Wealth Management Services

What is wealth management?

Launch your own wealth management services to address the needs of affluent clients. We will build an effective wealth management strategy focused on a holistic view of a client's financial picture. Contact us to bring your business idea to life.

help achieve goals

Software designed to help achieve your most ambitious business goals.

tech support

Provision of necessary tech support services.

timely updates

Ensuring timely updates of the software

Modernization

Modernization of software functionality as needed.

Software Company WEZOM

Our objective is to develop a profitable and effective solution that helps clients to expand their businesses and overcome financial constraints. We are committed to exceptional service and utilizing all resources to bring the finest products & services.

We've Been Awarded Plenty for the Milestones We Have Achieved

What clients say

We chose WEZOM amongst other companies because they provided prototypes of future systems and we had a clear understanding of what the finished product would look like. We worked with the team on several projects, including the development of a CRM with adaptation for desktop and mobile versions, as well as the creation of a suite of server applications that are available on iOS, Android, and online. We are very pleased with the results and the flexibility of the WEZOM team.

I am very satisfied wit the work process and project management. Everything was clear, on time and I had nothing specific to add. Yes, we are satisfied with the result of the work and the product meets the goals set. I can't wait to continue our work on the app.

Thanks to WEZOM, our sales increased by 65% and conversions increased by 150%. The team fully developed an online store for us, with 1C and amoCRM integrations. The guys conducted a market analysis, created a mind map with all the functions of the future site, and argued for each element of development. Everything was transparent, and the quality was high.

Questions & Answers

What are the different types of wealth management?

Wealth management services include asset allocation, financial management, estate planning, asset management, and more. Strategic wealth management can help you grow your wealth through strategic planning. Wealth management software can assist you in all of these aspects, and can also simplify mobile wealth management. Wealth management systems automate processes and reduce errors. A financial advisor can help you with wealth management, as well as with wealth management solutions.

What is the key objective in wealth management?

Wealth management is aimed at financial decisions based on a timeframe. Wealth management companies, as well as financial advisors, consider different financial aspects and use wealth management solutions when making decisions and setting goals. Software for wealth management helps make the process effective. With the help of a wealth management solution, you can make your goals more productive and achieve more.

SaaS: Shaping the Landscape of Wealth Management

In the rapidly transforming world of finance, wealth management has been significantly influenced by the rise of technology. Software as a Service (SaaS) has emerged as a key catalyst, offering robust, adaptable, and cost-effective solutions for wealth management firms.

SaaS: The Game-Changer in Wealth Management

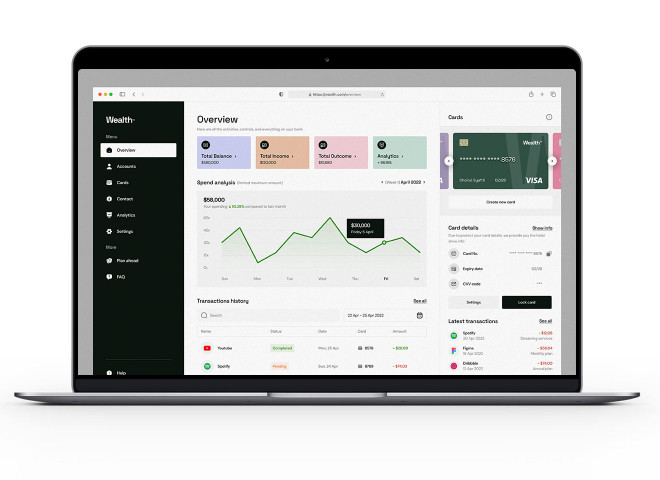

SaaS for wealth management is a holistic digital solution that simplifies the complex processes involved in managing wealth. It provides a unified platform that allows wealth managers to effectively monitor, analyze, and manage their clients' portfolios. This innovative technology solution offers a range of features, from real-time data analytics to automated reporting, enabling wealth managers to make informed decisions and provide personalized services to their clients.

The inherent scalability of the SaaS model allows wealth management firms of all sizes to leverage advanced technology without a significant upfront investment. It offers flexibility, allowing firms to adjust their operations based on their needs. Moreover, with SaaS, firms can stay abreast of the latest technology advancements without worrying about maintenance or upgrades, as these are typically managed by the service provider.

The SaaS Advantage in Wealth Management

Streamlined Efficiency and Productivity

SaaS solutions automate routine tasks, freeing up wealth managers to focus on strategic decision-making and client relationship management. They offer integrated tools for portfolio management, risk assessment, and compliance, reducing the time and effort required to manage these aspects manually.

Enhanced Client Engagement

With SaaS, wealth managers can provide their clients with access to user-friendly digital platforms where they can view their portfolio performance, make transactions, and communicate with their advisors. This not only improves client engagement but also enhances transparency and trust.

Data Security and Compliance

SaaS providers typically have robust security measures in place to protect sensitive financial data. They also ensure that their solutions are compliant with the latest financial regulations, relieving wealth management firms of these responsibilities.

In conclusion, SaaS is revolutionizing the wealth management industry, offering firms a way to enhance their services, improve efficiency, and stay competitive in the digital age. As technology continues to evolve, the role of SaaS in wealth management is set to become even more significant.