Oil and gas accounting is an absolutely important and maybe even underestimated area where a company’s performance and overall success depend on knowledge and experience. It isn’t easy to master oil and gas accounting but it is still achievable.

Choosing accounting software for your business can be a challenge. There is a large number of oil and gas accounting solutions available on the market to choose from and several factors to consider, including cost, features, shelf life, and user experience. Fortunately, we know a thing or two about production of accounting software for oil and gas and want to share some of our insights and best practices so that you can make an informed decision.

This article will discuss details of accounting in the oil and gas industry, the benefits of professional oil and gas software, and how to get the most out of software and other possibilities, and boost your business. Learn how specialized software drives operational excellence, financial precision and regulatory compliance in this sector.

What Is Oil and Gas Accounting Software?

Oil and gas accounting software refers to specific types of software that are used in oil and gas. These software kinds help improve processes and to reach certain business goals.

Let’s have a more detailed look at what benefits oil and gas accounting software provides to businesses and business owners, and how to use it properly.

Although it may sound obvious, oil and gas software is about covering a very important aspect of the industry’s work, but it has other important features that are worth mentioning. With technological progress and frequent uses of AI in oil and gas, software becomes more complex – and even more vital. Anyone looking for a reliable software option for the oil and gas industry should be aware of the importance of these software kinds.

Also, the question is How to find the right software option for YOU? and it can also be answered through more theory about each type of software and the technical parameters of each one.

What's Different about Accounting Management Software in Oil and Gas?

Sometimes, you need to be a part of the oil and gas industry to understand the intricacies of accounting. One of the reasons why software for accounting has evolved so profoundly and is so important is that accounting processes require a lot of details and intricacies. Another example of something that is vital for the industry can be a cost management solution. As there is a huge number of such intricacies in the industry of oil and gas, sometimes, it is worth studying what software types suit you.

Best Practices for Choosing Oil & Gas Accounting Systems

There are certain best practices in choosing software for oil and gas accounting, so let’s have a look at them so that you can make your choice more wise and well-thought.

The Fundamental Principles of Oil and Gas Accounting

Among other things, following U.S. Generally Accepted Accounting Principles (GAAP) as set forth by the Financial Accounting Standards Board (FASB) is still essential regardless of the organization’s type and professional field. Considering factors like integrity and respect is also essential if you are serious about professional growth.

At the same time, oil and gas accounting includes different major fields within it, and they should be considered as they are all important for the field. They are:

- Exploration.

- Development.

- Production.

- Transportation.

- Refining.

- Marketing to end-users.

As upstream companies mainly operate within exploration and development, midstream companies’ work revolves around transportation, and downstream companies generally engage in refining and marketing processes, these differences make the field a little more complicated. Upstream accounting has certain important intricacies that needs attention.

Each of these has its own unique set of departments that handle the various entries and procedures to ensure costs, revenue, and profits are accounted for properly. You can break down most niche accounting functions into one of those six primary ones as all industries have capital expenditures, operating costs, general and administrative expenses (G&A), and other aspects. The differences between upstream, midstream, and downstream software processes the need in the differences in software even more pronounced.

Still, every area has its intricacies and interesting details that enrich the market and possess unique value.

The Differences Between Upstream, Midstream, and Downstream Accounting Services

Talking about the difference between upstream midstream and downstream software, these are different software kinds for different needs. All oil and gas companies perform some of the same core activities, such as capital expenditure, G&A, interest payments, revenue recognition, and operating expenses. However, there are some distinctions in how they go about performing them.

For example, upstream companies engage in lease acquisitions, joint operating agreements, exploration activities such as drilling and development as well as reserve accounting; midstream entities focus on product imbalances, storage and gathering; downstream entities concentrate on sourcing and refining; service organizations fixate on construction services or drilling services other than drilling.

Any actual difference comes down to an individual company's overall business processes and how they meet their customers' needs.

What are the Differences Between Successful Efforts and Full Cost Accounting?

In the realm of oil and gas enterprises, the focal point invariably centers on how they handle their capitalized expenditures. Exploration and Production (E&P) companies that adopt the Successful Efforts accounting method channel their expenses towards success or failure, contingent upon the outcome of their drilling ventures – specifically, the production of hydrocarbons.

In cases of drilling ventures deemed unsuccessful, these expenditures are promptly deducted as expenses on the income statement. Other costs, such as those pertaining to geological and geophysical exploration, are primarily recorded as expenses as they are incurred.

The accumulation of Successful Efforts costs is organized according to geological structures, typically referred to as "fields" or depletable units (DUs). Within each DU, there are two distinct calculations for depletion: one based on leasehold expenses, and the other rooted in well-related costs. Subsequently, the company undertakes evaluations for impairment on unproved properties and employs the Discounted Cash Flow (DCF) method for assessing the value of proved properties. Nevertheless, it is worth noting that the Successful Efforts method introduces a higher level of complexity, necessitating a more substantial allocation of accounting resources for its execution.

WEZOM Experience in Accounting Software Development

WEZOM has something to offer in the field of accounting software development as the company’s experience includes covering the needs of companies that require robust accounting solutions as the market puts pressure on companies that have certain uncovered areas in accounting and desire to be successful.

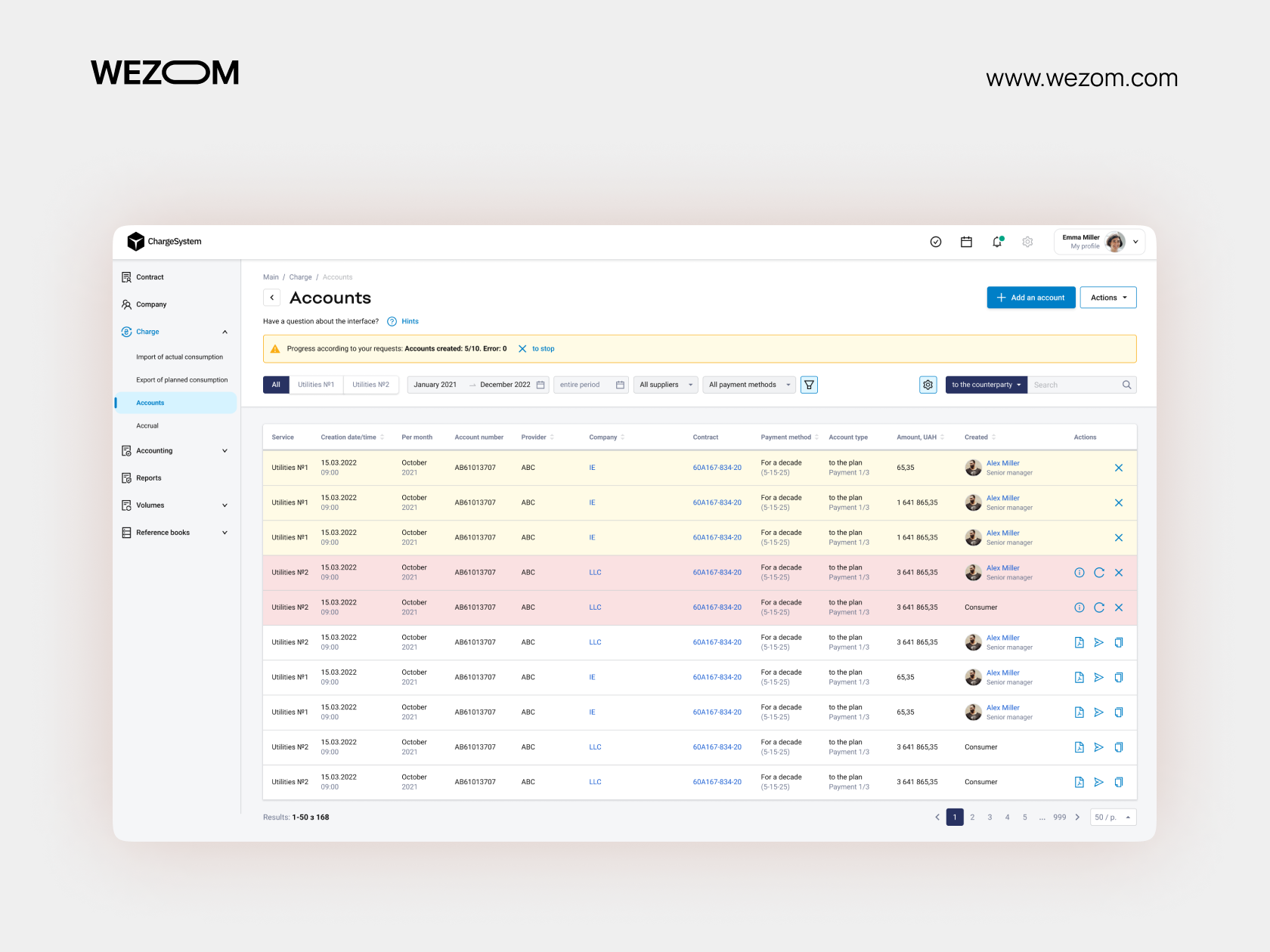

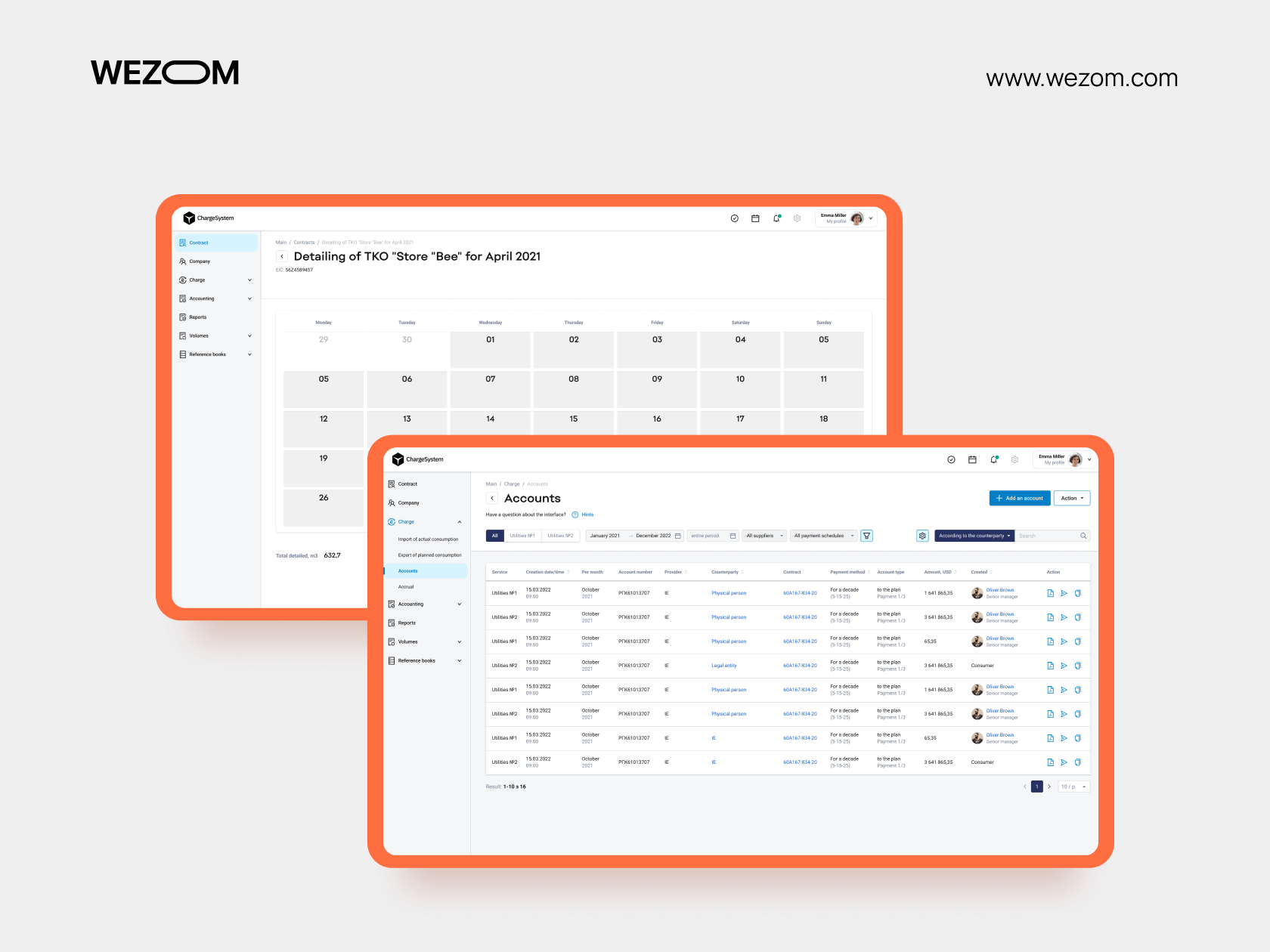

Some of the relevant cases in the company’s work include resting an ERP with a dedicated team specializing in project management for Oil & Gas, and building a billing CMS for an energetic company. In the first case, the need was to create a solution that would simplify the work and speed up internal business processes in an experienced company, while in the second case, the choice was based on the necessity to change tools as the company was large in size and it needed a new way to reach business goals.

As the method, with which WEZOM approaches clients, includes the careful consideration of individual needs, in both of the real-life cases, the process of software creation involved many stages and additional decisions in both cases.

Conclusion

Although oil and gas accounting is quite a complicated field, it can still be improved through mediums like oil and gas accounting software. Knowledge, expertise and experience are among additional factors that play equal role, so by expanding your knowledge of accounting in this particular industry, you can reap serious advantages. After all, any type of accounting relies on a good deal of theory, so the theory of accounting in the field of oil and gas is definitely worth learning, or at least familiarize with it.

As for the software, solutions like petroleum accounting software are an inevitable part of accounting improvement. As the world and the market are rapidly changing, you need to follow the trends and fit into standards.

Specialized software has emerged as a vital tool in addressing these challenges, enabling companies to streamline their operations, improve financial reporting accuracy, and enhance decision-making processes. As the industry continues to evolve, embracing technology will be essential for staying competitive and compliant while responsibly managing finite resources. Oil and gas accounting software is not just a convenience; it's a strategic imperative for the future of the industry.