Have you ever wondered how Uber calculates trip prices? How Netflix accurately predicts which movie to recommend for your evening? Or why Google displays these specific websites in your search results?

Mostly they work on the basis of Data Science — an area of research that includes various aspects of statistics, machine learning, analytics, and financial planning. Actually, Data Science in financial services is exactly the topic we would like to explore in this article. But first, let's start with some theoretical part to provide a deeper understanding of the theme.

What is Data Science

It is an interdisciplinary field that utilizes methods, algorithms, systems, and tools to extract knowledge and information from data in various forms. The primary goal of Data Science is to identify patterns, analyze trends, forecast future events, make decisions, and create new products/services based on this data.

.jpg)

Data Science is used in various fields: medicine, finance, marketing, telecommunications, and much more. In the modern world, it is becoming increasingly important and in high demand, thanks to the growth of information volumes and the possibilities of its analysis.

Further below, we'll explore several examples of how Data Science can specifically benefit your business.

Demand Forecasting

Data analysis helps to forecast demand, helping businesses optimize inventory, plan production, and manage supplies. This is what happens in Amazon, for example. The platform's algorithms notify sellers in advance about the need to replenish warehouse stocks, taking comprehensive analysis of their activities as a basis.

Customer Base Analysis

Data Science helps identify behavioral patterns, preferences and needs within the customer base. This is widely applicable for creating an effective marketing strategy, personalizing offers, and increasing customer satisfaction.

Decision Making Based on Data

For example, Uber uses Data Science to optimize routes and calculate trip prices. Algorithms analyze data on traffic, time of day, weather conditions, and other factors to offer users the most efficient and cost-effective routes.

Business Process Optimization

Analytical information helps identify weaknesses, improve operational efficiency, and reduce costs.

Monitoring and Forecasting

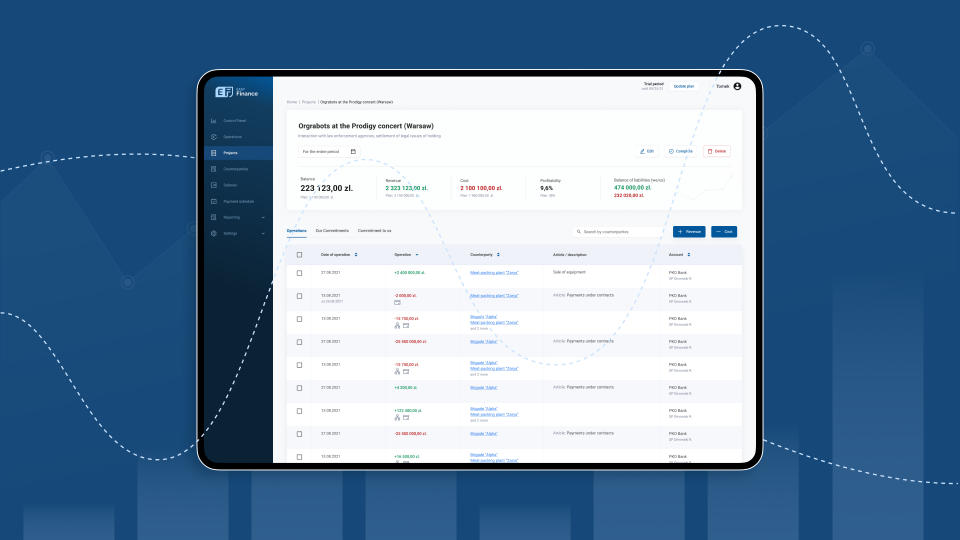

Well-crafted reports are really helpful for managing budgets, identifying risks, and making decisions on financial planning. For instance, data provided by our Data Scientist helped find the best solution for the EasyFinance project. We developed an algorithm that addressed tasks related to expense tracking, revenue, and net profit and turned it into an automated tool.

Thus, Data Science provides tools and methods for data analysis that help improve efficiency, and competitiveness, and make informed strategic decisions.

How to Apply Data Science in Finance

Well, let's now discuss Data Science in the finance industry. Banks, as well as other players in financial markets, have long been using data science in their business. For example, for making decisions on loan approval.

.jpg)

You might find it interesting that the use of so-called "alternative data" is still considered controversial by regulatory bodies (particularly from the standpoint of the Consumer Financial Protection Bureau). However, this does not prevent banks from advocating for the use of artificial intelligence to assess the creditworthiness of potential borrowers.

But there are also some other tasks that can be addressed through finance Data Science projects.

Risk Management

In the context of financial institutions, we can talk about the following points:

- Credit scoring (creating models that help make decisions on loan issuance taking risks into account);

- Market risk modeling (assessment of possible changes in asset prices, currency exchange rates, interest rates, and other financial instruments);

- Identification of operational risks (fraud, management errors, and technological failures);

- Forecasting defaults and losses;

- Analysis of marketing risks.

There are many applications of Data Science in finance that offer ready-made solutions. However, more and more we come across situations when it might be not enough for a specific project.

Cybersecurity and Fraud Prevention

Companies like Visa, for example, actively use Data Science to detect suspicious patterns in network traffic, intrusions, and anomalies. Also, analyzing event logs enables forecasting attacks and identifying potentially dangerous scenarios.

Personalized Services

Large banks, including Bank of America and Capital One, U.S. Bank, have virtual assistants. Data Science case studies in banking help train machine intelligence to respond correctly to customer requests.

Moreover, analyzing user information helps identify areas of interest and promote relevant products/services.

Аlgorithmic trading

Data Science plays an important role in creating profitable trading strategies, as well as automating the operations of financial institutions. For example, regression analysis and trained neural networks can show optimal moments to enter and exit the market, and assist in portfolio management, and risky positions.

These are just a few examples of how Data Science in financial services is used. Overall, information analysis helps financial institutions make informed decisions, optimize processes, and reduce risks, thus being a key factor in long-term success.

3 questions about Data Science to Wezom specialists

We decided to ask our team members what they thought about the next questions.

1. What is the future of data science in finance?

We believe that Data Science will continue to play a key role in the finance sector, contributing to the improvement of analytics, decision-making, customer experience, and security. The discovery of new data analysis methods and innovations in this field will make financial markets more efficient and resilient.

2. Is data analysis only necessary for large projects, or can it be useful for small and medium-sized businesses?

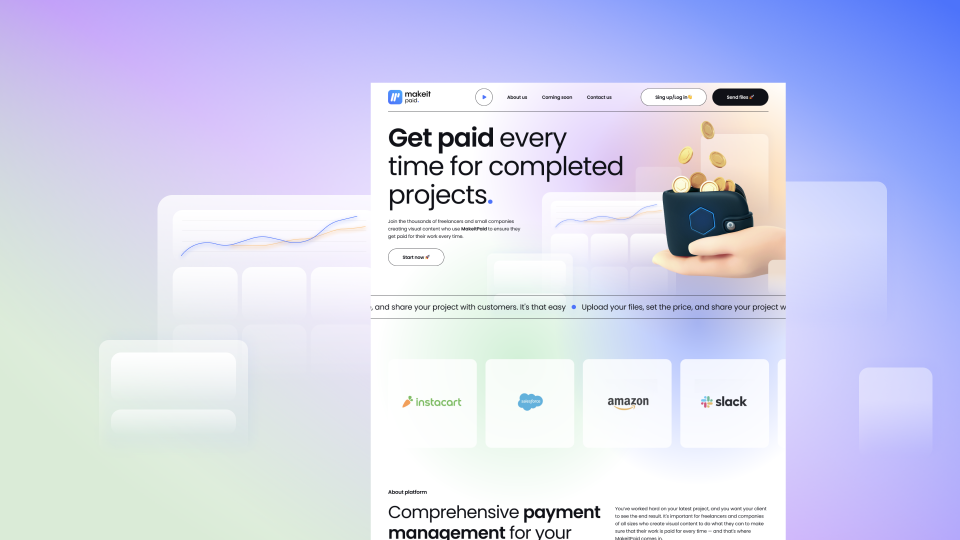

Data Science in banking sector is just one example taken for the article's theme. For instance, in the Makeit.io project, we used analysis to determine what features the CRM system end-users expect from us. Additionally, statistical information helped the team decide which third-party cloud storage solutions to integrate.

3. What is the role of data analysts in the project, and who can replace them?

Typically, this specialist is responsible for:

- Collecting data from various sources and cleaning it;

- Analyzing, and identifying patterns, trends, and relationships;

- Visualizing: diagrams, charts, and reports to present results in an understandable form for stakeholders;

- Concluding the current state of the project, identifying problem areas, etc.

Some tasks of data analysis can be performed by developers or database specialists, especially if required within a multi-disciplinary team.