Development of EasyFinance, an Online Tool for Managing Business Finances

Currently, small business owners, without the right tools at hand, are forced to bother with filling out Excel spreadsheets to maintain internal accounting and keep abreast of their income and expenses. Our client decided to help them deal with this problem by launching an automated solution for financial accounting.

Who Is Our Client?

Our client is an entrepreneur from Poland who personally faced some problems with using Excel spreadsheets for accounting.

Thus, he decided to launch his own startup which would help business representatives like himself to cope with the tasks of accounting in the simplest and fastest way.

In particular, it was supposed to be an online solution based on the SaaS model, which would provide users with all the necessary functionality to calculate income, expenses, and other critical business indicators in one place.

The Client's Request: to Create an Online Financial Management Tool for Small Business Owners

Small business owners quite often face the problem of the lack of affordable tools that would automate the tasks associated with calculating the company's profit and loss at specific time intervals. Instead, they have to use broader tools like Excel spreadsheets. But, as practice shows, this approach to accounting slows down the calculation process and makes it inconvenient.

This was the main reason for the emergence of the client's business idea: to create a SaaS solution that would be equipped with all the necessary functionality for financial accounting.

After a deep analysis of ready-made solutions and determination of the basic set of features necessary for such a solution, the client turned to us to develop an online project with the possibility of further scaling.

What Goals We Followed and What Services We Provided?

To provide the client with the fastest payback for the project and its longevity in the conditions of fierce market competition, we started the web development process only after lengthy stages of planning and marketing analysis.

Indeed, our approach paid off: after five months spent working on a startup, it was launched and found its target audience.

What Technologies Were Used in the Development of EasyFinance?

After creating an accurate list of technical and non-technical requirements for a custom financial management solution, our experts have chosen the following technology stack for its implementation:

1.for backend:

- PHP

- Laravel

2.for frontend:

- React.js

Our Workflow and Top-3 Challenges with the EasyFinance Project

As the client’s business idea was a startup, it required special preparation for its development.

1.Our cooperation began with an in-depth analysis of the client's idea and its transformation into a concept, from which specific technical and non-technical requirements could already be extracted.

2.We also analyzed the current market state to understand what the basic functionality of the future software should be implemented and what additional features will help it stand out against competitive solutions.

3.After that, our team developed a mind map for free and demonstrated how the interaction of the end user with the created software should be arranged.

4.The next step was to select the optimal technologies for the implementation of the startup in order to ensure its further scaling at a minimal cost. In particular, based on these requirements, we chose React.js to create the frontend.

5.As for the development process itself, our experts used Agile and Scrum approaches. We started it by building prototypes, modeling user flows, creating custom scenarios, and demonstrating to the client how it all should work as a result.

6.After all the nuances were approved, our software engineers started writing the program code.

7.In terms of design, we used a design chart to bring the startup launch closer.

If we talk about the main three challenges that our experts encountered in the process of cooperation with the client, they were as follows:

- limited budget;

- the need to choose a technology stack to create a scalable solution;

- high competition.

What Problems Did Our Team Face?

Continuing the topic of challenges described in the previous paragraph, it is worth noting that for each month of work on a startup, the client had a strictly limited budget.

Therefore, we had to slow down the processes a little, which, in theory, could be faster in order to stay within the budget indicated by the product owner. As a result, we completed the project in five months, after which it successfully went into public use.

What Solution Did the Client Need and What Was the Result?

Our partnership has brought the client a competitive software product - an online service that helps small businesses manage their financial flows and optimize them for even more profit than ever before.

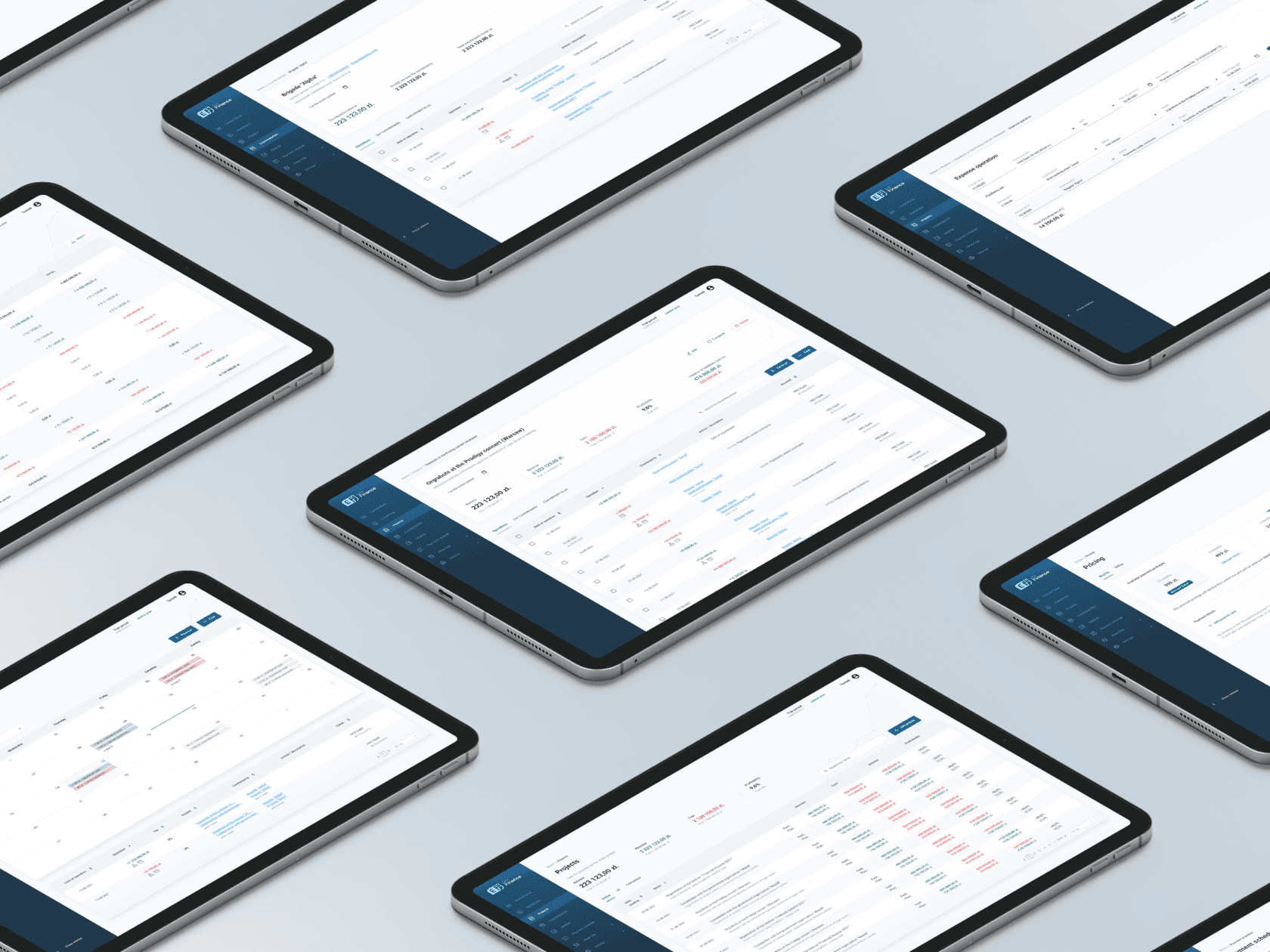

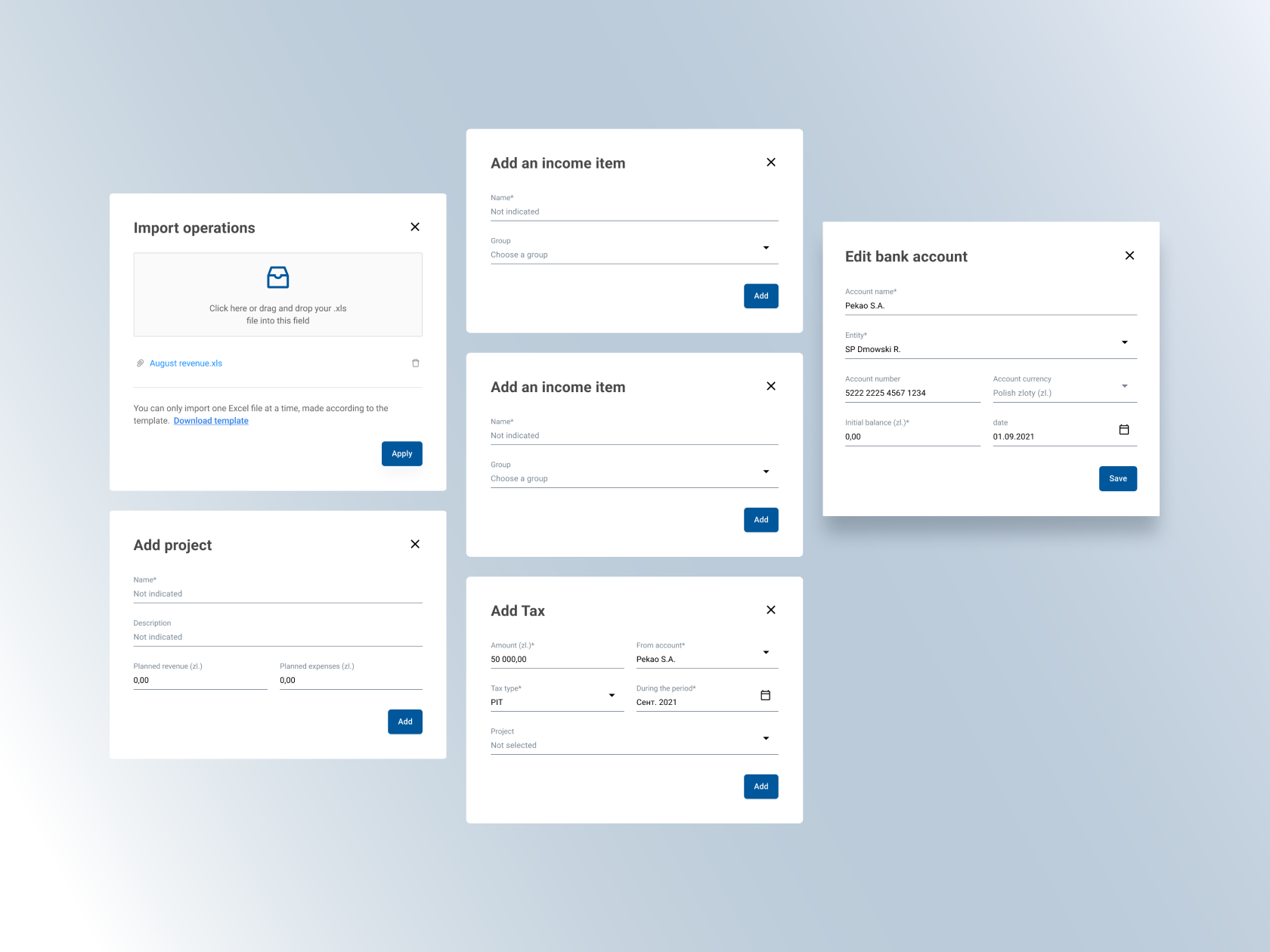

In particular, this software included four main components:

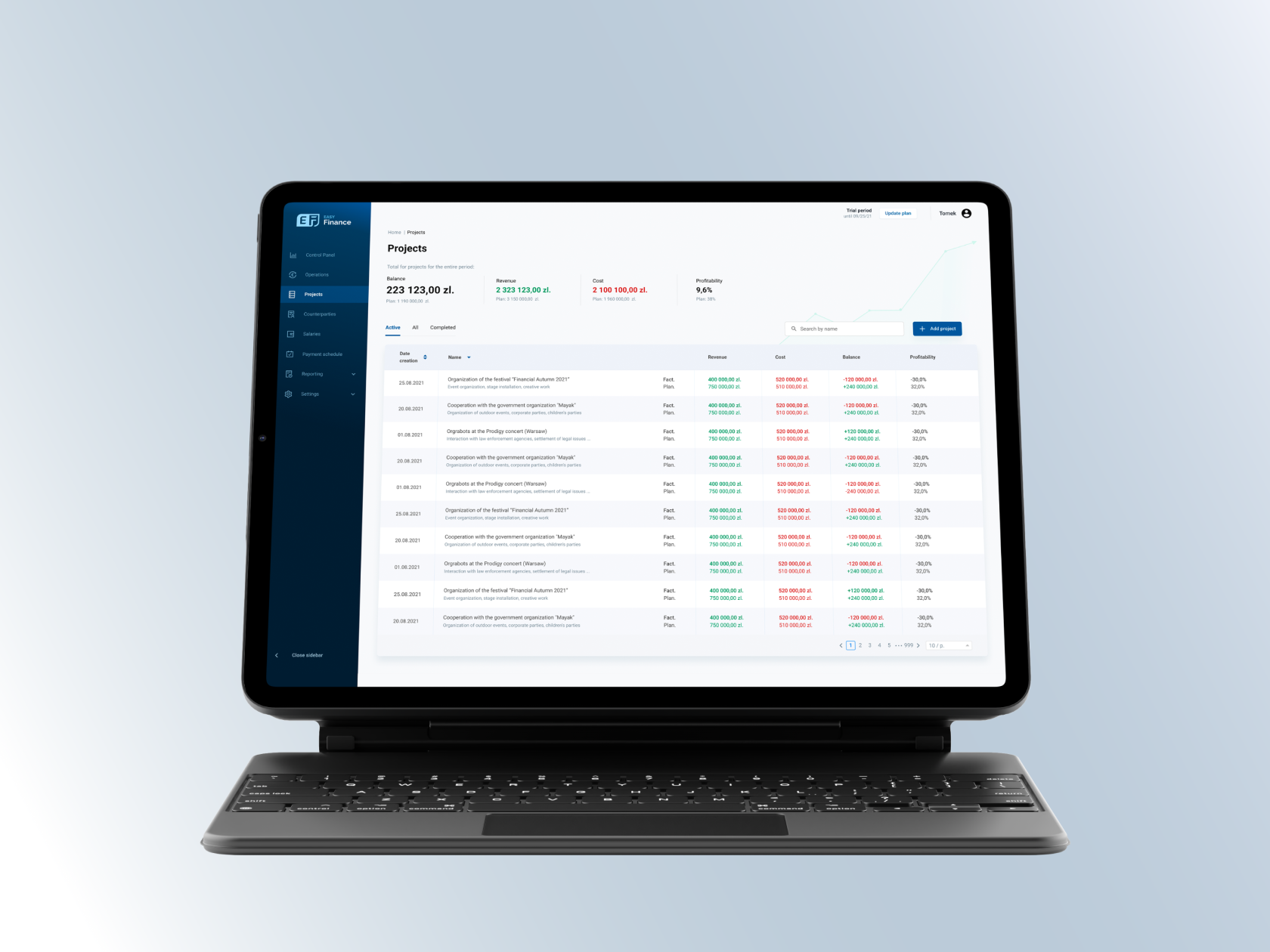

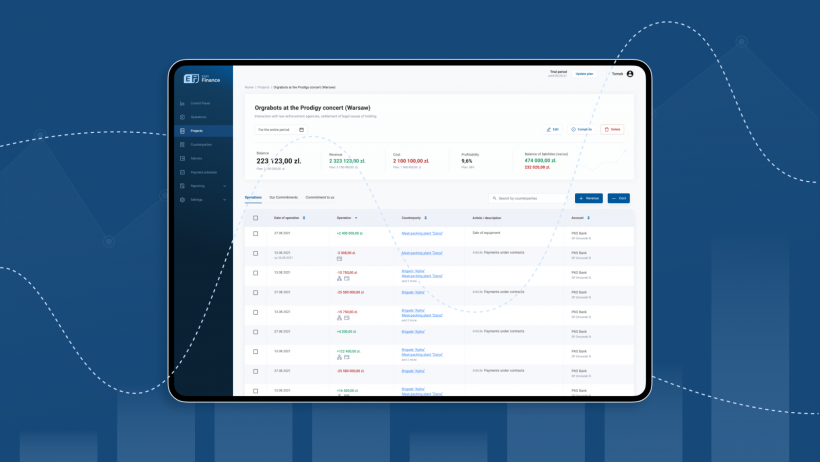

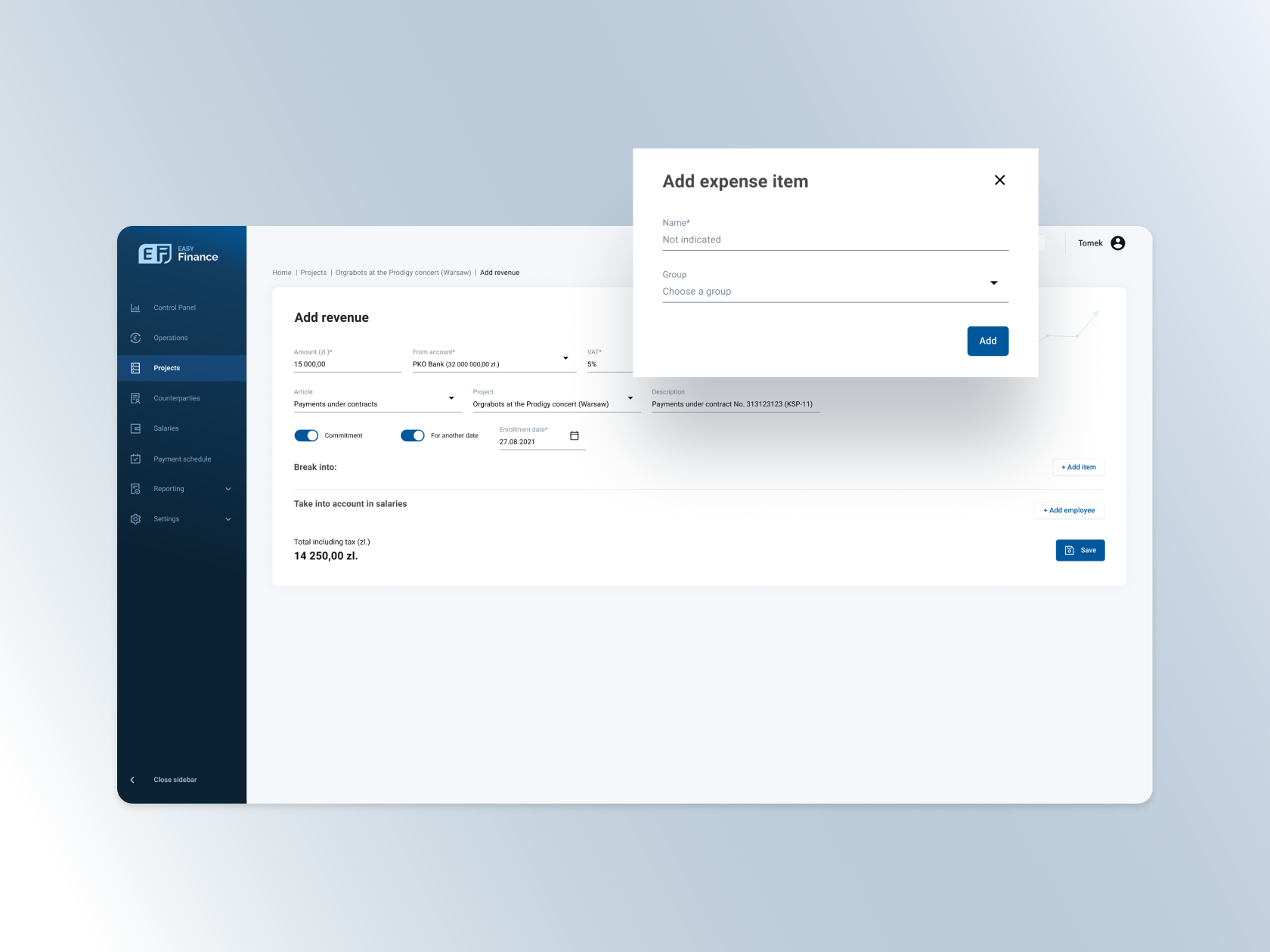

- Automation of financial accounting. The product removes the routine in Excel, so instead of creating reports and updating them regularly, users get the opportunity to shift the responsibility for all calculations to this software.

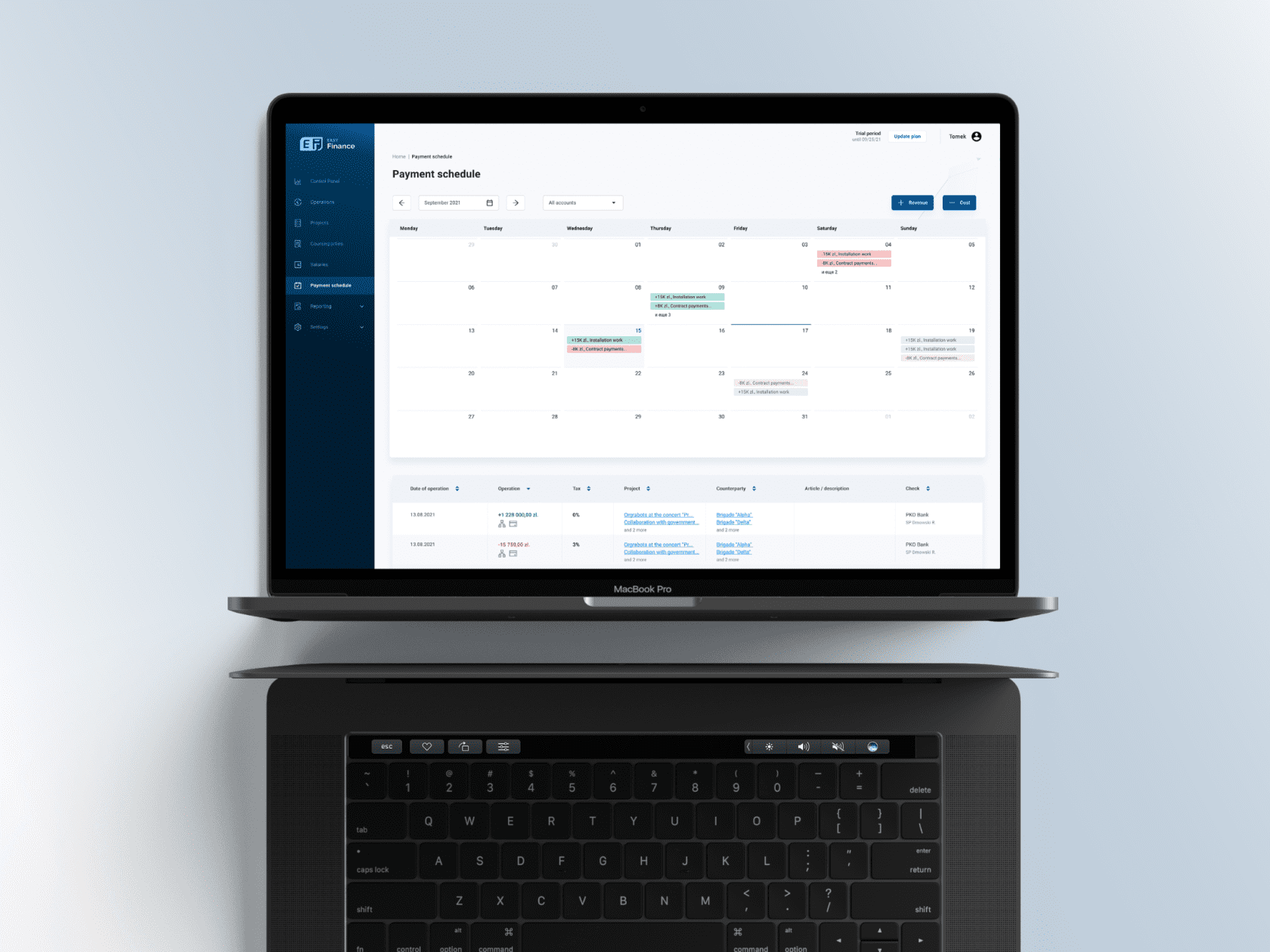

- Сalendar of payments. A convenient calendar tells users how much and when to pay receivables and from whom to expect payments. This allows them to avoid situations where the current balance of the business account does not allow them to cover the planned obligations.

- Analysis of financial indicators. This feature provides users with insights that showcase the strengths and weaknesses of their business. They see how much they earn, and what brings them losses.

- Convenient dashboard with key business metrics. This dashboard provides up-to-date metrics so that business owners can instantly react to the negative dynamics of their business strategies.

Also, this product is equipped with functionality for calculating the salaries of company employees and additional remunerations that make up a fixed percentage of turnover. In addition, it displays not only the actual state of users' business but also allows them to predict potential threats to its continued existence.

Note that we paid special attention to the security of this software: all user data that it operates on is securely encrypted and stored on two servers located in different parts of the world, which protects them from loss or theft by third parties.

Now, the product is actively sold by subscription (according to the SaaS model). In the nearest future, the client is going to to expand its functionality.