Marketplace Lending Services

What is marketplace lending?

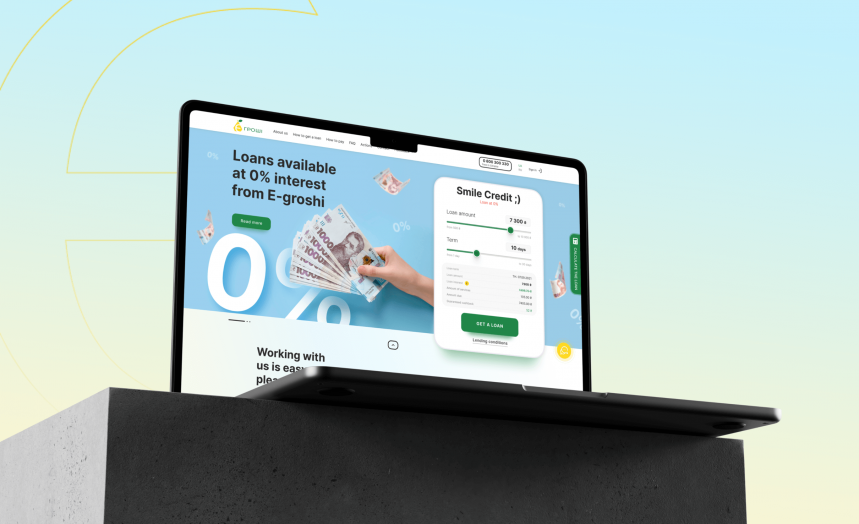

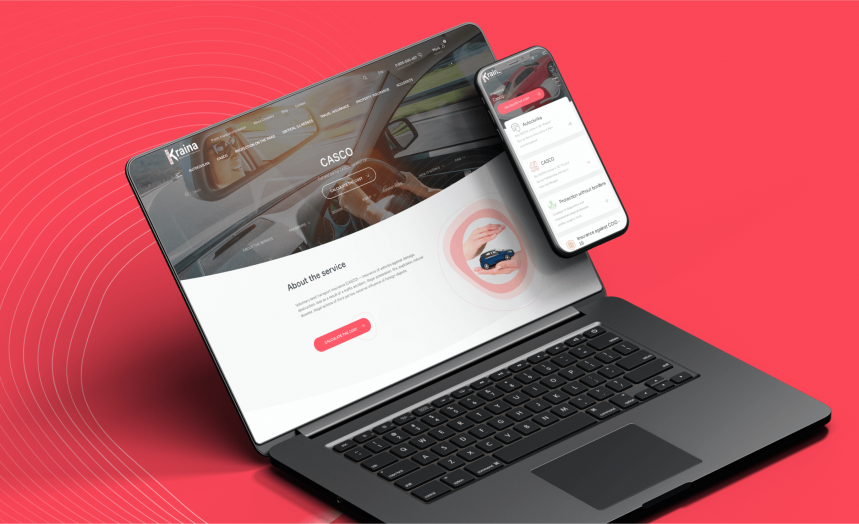

Launch your own marketplace lending platform to connect borrowers with investors willing to offer loans, both new ones and refinancing. The WEZOM team will create a user-friendly centralized solution that will comply with all needed security standards.

technical support

Provision of technical support services for already launched marketplace lending solutions by the WEZOM team.

Regular updates

Regular updates to the marketplace lending solutions as needed.

scale the solutions

Capability to scale the solutions as the number of users grows rapidly.

Software Company WEZOM

Our objective is to develop a profitable and effective solution that helps clients to expand their businesses and overcome financial constraints. We are committed to exceptional service and utilizing all resources to bring the finest products & services.

We've Been Awarded Plenty for the Milestones We Have Achieved

What clients say

We chose WEZOM amongst other companies because they provided prototypes of future systems and we had a clear understanding of what the finished product would look like. We worked with the team on several projects, including the development of a CRM with adaptation for desktop and mobile versions, as well as the creation of a suite of server applications that are available on iOS, Android, and online. We are very pleased with the results and the flexibility of the WEZOM team.

I am very satisfied wit the work process and project management. Everything was clear, on time and I had nothing specific to add. Yes, we are satisfied with the result of the work and the product meets the goals set. I can't wait to continue our work on the app.

Thanks to WEZOM, our sales increased by 65% and conversions increased by 150%. The team fully developed an online store for us, with 1C and amoCRM integrations. The guys conducted a market analysis, created a mind map with all the functions of the future site, and argued for each element of development. Everything was transparent, and the quality was high.

Questions & Answers

How is marketplace lending different from traditional lending?

Online lending marketplaces are an innovative way to engage in lending. Marketplace lending platforms do not take deposits or lend their own capital. Online marketplace lending implies the platforms serve as brokers to connect lenders and borrowers and take a fee for operating the online lending platform. Marketplace lending solutions are bringing innovations into the field. Also, online platforms provide users with opportunities to make the operations fast and efficient.

Empowering Financial Transactions: The Evolution of Marketplace Lending

The landscape of lending and borrowing has been completely transformed by the emergence of marketplace lending. This revolutionary solution provides a seamless platform that connects borrowers with investors, enabling both new loans and refinancing opportunities. Marketplace lending goes beyond mere convenience, emphasizing efficiency and security to deliver a truly groundbreaking financial experience.

Introducing the Paradigm of Marketplace Lending

Marketplace lending introduces a dynamic platform that seamlessly connects borrowers with investors, enabling access to a wide range of loan options, including new loans and refinancing opportunities. The innovative Wezom team has developed a user-friendly centralized solution that not only adheres to essential security standards but also provides customers with an intuitive and streamlined experience.

Key Components of a Comprehensive Marketplace Lending Solution

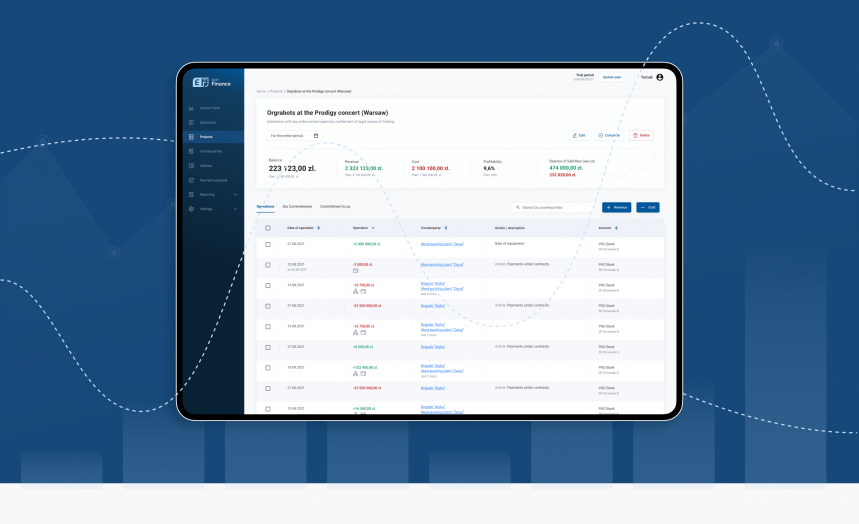

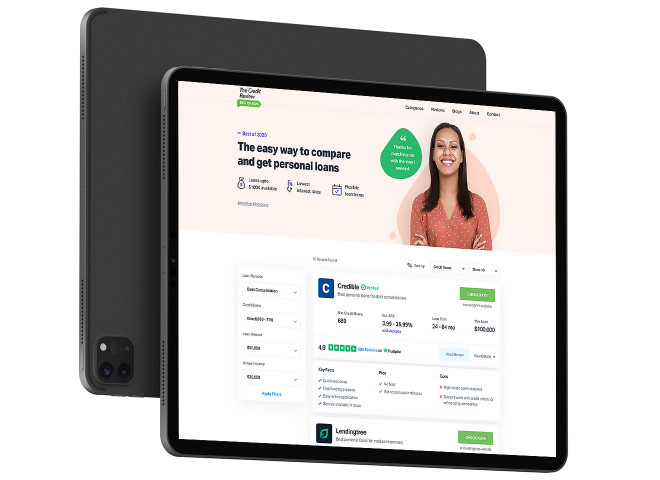

To deliver a comprehensive marketplace lending solution, several key features must be included. These encompass a diverse array of loan types, efficient online processing, an intuitive interest rate calculator, dedicated borrower and investor accounts, responsive online support, and highly customizable services. Diverse Loan Types Users are presented with a convenient visualization of all available loan types, equipped with the ability to sort and filter based on key parameters. Efficient Online Processing By bringing lending services online, the need for customers to physically visit brick-and-mortar bank branches is eliminated, simplifying and expediting the lending process. Intuitive Interest Rate Calculator Customers are provided with a user-friendly loan interest rate calculator, significantly reducing the workload on call center staff. Borrowers' and Investors’ Accounts A clear and user-friendly structure is developed to accommodate borrower and investor profiles, equipping them with all the necessary functionalities for seamless online financial operations. Responsive Online Support The integration of a smart chatbot enables independent handling of users' common queries, alleviating the burden on call center employees. Highly Customizable Services The application is enriched with a range of customizable features, enhancing user experience and ensuring a competitive edge.

Testimonials from Satisfied Clients

Our valued clients have expressed their utmost satisfaction with our services, commending the exceptional quality of our work, our professionalism, and our unwavering commitment to meeting deadlines. They have also highlighted our effective communication and strong dedication to their projects, further solidifying their trust in our capabilities.

Frequently Asked Questions

What exactly are marketplace lending platforms? Marketplace lending platforms facilitate online lending by connecting consumers or businesses seeking loans with investors who can either buy or invest in the loan. This innovative model is often referred to as "peer-to-peer" lending. How does marketplace lending differ from traditional lending? Marketplace lending distinguishes itself from traditional lending by operating entirely online and directly connecting borrowers with investors. This eliminates the need for traditional financial intermediaries, resulting in a more efficient and cost-effective process. In conclusion, marketplace lending has emerged as a powerful tool that has revolutionized the lending industry. It offers unparalleled convenience, efficiency, and security, making it an indispensable component of modern financial transactions.