critical functions, which also significantly increased the quality of the software.

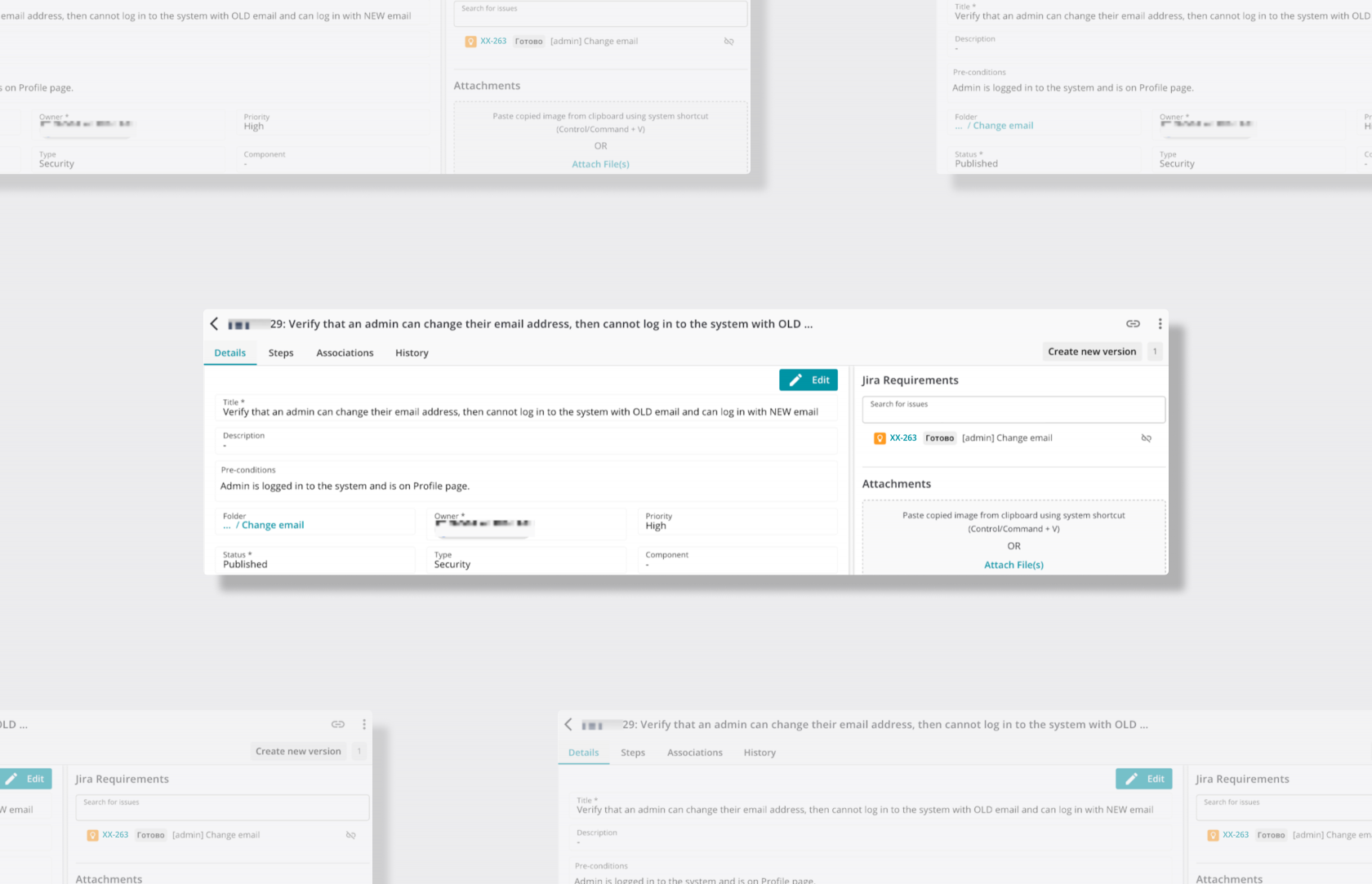

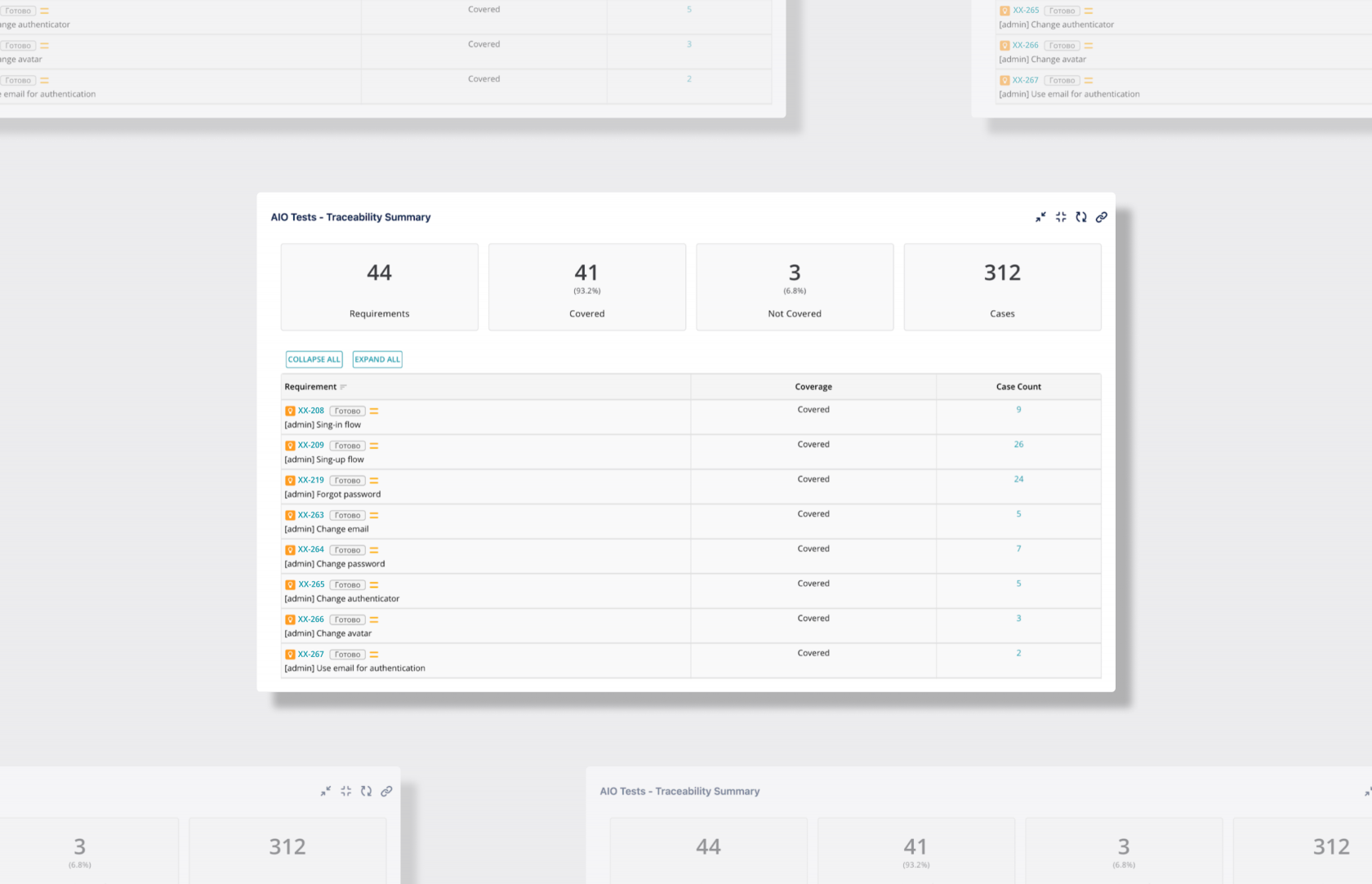

For reporting, we formed artifacts, a test plan, test cases, a traceability matrix, and defect reports (including a defect summary report). We also developed an automation framework for reporting on automated testing and prepared a separate report for all tests included in the regression scope performed during the sprint.

As a result of this financial software testing project, we achieved the following success indicators:

- 100% test coverage across critical project features;

- 500+ test cases to cover all functional requirements of the platform;

- -50% time reduction for regression testing due to automation;

- 100+ user scenarios tested to enhance user experience;

- 98% successful completion of regression tests to confirm the system’s stability.

Thanks to effective collaboration between QA and AQA during the entire testing process, the Fintech Software platform was launched with minimal defects and achieved a high level of user satisfaction.