Core Banking Service

What is core banking?

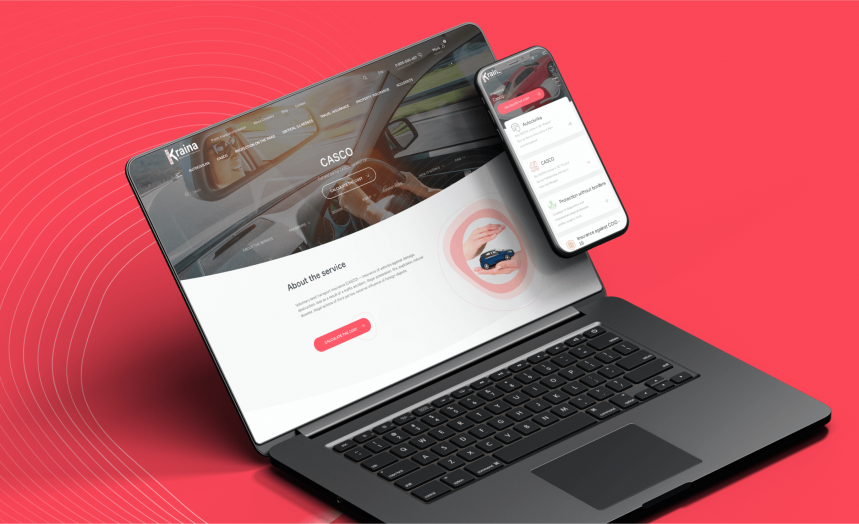

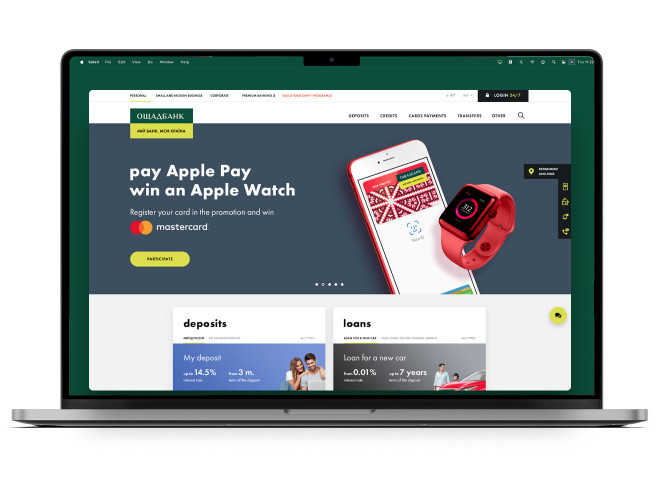

Create core banking solutions to process transactions at various branches of your bank, such as deposits and loans. Our team will build an intuitive branded interface for your software solution and provide compliance with all needed data protection standards.

scaling services

Adapting and scaling services as your business expands.

optimizations

The WEZOM team will perform necessary optimizations.

up-to-date

Keeping your core banking platform up-to-date.

Software Company WEZOM

Our objective is to develop a profitable and effective solution that helps clients to expand their businesses and overcome financial constraints. We are committed to exceptional service and utilizing all resources to bring the finest products & services.

We've Been Awarded Plenty for the Milestones We Have Achieved

What clients say

We chose WEZOM amongst other companies because they provided prototypes of future systems and we had a clear understanding of what the finished product would look like. We worked with the team on several projects, including the development of a CRM with adaptation for desktop and mobile versions, as well as the creation of a suite of server applications that are available on iOS, Android, and online. We are very pleased with the results and the flexibility of the WEZOM team.

I am very satisfied wit the work process and project management. Everything was clear, on time and I had nothing specific to add. Yes, we are satisfied with the result of the work and the product meets the goals set. I can't wait to continue our work on the app.

Thanks to WEZOM, our sales increased by 65% and conversions increased by 150%. The team fully developed an online store for us, with 1C and amoCRM integrations. The guys conducted a market analysis, created a mind map with all the functions of the future site, and argued for each element of development. Everything was transparent, and the quality was high.

Questions & Answers

How does core banking software work?

Core banking needs software for different operations like the management of funds and financial transactions. Core banking software is also helpful in terms of financial marketing. The benefits of banking solutions include improved customer experience, easier monitoring of cash flows, and improved efficiency. Core banking system providers can add features for customers that allow them to manage finances. The core banking system architecture can also include portals for account management.

How much does a core banking system cost?

The core banking system price depends on complexity, but generally, you can buy a license starting from $250,000 per year. The average price of a core banking solution is about $100 million, and it suits average-sized banks. The license will also depend on the number of branches and other factors.

The Evolution of Finance: The Impact of Core Banking

Core banking is a technological breakthrough that has entirely revolutionized our financial interactions. As one of the most transformative fintech solutions, it forms a unified network that links numerous bank branches, enabling seamless online activities such as loan administration, withdrawals, and transactions. This service extends beyond mere convenience; it’s about boosting efficiency and strengthening security.

Decoding Core Banking

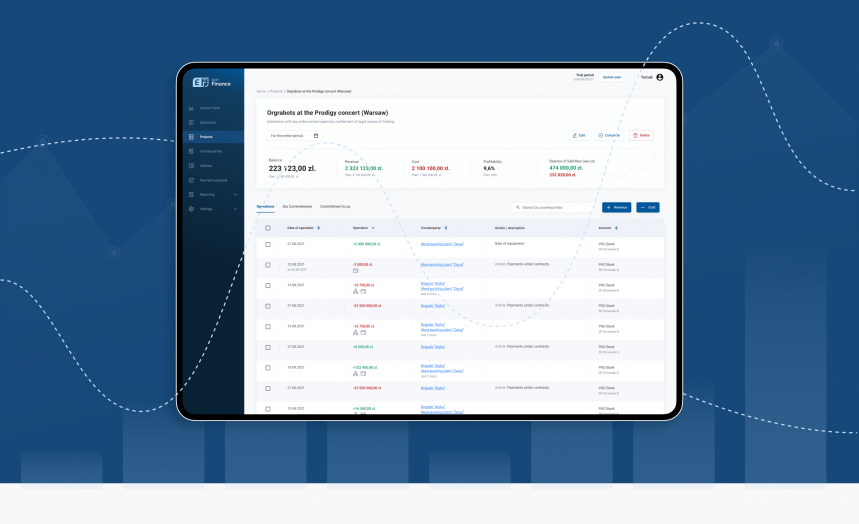

Core banking is a system that creates a central hub linking various branches of the same bank to perform banking operations and update accounts in real-time. It grants customers the ability to manage their accounts and execute banking operations from any branch of the bank. This system supports operations like loan administration, deposits, and transactions. The term CORE in banking signifies a concept that allows a client to see a bank as a single integrated entity.

Essential Features of Core Banking

A well-rounded core banking system should encompass crucial features such as loan processing, data analytics, digital banking, real-time check system, customer relationship management, and chatbots.

Loan Processing

This function is devised to be fast and simple for both bank employees and customers.

Data Analytics

A responsive, timeline-based data analytics tool is crafted to facilitate employees to interact with customers more effectively.

Digital Banking

Some client operations are shifted to the digital platform to lessen the workload of employees.

Real-Time Check System

A tool is devised to collect customer data, enabling quicker and more informed lending decisions.

Customer Relationship Management

A centralized tool is created to manage the bank's customer interaction data within the core banking software.

Chatbots

An online assistant is available to tackle common issues and reduce the workload of the call center.

Client Feedback

Our clients have expressed their contentment with our services. They have commended the quality of our work, our professionalism, and our dedication to adhering to deadlines. They have also acknowledged our communication skills and our proactive involvement in their projects.

Common Queries

What is core banking?

Core banking is a system that creates a central hub linking various branches of the same bank to perform banking operations and update accounts in real-time. A core banking system supports operations like loan administration, deposits, and transactions. CORE in banking signifies a concept that allows a client to see a bank as a single integrated entity.

How does core banking software function?

Core banking software functions by creating a central hub linking various branches of the same bank. This allows customers to manage their accounts and execute banking operations from any branch of the bank.

What is the cost of a core banking system?

The cost of a core banking system can fluctuate based on several factors such as the size of the bank, the number of customers, and the specific features required. For a detailed quote, please contact us directly.

Wrapping Up

In essence, core banking is a potent tool that has brought about a revolution in the banking industry. It provides convenience, efficiency, and security, making it a vital part of contemporary banking.