Your carrier just delivered a load. Invoice sent. Now what?

Usually you just wait. 30 days minimum. Sometimes 60 or 90. Meanwhile, bills pile up, drivers need paychecks, and fuel doesn't pay for itself.

Instant business to business payments are fixing this problem. We're talking minutes instead of months, real cash flow instead of paper promises.

In this article, we'll break down how instant payment systems work in freight, what benefits they bring to your operations, and which tools can help you make the switch. You'll also see why companies adopting these solutions now are gaining real competitive advantages in logistics.

What Are B2B Payments?

Business-to-business payments are financial transactions between companies rather than between a business and a consumer. In freight, these payments cover everything from carrier fees and fuel surcharges to warehousing costs and customs duties.

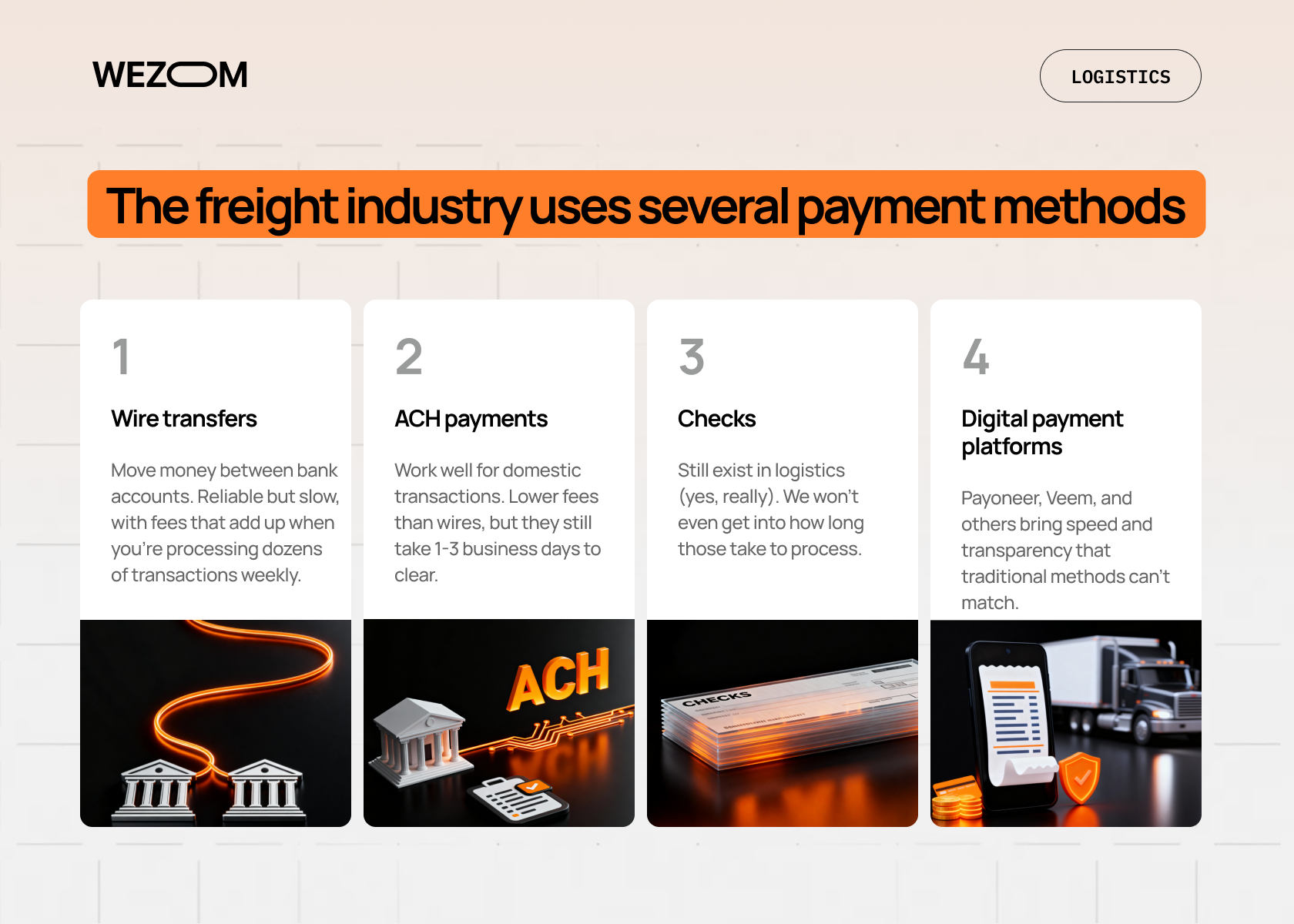

The freight industry uses several payment methods:

- Wire transfers move money between bank accounts. Reliable but slow, with fees that add up when you're processing dozens of transactions weekly.

- ACH payments work well for domestic transactions. Lower fees than wires, but they still take 1-3 business days to clear.

- Checks still exist in logistics (yes, really). We won't even get into how long those take to process.

- Digital payment platforms like Payoneer, Veem, and others bring speed and transparency that traditional methods can't match. They're built specifically for B2B freight payments and understand logistics economics.

The Role of Instant Payments in Freight

So what actually changes when you switch to instant payments? The impact goes beyond just "getting paid faster", though that alone would be worth it. Let's look at the specific ways instant payments transform freight operations.

Faster Payment Processing

Traditional payment cycles in freight run 30, 60, sometimes 90 days. According to Convera's 2025 analysis, instant payment solutions can process transactions in minutes rather than days.

Small carriers especially feel this impact. They complete a haul, send an invoice, then wait. Meanwhile, they've got fuel costs, driver salaries, and maintenance bills that don't wait for payment cycles to complete.

Improved Cash Flow

Cash flow issues kill more freight businesses than bad business models do. We've worked with brokers who had millions in outstanding receivables but couldn't make payroll because everything was tied up in pending payments.

Instant payments flip this equation. When trucking companies receive payment immediately after delivery confirmation, they can reinvest in their operations right away.

Increased Operational Efficiency

Companies using instant payment systems spend dramatically less time on payment follow-ups. The administrative burden drops. Your finance team stops chasing payments and starts focusing on growth strategies.

Reduced Financial Risk

Real-time settlement removes much of the uncertainty around late payments. The gap between "work completed" and "payment received" shrinks from weeks to minutes.

Stronger Relationships with Suppliers and Partners

Trust builds when people get paid on time. Freight providers prioritize brokers who pay fast. Suppliers extend better terms to customers with strong payment histories.

One client told us they went from being "just another broker" to preferred partner status with their top carriers simply by switching to same-day payment terms.

Benefits of Instant B2B Freight Payments

Now let's get specific about the business advantages you'll actually see when you implement instant payments.

| Benefit | Traditional Payments | Instant Payments |

|---|---|---|

| Payment Speed | 30-90 days | Minutes to hours |

| Cash Flow Predictability | Variable, uncertain | Immediate, consistent |

| Administrative Time | 15-20 hours/week | 2-3 hours/week |

| Supplier Relationships | Transactional | Partnership-focused |

| Payment Disputes | Frequent | Rare, quickly resolved |

So what do these improvements actually mean when you're managing loads, dealing with carriers, and trying to grow your business?

First of all, enhanced financial predictability. When you know exactly when money will hit your account, planning becomes simpler. You can forecast with confidence and commit to growth investments without worrying whether receivables will actually come through.

Secondly, lower administrative costs. Stampli's 2025 research indicates that companies using automated instant payment systems reduce their invoice processing costs by up to 60%.

You can notice stronger supplier loyalty. Transport providers remember who pays them fast. In a tight capacity market, that memory translates directly into preferential treatment.

Slow payments create a growth ceiling. You can only expand as fast as your cash flow allows. But instant settlements remove that ceiling, your working capital moves at the same speed as your operations. As a result, your business grows faster.

And one more benefit to mention: reduced payment disputes. Ever had a carrier claim they never received payment? These disputes vanish with instant payments and proper digital systems. Everything's tracked, timestamped, and transparent.

How Instant B2B Payments Work

The technology behind instant payments connects financial systems with logistics operations in real-time.

Here's the typical flow: delivery gets confirmed in your system. This triggers automated invoice generation. The payment system verifies funds and processes the transaction immediately. Money moves from payer to recipient. Both parties receive instant confirmation.

No manual intervention needed. No waiting for batch processing.

Technology and Payment Solutions

Modern instant payment platforms use APIs to connect with your existing systems. They integrate with banking infrastructure, leverage real-time payment rails, and provide dashboard visibility.

Security is built-in through encryption, multi-factor authentication, and fraud detection that works better than traditional payment security.

TMS Integration

Integration with your Transportation Management System is crucial. When your TMS connects directly to your payment platform, delivery confirmation automatically triggers invoice generation and payment processing, no manual data entry needed.

Without integration, your team manually transfers information between systems, creating errors and delays. With it, the entire cycle from delivery to payment happens automatically. Your team only handles exceptions.

Most payment platforms offer APIs for popular TMS solutions like McLeod, TMW, or MercuryGate. The setup takes technical effort upfront, but the time savings are immediate.

Tools and Providers for Instant B2B Payments in Freight

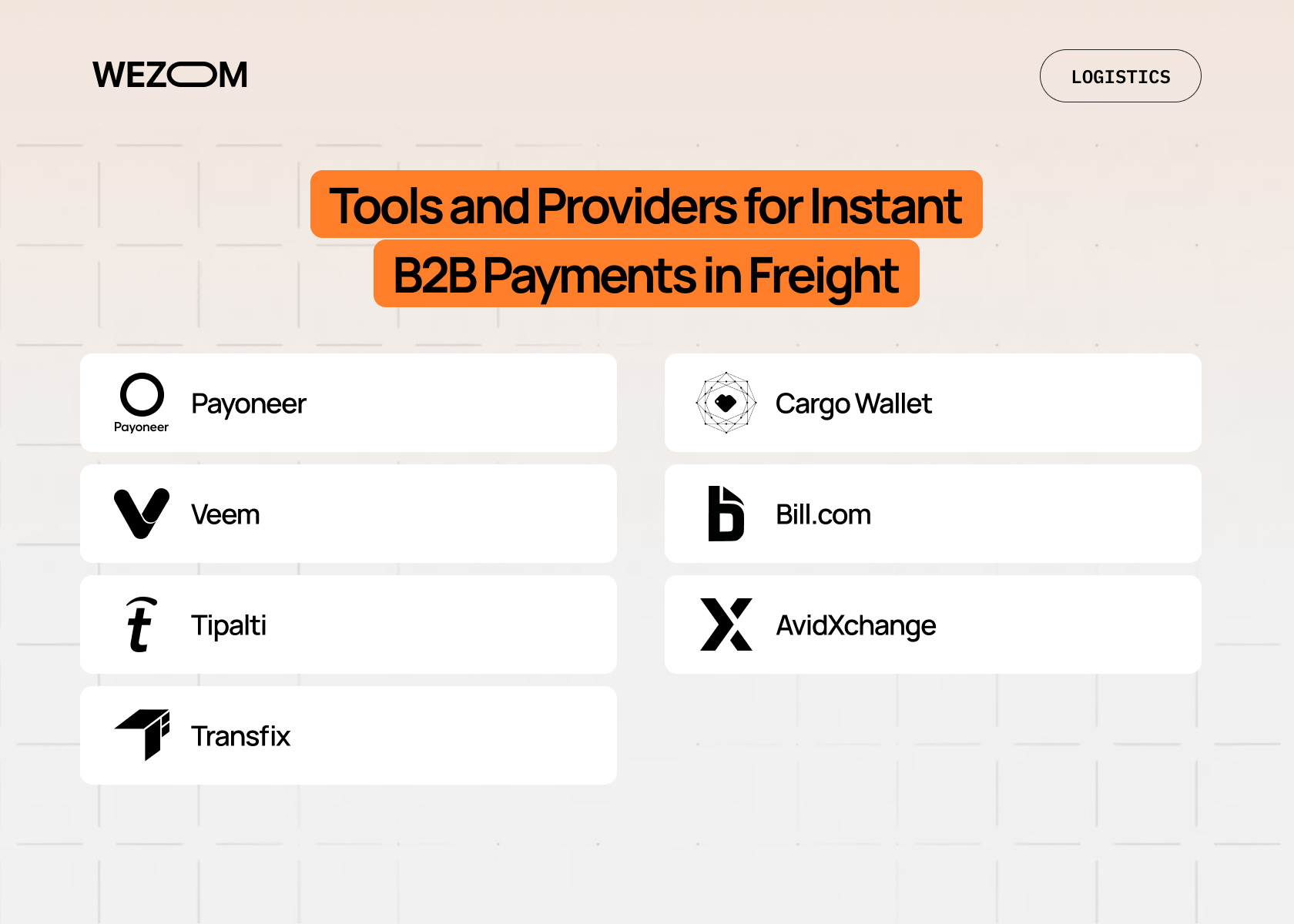

You can't implement instant payments without the right platform. Here are the main providers serving freight businesses, each with different strengths.

Payoneer offers global payment solutions with competitive rates and fast transfer times. Works well for freight companies dealing with international carriers.

Veem focuses on simplifying business payments with minimal fees and strong tracking capabilities.

Tipalti handles supplier payments at scale. If you're managing hundreds of carriers, their automation and compliance features become really valuable.

Transfix built payment solutions specifically for freight. They understand trucking economics.

Cargo Wallet, as highlighted in their 2025 analysis, specializes in aviation cargo but their instant payment infrastructure applies across freight modes. They've seen transaction times drop from days to under an hour.

Bill.com provides comprehensive accounts payable automation that works across industries but has strong freight adoption.

AvidXchange focuses on middle-market companies and offers both payment processing and invoice management in one platform.

Conclusion

Instant B2B payments solve real problems: cash flow gaps, administrative waste, payment disputes, and growth limitations. The companies implementing these systems now are gaining measurable advantages: faster settlements, lower costs, and stronger carrier relationships.

Ready to modernize your payment operations? Let's talk about how instant settlements can work for your business.

FAQ

What are instant B2B payments in freight?

Instant business to business payments in freight are real-time financial transactions between businesses that process in minutes rather than days or weeks. They allow carriers, brokers, and shippers to send and receive payment immediately after service completion.

How do B2B freight payments differ from traditional payments?

Traditional freight payments typically involve 30-90 day terms with manual invoice processing. B2B instant payments process automatically, often within hours of delivery confirmation, and integrate directly with logistics systems.

What challenges might companies face when adopting instant B2B payments?

Common challenges include integrating new payment systems with existing TMS platforms, training staff on new processes, and managing the transition period. But most companies find these hurdles smaller than expected.

Are instant B2B payments safe for businesses?

Yes. Modern instant payment platforms use bank-level encryption, multi-factor authentication, and real-time fraud detection. They're often more secure than traditional methods.

What are the benefits of instant payments for logistics companies?

Instant payments improve cash flow, reduce administrative costs, strengthen carrier relationships, eliminate most payment disputes, and enable faster business growth.