Personal Banking

What is personal banking?

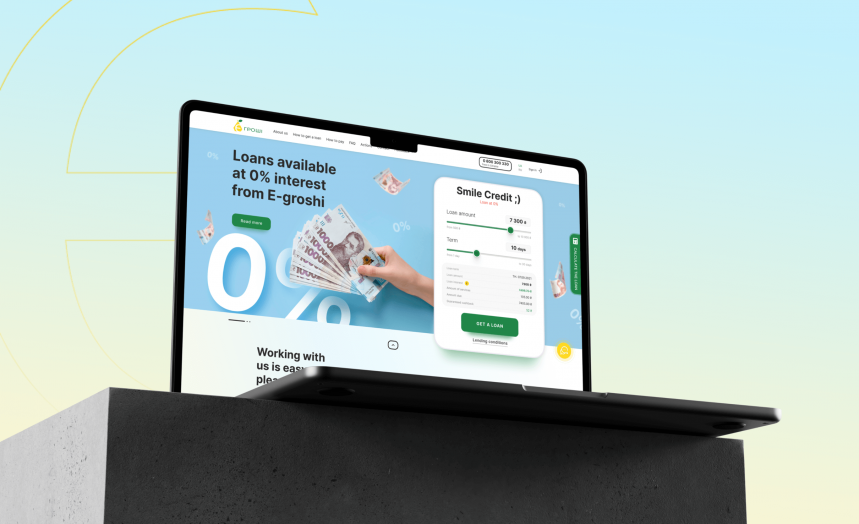

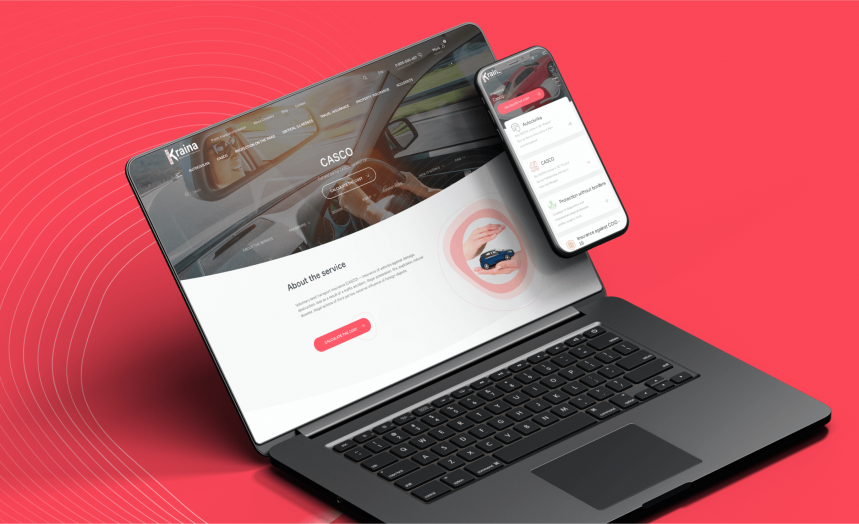

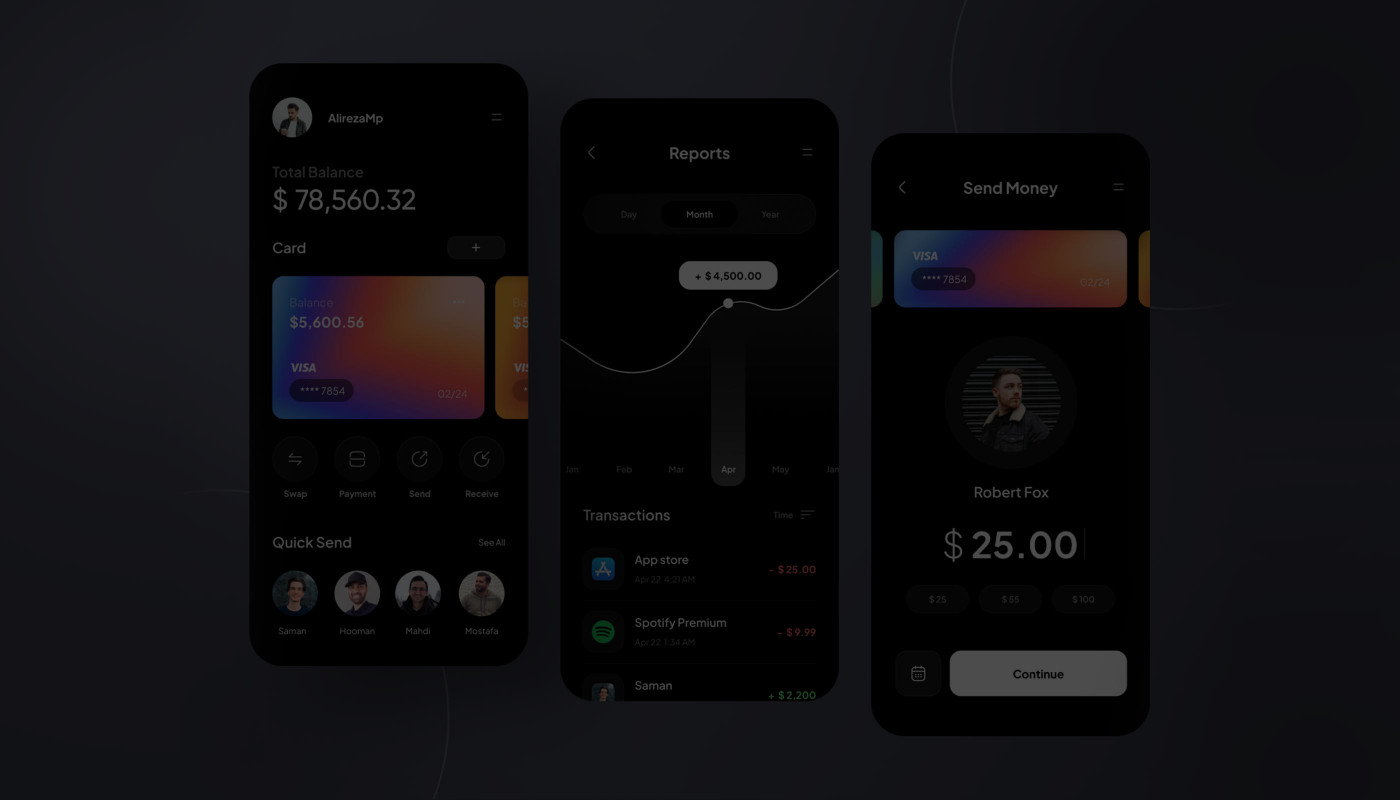

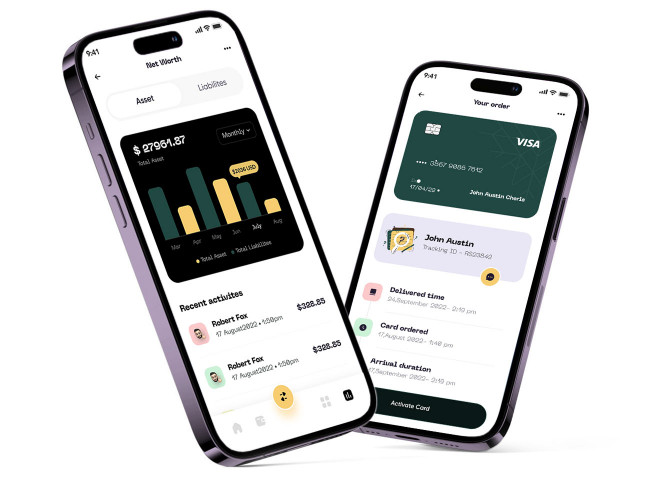

Provide your bank customers with the opportunity to manage their financial assets on their own through their personal devices. We will create a secure digital solution inspired by the best practices of world leaders in the financial industry.

tools for customers

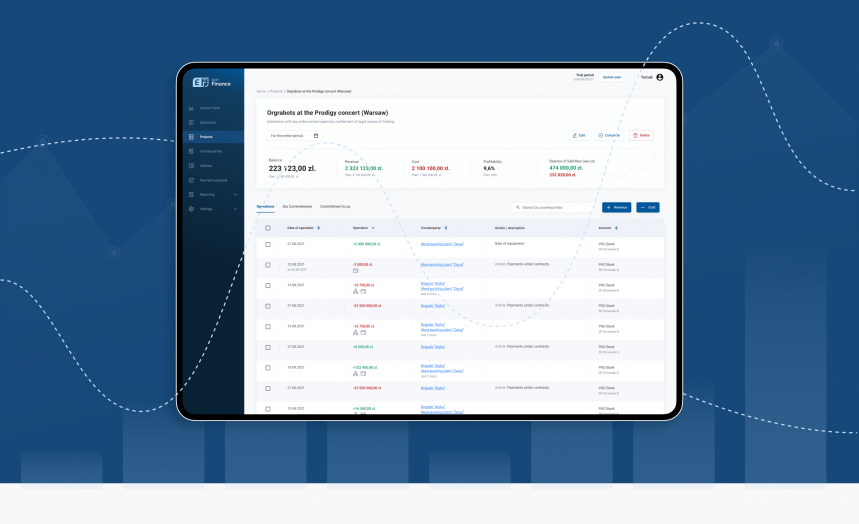

Provision of tools for customers to analyze their financial status.

complete transactions

Ability for customers to complete transactions and other banking activities such as lending and opening new accounts.

technical support

Provision of technical support upon request for your personal banking services.

expand the functionality

Ability to expand the functionality of personal banking services as needed.

Software Company WEZOM

Our objective is to develop a profitable and effective solution that helps clients to expand their businesses and overcome financial constraints. We are committed to exceptional service and utilizing all resources to bring the finest products & services.

We've Been Awarded Plenty for the Milestones We Have Achieved

What clients say

We chose WEZOM amongst other companies because they provided prototypes of future systems and we had a clear understanding of what the finished product would look like. We worked with the team on several projects, including the development of a CRM with adaptation for desktop and mobile versions, as well as the creation of a suite of server applications that are available on iOS, Android, and online. We are very pleased with the results and the flexibility of the WEZOM team.

I am very satisfied wit the work process and project management. Everything was clear, on time and I had nothing specific to add. Yes, we are satisfied with the result of the work and the product meets the goals set. I can't wait to continue our work on the app.

Thanks to WEZOM, our sales increased by 65% and conversions increased by 150%. The team fully developed an online store for us, with 1C and amoCRM integrations. The guys conducted a market analysis, created a mind map with all the functions of the future site, and argued for each element of development. Everything was transparent, and the quality was high.

Questions & Answers

What are the benefits of personal banking?

Personal banking benefits include convenience, safety and security, an opportunity to save money, affordability, and an easy access to credit. Personal banking is a comfortable way to engage in financial operations, it does not contain major risks, it is an affordable way to use a bank account and you can easily save money using personal banking services. Convenience is the key when it comes to banking.

What types of personal banking are there?

Different types of personal banking include saving accounts, checking accounts, money market accounts, mortgage cards, and certificates of deposit (CDs). Personal banking software can also help you with mortgage loans, auto loans and overdraft lines of credit. Banking software makes banking processes way faster and more efficient.

Unlocking the Potential of Personal Banking: Empowering Customers with Advanced Software Solutions

Elevate Your Personal Banking Experience with Next-Generation Software Solutions

In the rapidly evolving landscape of personal banking, staying ahead requires leveraging innovative software solutions that optimize efficiency, enhance security, and deliver exceptional customer experiences. At Wezom, we specialize in providing cutting-edge technology that empowers individuals and financial institutions to streamline their personal banking processes and embrace the digital transformation.

Revolutionize Personal Banking with Tailored Software Solutions

Are you searching for ways to optimize your personal banking services and provide seamless digital experiences to your valued customers? Look no further! Our comprehensive software solutions are meticulously designed to address the unique challenges faced by the personal banking industry. Here's how our advanced technology can revolutionize your banking operations:

1. Streamlined Account Management and Robust Security Features

Our software solutions offer intuitive features for streamlined account management, enabling individuals to effortlessly monitor balances, track transactions, and manage their financial portfolios. With robust security measures, including cutting-edge encryption protocols and multi-factor authentication, we prioritize the protection of your customers' sensitive data.

2. Seamless Digital Banking Experience

Deliver a seamless digital banking experience that caters to the evolving expectations of today's tech-savvy customers. Our software empowers users to access their accounts anytime, anywhere through user-friendly web and mobile applications. From fund transfers to bill payments and account inquiries, our solutions simplify banking processes, offering convenience and control at your customers' fingertips.

3. Personalized Financial Planning Tools and Insights

Empower your customers to take charge of their financial futures with personalized financial planning tools. Our software solutions provide robust features such as budgeting, goal setting, and investment tracking, enabling individuals to make informed decisions and achieve their unique financial objectives. By offering these tailored tools, you can foster deeper customer engagement and build lasting relationships.

4. Advanced Fraud Detection and Prevention Mechanisms

Safeguard your customers and your institution from fraudulent activities with our advanced fraud detection and prevention mechanisms. Leveraging cutting-edge technologies, our software employs sophisticated algorithms and comprehensive transaction monitoring to identify and mitigate suspicious behavior proactively. Protect your customers' assets and maintain their trust in your institution.

5. Actionable Data Analytics and Intelligent Insights

Harness the power of data to gain actionable insights into customer behavior, preferences, and emerging trends. Our software solutions provide robust data analytics tools that enable you to uncover valuable intelligence, refine your marketing strategies, and deliver personalized banking experiences that resonate with your customers. Leverage data-driven decision-making to drive growth, enhance customer satisfaction, and stay ahead of the competition.

Partner with Wezom for Cutting-Edge Personal Banking Solutions

Embrace the digital transformation in personal banking with Wezom's innovative software solutions. Our advanced technology will revolutionize your operations, elevate customer experiences, and position your institution as a leader in the industry. Stay ahead of the competition and unlock the full potential of personal banking with our highly customizable software solutions.

Contact us today to schedule a consultation and discover how Wezom can transform your personal banking services into a seamless, secure, and customer-centric experience that sets you apart. Experience the future of personal banking with Wezom's advanced software solutions.