Blockchain technology has emerged as a game-changer for real estate investment. Usually, this sector has grappled with inefficiencies that were quite challenging. However, blockchain presents a glimmer of hope, offering the means to revolutionize how real estate investments are managed.

The ownership of property has traditionally been determined by a judge or court. Now it's different, as the old-world gives way to the new and digital age. A blockchain ecosystem provides ownership rights efficiently, eliminating paperwork, bureaucracy and expense while guaranteeing transparency. These tenets can be accepted peacefully and confidently.

Despite its slow adoption in the real estate segment, digital currency can help streamline the home-buying process by providing faster access to homeownership. In this article, we delve into the ways blockchain and related technologies can enhance real estate investments. We will also examine real-life examples that demonstrate the practical application of blockchain in the field.

Understanding Blockchain in Real Estate

Blockchain technology makes property transactions quicker, more accurate, and more secure. Blockchain records are immutable, so we know that information about property ownership is trustworthy and can't be messed with.

It gives everyone involved in the transaction reliable data they can count on. As data plays a crucial role in modern real estate investment, this point adds up to the importance of blockchain technology and its potential for future change.

Moreover, blockchain creates a reliable and tamper-proof system for verifying property ownership.This eliminates the concern of forged or falsified ownership documents. With blockchain, verifying property ownership is way easier and less problematic.

Current Blockchain Innovations

Blockchain can make real estate transactions much safer. With blockchain technology, it's harder for people to commit fraud, and we can keep accurate historical data.

Using blockchain removes the need for middlemen and lets us use smart contracts. This makes transactions cheaper and simplifies the process of checking everything is in order. These benefits have already been seen in the real estate market. It shows that blockchain has the potential to solve problems that have existed in real estate for a long time.

Solving Real Estate Challenges with Blockchain

The transparency of blockchain streamlines due diligence processes and ensures that information is accurate and up to date. Moreover, blockchain enables faster and more efficient property transactions by eliminating intermediaries and reducing paperwork. Smart contracts play a crucial role in automating and enforcing agreements, thereby enhancing security and trust in real estate transactions.

Role of NFTs in Real Estate

The real estate segment has extensive use of non-fungible tokens, or NFTs. With NFTs, investors can purchase a share of a property represented by a digital token, enabling fractional ownership. This innovative model enhances liquidity in the real estate market and expands investment opportunities to a wider range of individuals.

Smart Contracts in Commercial Real Estate

Smart contracts in commercial real estate are able to change the industry by automating processes and streamlining operations. These self-executing contracts automatically execute predefined actions when specific conditions are met, offering opportunities for automation in areas like lease agreements and property management. Digitizing and automating lease agreements can reduce paperwork and administrative tasks.

Automated rental payments ensure timely and accurate transactions, while smart contracts can facilitate property management tasks. However, challenges remain, including ensuring legal enforceability and addressing the adaptability of smart contracts to complex transactions. Despite these challenges, the benefits of smart contracts in commercial real estate make them a promising technology for transforming the industry.

Potential of Blockchain in Real Estate

The blockchain is a distributed, public ledger that offers the potential to improve liquidity and enable fractional ownership of real estate assets. Tokenization of real estate assets makes it easier to transfer ownership and increases market liquidity.

Fractional ownership empowers investors with limited capital to diversify their portfolios and participate in the real estate market. The elimination of intermediaries reduces transaction costs and improves efficiency. These advantages make blockchain a promising technology that can transform the real estate industry.

Use Cases and Real-Life Applications

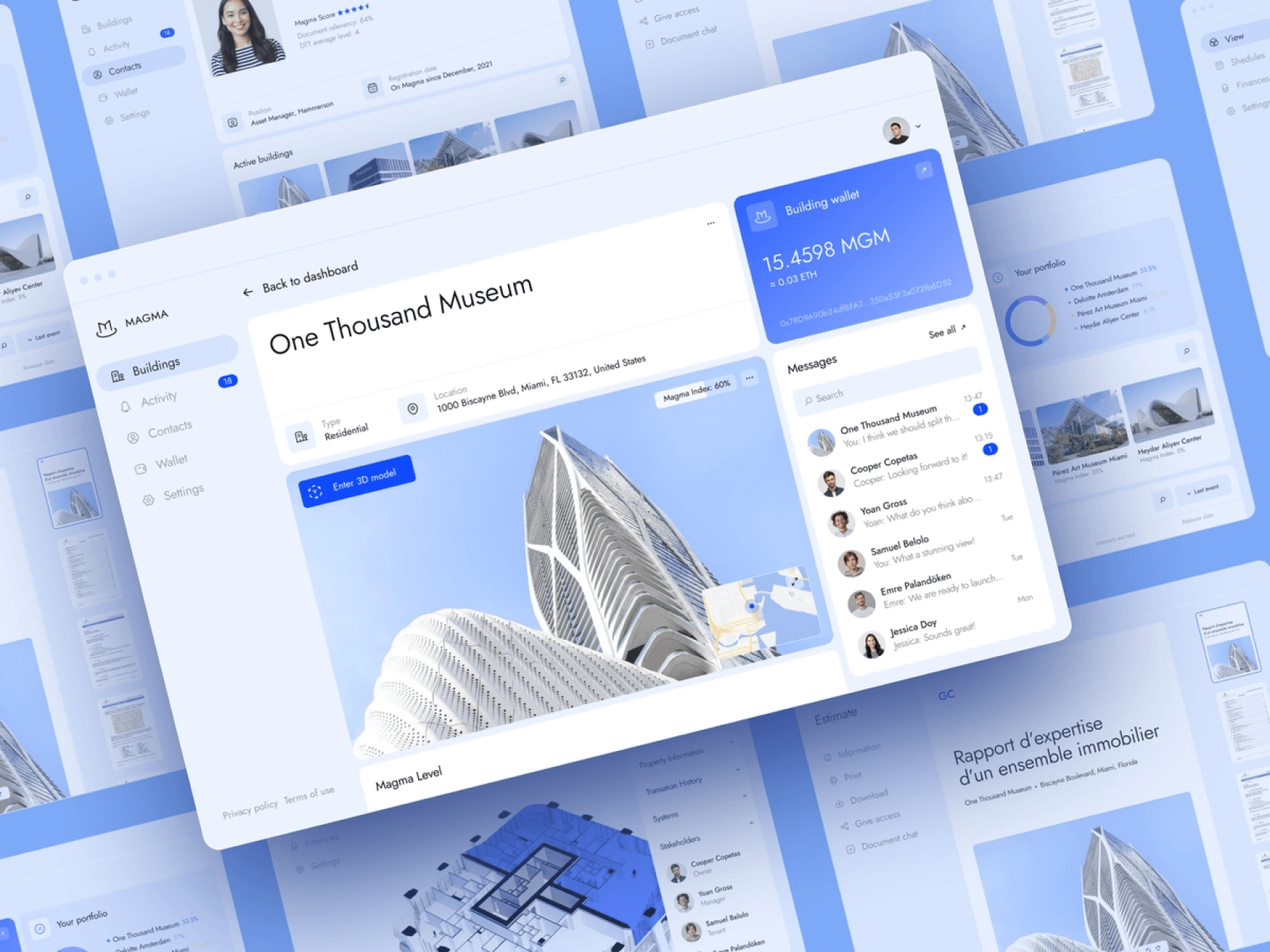

Blockchain technology has already made significant strides in real estate. One prominent application is the use of tokenization platforms, which enable fractional ownership of properties. This innovative approach allows a broader range of investors to participate in real estate by purchasing fractions of properties represented by digital tokens. By tokenizing real estate assets, the transferability and liquidity of these investments are greatly enhanced.

Blockchain also ensures secure transactions in real estate, minimizing the risk of fraud and ensuring the authenticity of property titles. The immutable nature of blockchain records makes it virtually impossible to tamper with ownership information, providing a high level of trust and transparency.

Moreover, blockchain technology streamlines property management processes. Tasks such as rental agreements, payment processing, and maintenance can be automated through smart contracts. This automation reduces paperwork, eliminates the need for intermediaries, and increases efficiency in property management.

Real-life examples of blockchain implementation in real estate are already proving successful. For instance, there are tokenization platforms that allow investors to purchase fractional ownership in properties, enabling diversification and increased accessibility. These platforms have gained traction and are transforming the way real estate investments are made.

Statistics also highlight the impact of blockchain in real estate. According to a report by Deloitte, blockchain can to reduce transaction times and costs by up to 40%. The report also emphasizes the increased transparency and security offered by blockchain, which can significantly improve the efficiency and trustworthiness of real estate transactions.

These practical use cases and statistics demonstrate the tangible benefits of blockchain in real estate. From fractional ownership to secure transactions and automated property management, blockchain technology is reshaping the industry and unlocking new possibilities for investors and stakeholders.

Data Privacy in Blockchain Real Estate

Data privacy is a significant consideration when implementing blockchain technology in the real estate industry. While blockchain enhances transparency and security, it also raises concerns regarding the privacy of sensitive information and ownership rights.

Tokenized systems, which enable the fractional ownership of properties, must define clear ownership rights and establish limits to prevent unauthorized access to sensitive data. It is essential to strike a balance between transparency and privacy to ensure the successful implementation of blockchain in real estate.

A blockchain-based real estate system stores property records and transaction history on a decentralized, immutable ledger. This provides transparency, trust in the authenticity of the data, and protection against tampering or unauthorized changes. However, it is crucial to protect the privacy of individuals and prevent unauthorized access to personal information.

Implementing robust data privacy measures involves encrypting sensitive data and defining access controls. Encryption ensures that only authorized individuals can view and access specific data, while access controls limit the exposure of personal information to only those who require it for legitimate purposes.

Conclusion

Digital currency and blockchain technology can transform the real estate industry, making homeownership possible for many people who previously could not afford it. By leveraging blockchain's features such as smart contracts and tokenization, real estate investment becomes more inclusive and cost-effective. Property has been a solid investment for as long as we’ve had houses. However, real estate investing typically requires significant capital. Investment funds allow small investors to get involved in more significant projects, contributing a smaller stake to the overall commitment.

Blockchain technology has significant potential to drive transparency, efficiency, and cost savings for commercial real estate owners by removing many of the existing inefficiencies in key processes. CRE companies and industry participants evaluating an upgrade or overhaul of their current systems should consider blockchain as its demonstrated usefulness can bring significant value to the industry.

Blockchain technology is a new phenomenon that will change our world. It already is--just like the internet did. Blockchain will change finance, real estate, and many other aspects of our lives. Though still novelties to most real estate agents, crypto tokens are an important part of this new era in finance.

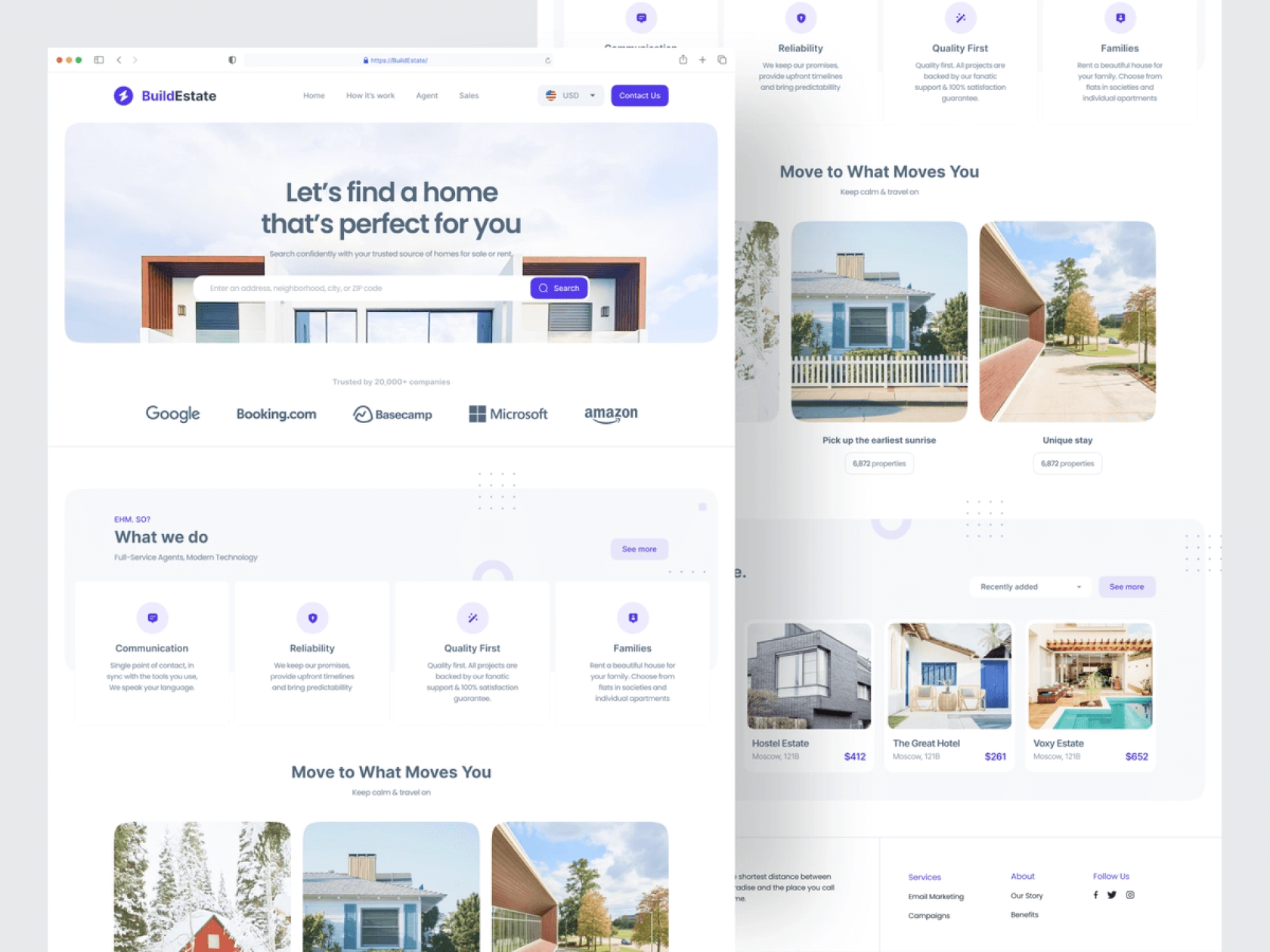

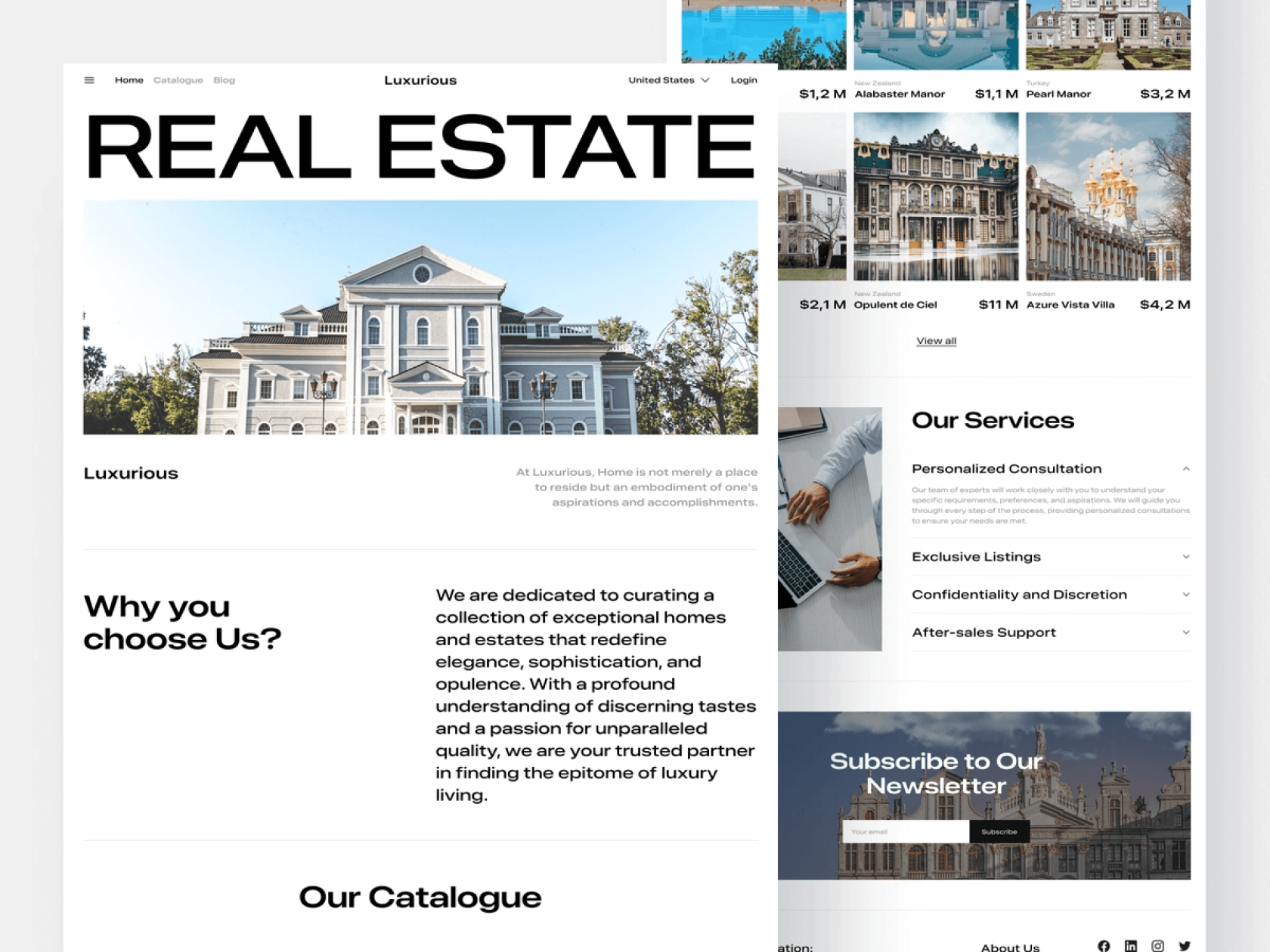

Real estate agents should be aware that new technologies can help their business outperform the competition. To do this, they can consider creating a platform that will be both a real estate catalog and an NFT marketplace.

Also if realtors are looking for potential investors, it will be useful for them to create a calculator mobile application that calculates the cost of investments. And WEZOM company can help with this because the team repeatedly faced interesting tasks from its clients in the field of real estate.