Digital Banking

What is digital banking?

Transfer most of your banking services to an advanced, centralized software solution to improve your customer experience and relieve your employees of increased workloads. Our team will do their best to create a convenient digital assistant for your clients' financial transactions.

experience

Creation of an improved experience for your customers.

Regular updates

Regular updates to the digital self-service solution.

security and relevance

Ensuring the security and relevance of the solution for end users.

Software Company WEZOM

Our objective is to develop a profitable and effective solution that helps clients to expand their businesses and overcome financial constraints. We are committed to exceptional service and utilizing all resources to bring the finest products & services.

We've Been Awarded Plenty for the Milestones We Have Achieved

What clients say

We chose WEZOM amongst other companies because they provided prototypes of future systems and we had a clear understanding of what the finished product would look like. We worked with the team on several projects, including the development of a CRM with adaptation for desktop and mobile versions, as well as the creation of a suite of server applications that are available on iOS, Android, and online. We are very pleased with the results and the flexibility of the WEZOM team.

I am very satisfied wit the work process and project management. Everything was clear, on time and I had nothing specific to add. Yes, we are satisfied with the result of the work and the product meets the goals set. I can't wait to continue our work on the app.

Thanks to WEZOM, our sales increased by 65% and conversions increased by 150%. The team fully developed an online store for us, with 1C and amoCRM integrations. The guys conducted a market analysis, created a mind map with all the functions of the future site, and argued for each element of development. Everything was transparent, and the quality was high.

Questions & Answers

How to improve digital banking?

Some of the ways that can help improve digital banking include big data and analytics, a seamless omnichannel experience, emphasis on product design, and other factors. These aspects contribute to better customer experience and digital banking in general. Also, paying attention to convenience and automated digital customer support may be very useful. Digital banks need to make banking operations easy, fast, and automated.

What are the benefits of digital banking?

Some of the benefits of digital banking include convenience, effectiveness, easy access, security, and the possibility to make international transfers. With digital banking, operations become easier and you can reap numerous benefits just by accessing banking services with the help of online platforms. The benefits of digital transformation in banking also include automation and convenience. Online processes are way faster and easier. Many of the advantages of digital banking relate to higher efficiency, comfort, and optimization.

Complete Digital Banking Development Solutions That Redefine Finance

Transform Your Banking Operations Digitally

What Is Digital Banking Development?

Digital banking development refers to building and optimizing digital platforms—like mobile apps, web portals, and APIs—that enable financial institutions to deliver convenient, secure, and fast services to customers without physical interaction. It's not just an app—it's a full ecosystem overhaul designed for the digital-first consumer.

Why Digital Banking Is No Longer Optional

The shift in consumer behavior has made digital access to banking services a basic expectation. If your business doesn’t meet these expectations, users will switch to those who do. Digital banking development is key to retaining clients, enhancing engagement, and staying ahead of agile fintech disruptors.

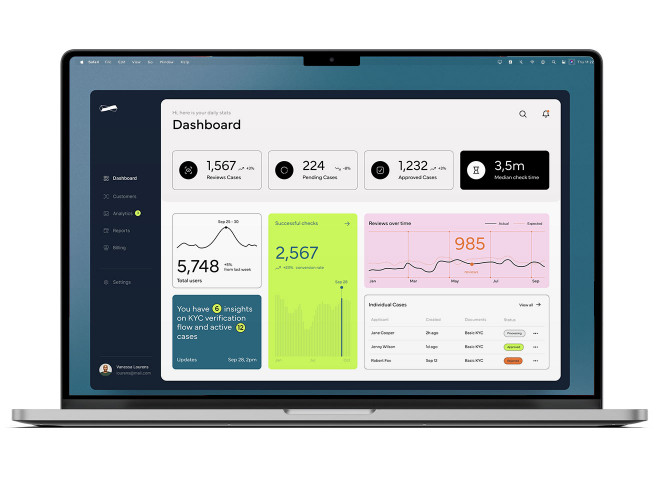

Customer Experience as the Core

With a user-first approach, digital banking platforms must offer an intuitive interface, real-time transaction updates, chatbot support, and personalized services to drive satisfaction and loyalty.

Security at Every Layer

Cybersecurity remains a major concern. Top-tier development includes encryption protocols, biometric logins, two-factor authentication, and fraud detection engines to ensure trust.

Key Features of Custom Digital Banking Solutions

Omni-Channel Accessibility

Ensure a consistent experience across web, mobile, smartwatch, and voice platforms to cater to customers anytime, anywhere.

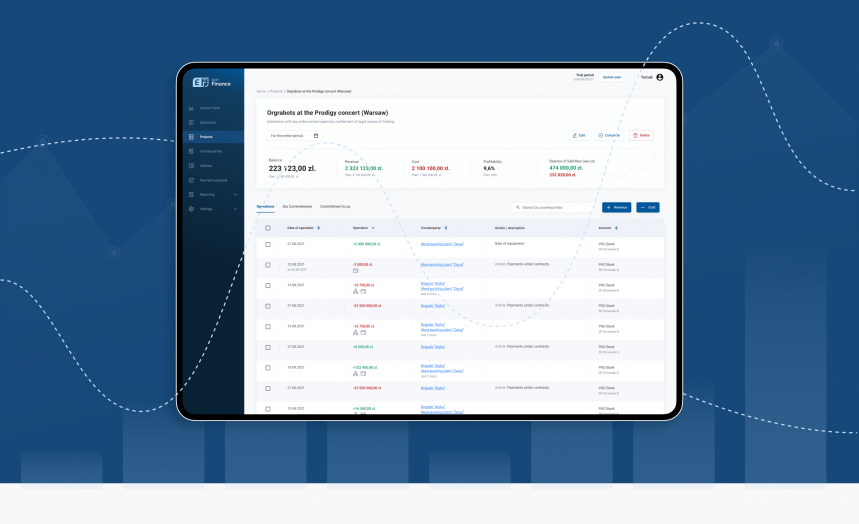

Core Banking Integration

Our fintech custom software development integrates seamlessly with your existing systems or modernizes legacy platforms to enable agile operations.

Real-Time Data Synchronization

Enable live transaction processing, instant notifications, and up-to-date dashboards for both users and administrators.

Regulatory Compliance

We incorporate frameworks that meet FDIC, PCI DSS, GDPR, and local regulatory standards—ensuring your solution is launch-ready and legally compliant.

Tailored for Growth and Scalability

Modular Architecture

Build your platform like Lego—start with essentials and expand with AI, crypto-wallets, or budgeting tools when ready.

Cloud-First Deployment

Leverage AWS, Azure, or private clouds to ensure uptime, agility, and cost-efficiency at scale.

Real-World Use Cases Driving Results

Neo-Banks Launching from Scratch

From MVP to full-service platforms, we help entrepreneurs launch digital-first banking brands that disrupt traditional finance.

Traditional Banks Going Digital

We assist established banks in migrating services to digital platforms, increasing customer retention by over 65%.

Credit Unions Modernizing Infrastructure

Custom solutions to digitize community-focused institutions without losing their personal touch.

Why Choose Our Digital Banking Development Services?

- Proven Industry Experience: Decades of expertise in banking, fintech, and enterprise-grade solutions.

- Rapid Deployment: Go to market faster with our agile methodology and pre-built components.

- User-Centric Design: Crafted with UX/UI best practices to maximize adoption and satisfaction.

- Ongoing Support: From launch to scaling and compliance updates—we’re your long-term digital partner.

Let’s Build the Future of Banking—Today

Whether you’re launching a challenger bank or upgrading your legacy systems, digital banking development isn’t just a project—it’s a growth strategy. Partner with a team that understands tech and finance.

✅ Benefits at a Glance

- Full-stack development: Backend + Frontend

- Mobile-first + Web-first architecture

- AI-powered features (chatbots, analytics)

- End-to-end encryption + security audits

- Seamless third-party integrations (Plaid, Stripe, etc.)

- Scalable infrastructure for millions of users